With all of the concern that the COVID-19 virus has engendered due to its potential negative impact on global economic growth, the S&P 500 still had enough momentum to achieve a new all-time high of 3386 last Wednesday. U.S. equities have been buoyed by stronger than expected Q4 earnings growth. According to FactSet, with 87% (438 companies) of the S&P 500 having reported, EPS grew by 1.6% y/o/y and revenues by 3.6%. This compares favorably to the December 31, 2019 ESP projected decline of 1.7% in earnings. Given the initial decline in the equity market on February 3rd after the announcement of the spread of the coronavirus by China, the S&P 500 through last Friday is up approximately 5%.

As we enter this week’s trading sessions, with the corporate earnings season coming to an end, the possibility of the continued spread of COVID-19 will undoubtedly dictate global market price direction and volatility. COVID-19’s strong influence on asset prices is due to the dramatic slowdown it can inflict on global economic growth, should it not be contained. We have seen early Q1 2020 revenue warnings from Apple and Jaguar due to supply chain disruptions. Oxford economics reported the shutting of factories and supply chain disruptions could cost the Asian economy $400 billion in income and reduce China’s GDP from 6.0% to 5.4% for 2020. Should COVID-19 become a global pandemic, the loss in global income could soar to $1.1 trillion, shaving about 1.3% from global growth. The IMF in January had originally projected 2020 global growth to improve to 3.3% from 2.9% seen in 2019.

The present and potential effect of the COVID-19 on the global economy and financial markets is being felt this Monday morning. Global equity indexes since the announcement of a spread of COVID-19 cases in South Korea and Italy last Wednesday has sparked a global “risk-off” environment. Global equity indexes are down since February 19th by approximately 5.00%, while the fixed income market has seen a strong rally along with the typical safe haven assets such as gold ($1680.4/oz. a seven- year high) and the U.S. Dollar (+3.0% YTD). In fixed income, the U.S. 10-year and 30-year treasuries hit all-time low yields this morning of 1.367% and 1.820% respectively.

As a long- term allocator, Clearbrook will assess the underlying change in asset valuations and the potential alteration in asset allocation this current market dislocation may present. Our emphasis on high quality companies, preference for U.S. assets versus international, increase of active versus passive management, employment of alternative investments and our extension in duration over the past year should help to mitigate some of the downside risks.

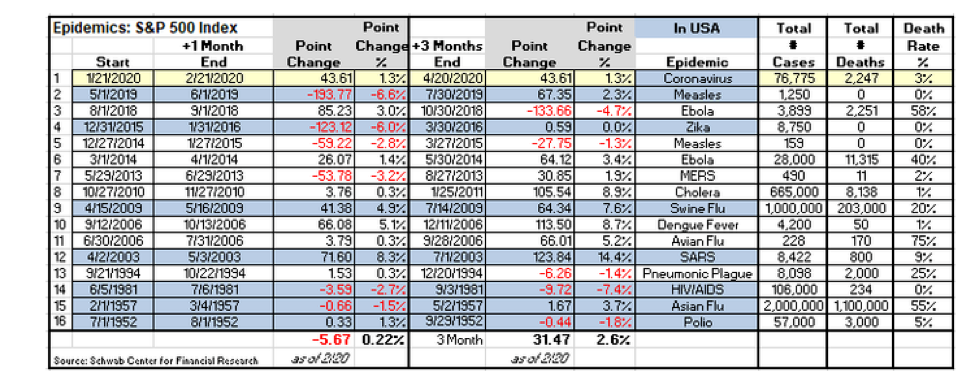

Throughout my 30 plus year career in the financial markets, we have seen a plethora of reasons for risk assets to decline in value. Often times it has been due an illicit act, structural problems that portend the break-down of a system or massive change in business model. For example, did the European debt crisis and insolvency of Greece bring down global markets? Have previous epidemics as highlighted below, prompted a paradigm shift in how investors viewed the potential for economic, revenue and earnings growth? A problem such as COVID-19 when properly contained, is not a long-term issue in comparison to the prolonged effects felt from the 2008-2009 “Great Recession”.

Disclaimer: This data has been obtained from a third party and Clearbrook has not verified the accuracy of the information

As seen from the chart above, we are seeking to use this risk-off decline in global assets to purchase high quality assets at discounted prices. This is predicated on our belief that once the COVID-19 scare is over, investors will return to valuing assets based on fundamentals such as revenue and earnings growth. The global central banks are providing, and stand ready to provide more monetary and fiscal stimulus to stabilize their economies. In addition, the dramatic decline in oil and gas prices has increased the amount of discretionary capital that consumers and businesses will have to spend. This should help to create a baseline for Q1 growth, from which a re-acceleration of growth should occur in Q2 and for the remainder of the year. There will be a desire to replace inventories and products that have drawn down due to the supply chain disruption. At this point in time, we do not advocate any portfolio changes until we have a clearer view on the economic impact of the COVID-19 virus, and its potential effect on corporate revenue and earnings growth for Q1 2020 and beyond.

Timothy C. Ng

Chief Investment Officer

This article discusses general market activity, industry or sector trends, or other broad-based economic, market or political conditions and should not be construed as customized research or investment advice. This article is for informational purposes only and does not constitute, and is not to be construed as a solicitation or recommendation of any particular investment advisory services. Opinions expressed in this article reflect current opinions of Clearbrook as of the date appearing in this material only.