Economic Data Watch and Market Outlook

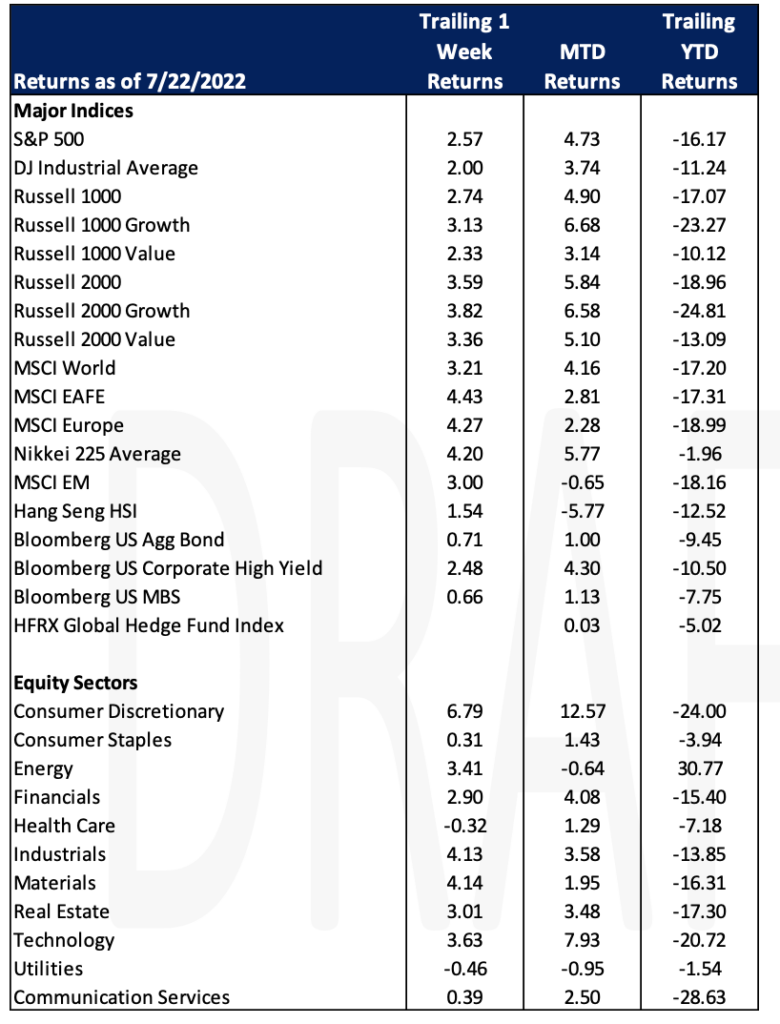

Asset prices advance during the week with the Russell 1000 rising 2.57% and the MSCI EAFE index rising 4.43%. Bonds rose slightly with the Bloomberg US Aggregate Bond index up 71 basis points. Is this a turn, with the belief that much of the pain has been experienced or a short-term dead cat bounce? There’s some evidence to suggest that the move upwards was related to short covering. As we noted last week there was a fairly significant negative aggregate S&P Futures position according to Deutsche Bank

