The U.S. is experiencing inflation rates that we have not seen since 1981. High inflation hurts companies and consumers alike and if wages do not keep up with inflation, consumers will need to cut back, hurting the economy. Companies’ margins are tightening due to soaring prices of raw materials, inventory, transport, and labor. The reading for April showed a more positive inflation number as some thought inflation could be easing, which made the record high reading for May unexpected.

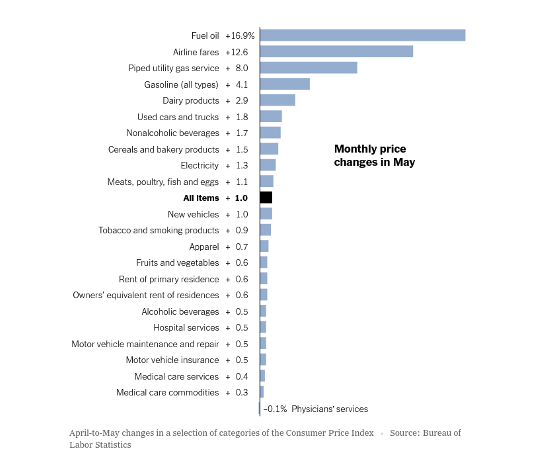

We saw the biggest increase in prices in fuel oil, airline fares, and gasoline. Airlines have been unable to hire and train enough pilots to stem the pilot shortage, and with record high gas prices, and demand for consumers to travel following easing COVID restrictions made for a perfect storm for airlines prices to spiral upward. Once we see airlines get back to full staff, gas and fuel prices begin to ease, and leisure travel becomes normalized, we can expect prices to stabilize.

U.S. worker productivity fell at its steepest pace since 1947 while unit labor costs accelerated. Hourly output per worker tumbled to a 7.3% annualized rate last quarter, which is the steepest decline since the third quarter of 1946. There are reportedly 11.4 million job openings available as of April 2022. This is in response to the rate of inflation, as people are requiring higher wages to afford daily necessities. We could see labor shortages begin to ease as savings from COVID run dry and people are forced to go back to work which would in turn help relieve some pressure companies are facing on the labor front.

The Russian and Ukraine war has had a direct impact on global inflation as Ukraine is the world’s fifth largest exporter of wheat, fourth largest of corn, and the number one exporter for sunflower oil. Fertilizer prices that spiked earlier in the year have come down and will ease some of the costs in growing crops. The tensions in Europe only make for a greater argument to grow and produce more crops domestically. Russia and Ukraine combined produce around 25% of the world’s wheat supply and the loss of this supply in turn has impacted the prices in the global food market.

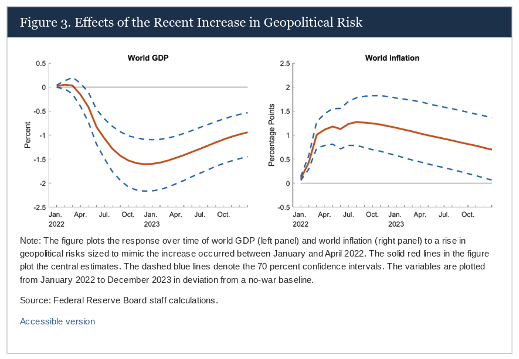

Russia is a leading global exporter of natural gas as well and the recent sanctions on the country’s ability to export has increased prices in the EU and across the world. The EU imports 40% of their total natural gas consumption with Germany topping the chart with imports of 55%. Geopolitical tensions have put a damper on markets, boosting inflation, but per the chart below from the Federal Reserve Board, world inflation is expected to ease or begin to ease towards the latter half of the year. In turn global GDP is expected to bounce, the question is to what level and when?

While the first half of 2022 may be disheartening, we are poised for several factors to improve in the second half of 2022. Prices for semiconductors have come down and shortages are beginning to ease. The automotive industry has said that they are approaching full manufacturing capacity as their worldwide production facilities now only see occasional supply chain issues. Per Counterpoint Research’s latest smartphone component tracker report shortages are likely to ease noticeably in the latter half of this year and demand-supply gaps are decreasing across most components.

This year has seen some downturns in almost every sector of the market, but it has only been six months and we are long-term investors. A lot has happened in these six months and the same thing can happen on the other side of the halfway mark of 2022. We need a few factors to swing positive, whether that be inflation easing, the Fed monetary policy stance to ease, labor costs decreasing, company earnings beating expectations, gas prices coming down, the Ukraine Russia War subsides, etc. There is a large consensus that we are closer to the bottom here and as long-term investors, we need to stay the course and be mindful of tactical asset allocation in our portfolios.