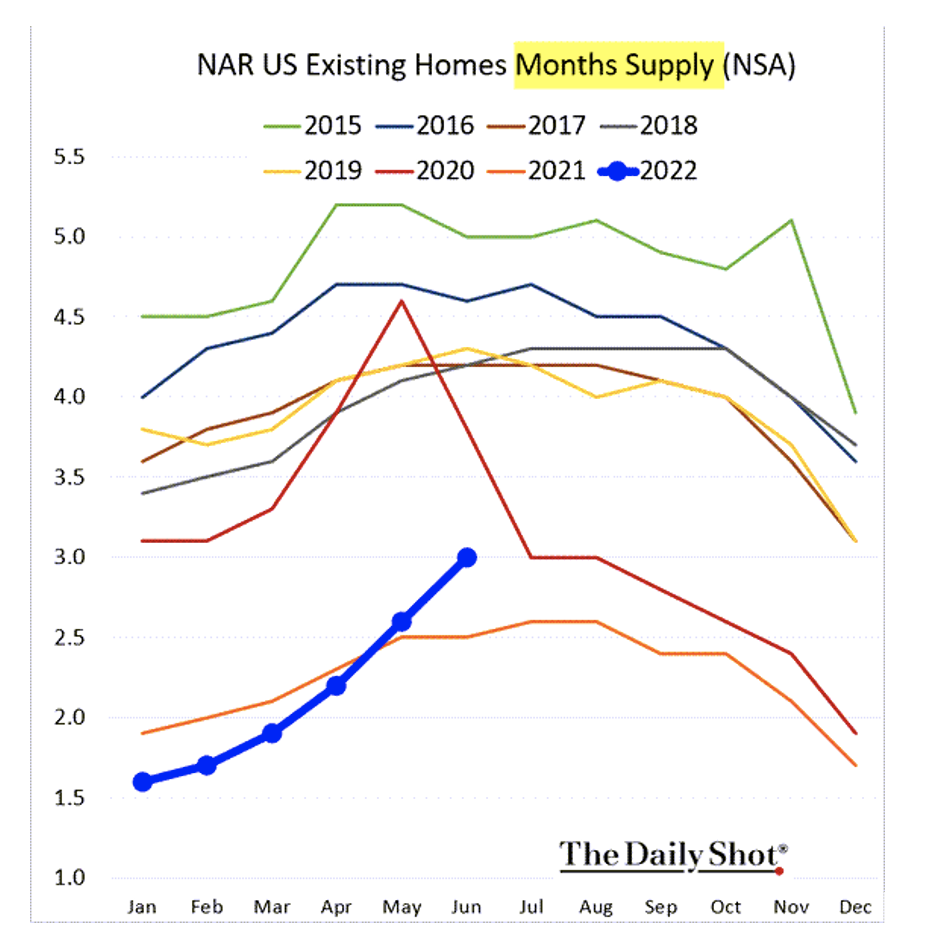

On Wednesday, existing home sales data was released showing a fifth consecutive month of decline in June. Existing home sales were forecasted to be 5.36 million but actually reported 5.12 million – the weakest level of sales since June 2020. Mortgages rates continue to climb with the Fed’s aggressive monetary policy in effect and inventories remain low across the country contributing to the decline in existing home sales. Prices of homes are also continuing to rise but at a slower rate. And, as the chart below indicates, inventories are climbing, albeit off a low level.

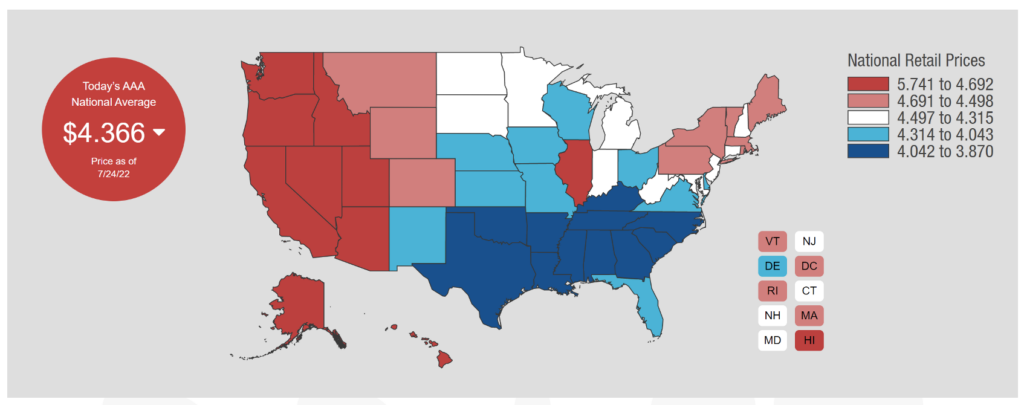

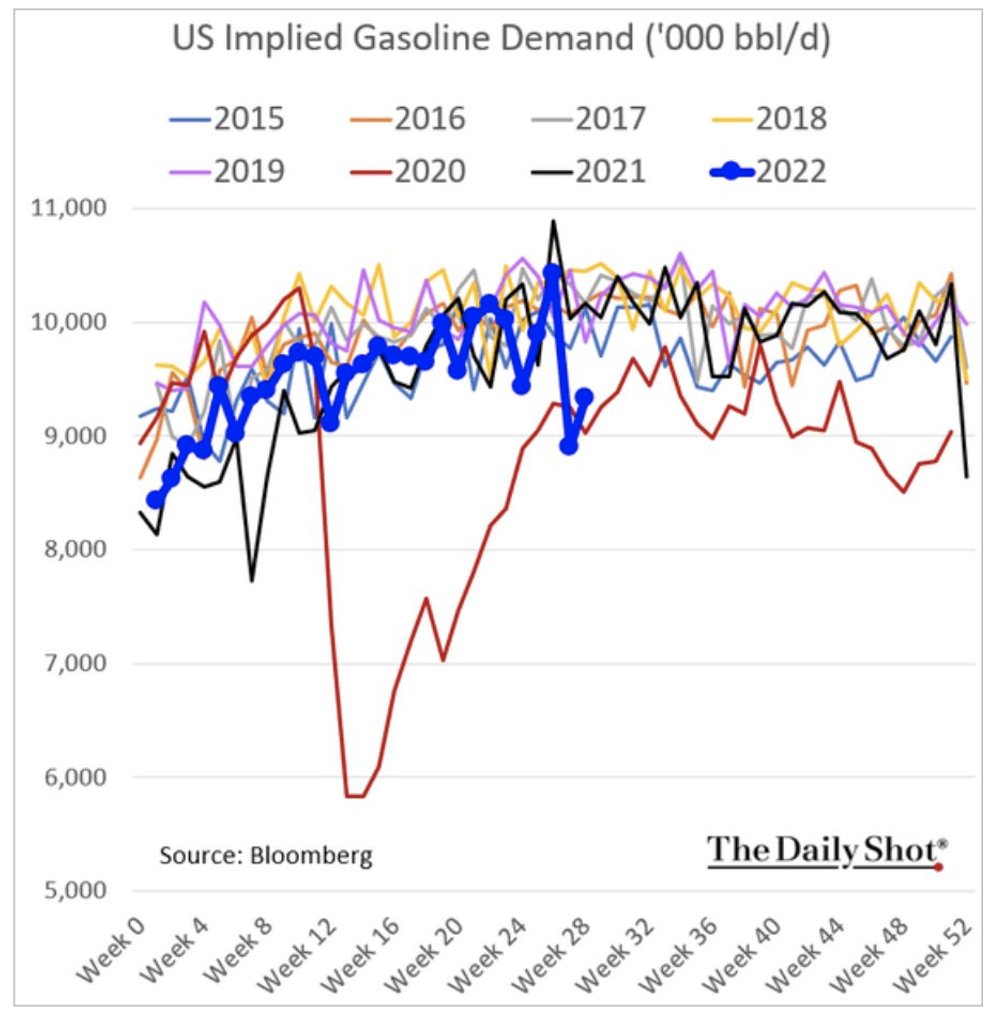

Gas prices have continued to come down with the national average at $4.36 per gallon according to AAA. Further, demand for gasoline has also trended downward.

This week we will hear about home sales data, mortgage and trade balances, but most of the focus will be on the announcement of the Fed’s decision at 2pm on Wednesday. Estimates are for a 75bps increase.

Equities

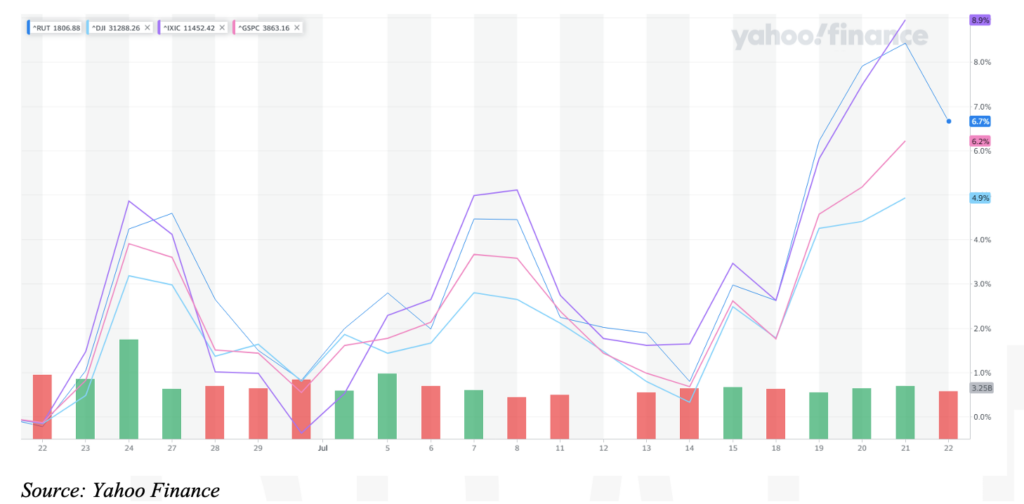

Equity indices enjoyed a positive week as second quarter results from companies have come in better than expected though by narrower than usual margins in EPS and revenue according to IBES data provided by Refinitiv. Note that only about one-fifth of the S&P500 have reported second quarter earnings thus far. Equities indices are also in positive territory month to date for the Dow Jones Industrials (+3.98%), S&P 500 (+4.37%), Nasdaq Composite (+5.36%) and Russell 2000 (+5.56%).

Though the market enjoyed a positive week, there were some indications from digital advertising that a slowdown maybe occurring as SNAP, down ~40% on the week, missed earnings attributed to the slowdown in their digital advertising numbers. Twitter also attributed their missed earning in the slowing of advertising revenue and the lawsuit against Elon Musk for the calling off his purchase of the company. In other Elon Musk news, Tesla soared 9% on Wednesday after Elon Musk said in an interview with Bloomberg that demand for electric vehicles is “extremely high”– a comment made at a time when the company is in the process of laying off workers. However, to Musk’s defense he noted that certain areas of the company grew a little too fast and workforce reduction was necessary. The stock has taken a beating so far this year along with the rest of the tech sector over increasing interest rates and recession fears. The stock price ended the week at $816.73, down from a 52-week high of $1243.49.

Next week other players in this segment will be reporting their second quarter results including Meta Platforms (formerly Facebook), Google and Apple. Digital advertising can be an indication of slowdown since marketers can turn off their spend in real time. Amazon announced they are expanding their capabilities in the healthcare by acquiring 1Life Healthcare Inc., which operates under the name One Medical for $3.9 billion. Amazon also owns PillPack, an online pharmacy, which they purchased over 2 years ago.

European markets closed slightly higher though PMI numbers reported were at a 15-month low of 50.6 and the ECB raised interest rates for the first time since 2011 by 50 bps.

Fixed Income

Yields fell during the week leading up to the Fed meeting. Longer duration bond yields fell to the lowest levels in 2 months on Friday resulting in the second straight week of declines. The 2-year note rose slightly until Thursday when it saw a steep decline in yield. Both the 10 and 30-year Treasuries both saw their lowest levels in yield since May 27th. Downward yield pressures were not just seen in the US, Germany’s 10-year government bond fell to its biggest one-day decline in a month, -0.19. Amid recession fears government bonds have seen inflows pushing yields lower. As inflation remains a main concern of the Fed and many other central banks, we shall see how aggressively they do hike rates. Some think due to the global economy slowing, many central banks may rethink their approach to future rate hikes. Not the case with the ECB as they increased rates for the first time in 11 years to aggressively attack the inflation crisis. They also indicated another increase in September as well if consumer prices keep rising. The ECB raised their deposit rate to 0.0% and their refinancing rate was raised as well to 0.5%. Investment grade debt and high yield bond spreads have narrowed significantly over the last month. In the past nine previous instances when the CDX high yield spreads fell below 75 basis points in 3 weeks the S&P 500 has risen over the next week, six months, and a year, with over 22% average returns. IG returns are less strong to the upside when spreads narrow, but still positive. When CDX IG spreads fall at least 15 basis points over 3 weeks the S&P 500 rose on average 13% 12 out of 14 times since 2005. At current prices junk bonds are not pricing in a recession per BCA research. The index is pricing in a default rate of 6.65% which is lower than the typical 8% default rate during recessions leading to spreads potentially widening if a recession were to hit. Next week is a big one for the market and we will wait and see how aggressively the Fed handles the next rate hike.

Hedge Funds

Following a week where hedge funds were not able to keep up with their respective benchmarks, this week saw them capture 80% of benchmark returns, led by North America and crowded longs. Crowded longs in NA rose 7.3% which is not only the 3rd best week YTD, but when compared to the S&P, the 2nd strongest in 2 years. The average Americas based L/S fund is up 2.9% MTD, capturing 50% of the S&P upside despite net exposures in the low 40s. Crowded shorts told another story, rising 7.9% for the week and are up 15.5% MTD. Other geographies were not as strong in comparison with the average global hedge fund +150 bps compared to +290 bps for the MSCI World. Europe lagged other regions but is still the best performing YTD only down ~ 160 bps for the year. Asia also finished positive for the week but is the only region still in the red for the month of July. This week saw the 2nd largest week of de-grossing YTD as hedge funds trimmed longs and covered shorts across regions, most notably in NA. NA was the only region with net buying as short covering outpaced long selling. The largest short covering was in ETFs and themes that included high interest shorts and traditional retail. Europe was slightly net sold for the week and Asia was more muted with slight net buying in China.

Private Equity

Analysts suspect the private equity market is set to experience a stern test over the coming quarters as volatile market conditions and complex geopolitical backdrop have created a substantially decreased risk appetite. Additionally, given the rising of interest rates and falling public market indices as the cost of debt rises, the proportion of equity has also risen equating to falling multiples and tepid deal activity.

Although PE deal activity slowed relative to the sweltering pace set in 2021, 2022 is still on pace to have a healthy year by historical standards. Through Q2 of 2022, US PE firms have completed approximately 4,000 deals with a cumulative value of just over $400 billion. Alternatively, exit activity is also down by a notable margin year over year. Because of falling valuations in both public and private markets, sponsors are electing to hold portfolio companies longer rather than sell them at a reduced price. Many PE firms are turning to GP-led secondaries transactions to hold on to later-in-life portfolio companies therefore taking advantage of the incredibly large sum of capital secondaries funds raised in the past 18 months.

A healthy PE- demand from non-US based institutions, family offices and insurance companies remains. Analysts suspect that middle-market managers will find it more difficult to source capital in this environment and there will be an uptick in managers using warehousing facilities, offering co-investments and selling stakes to gain edge in the competitive environment. Ultimately, analysts suspect deal activity will pick back up once the markets settle, but that may not be for several quarters.

Data Source: Bloomberg, BBC, Charles Schwab, CNBC, the Daily Shot HFR (returns have a two-day lag), Jim Bianco Research, Market Watch, Morningstar, Pitchbook, Standard & Poor’s, the Wall Street Journal, Morgan Stanley, Goldman Sachs and IR+M