Economic Data Watch and Market Outlook

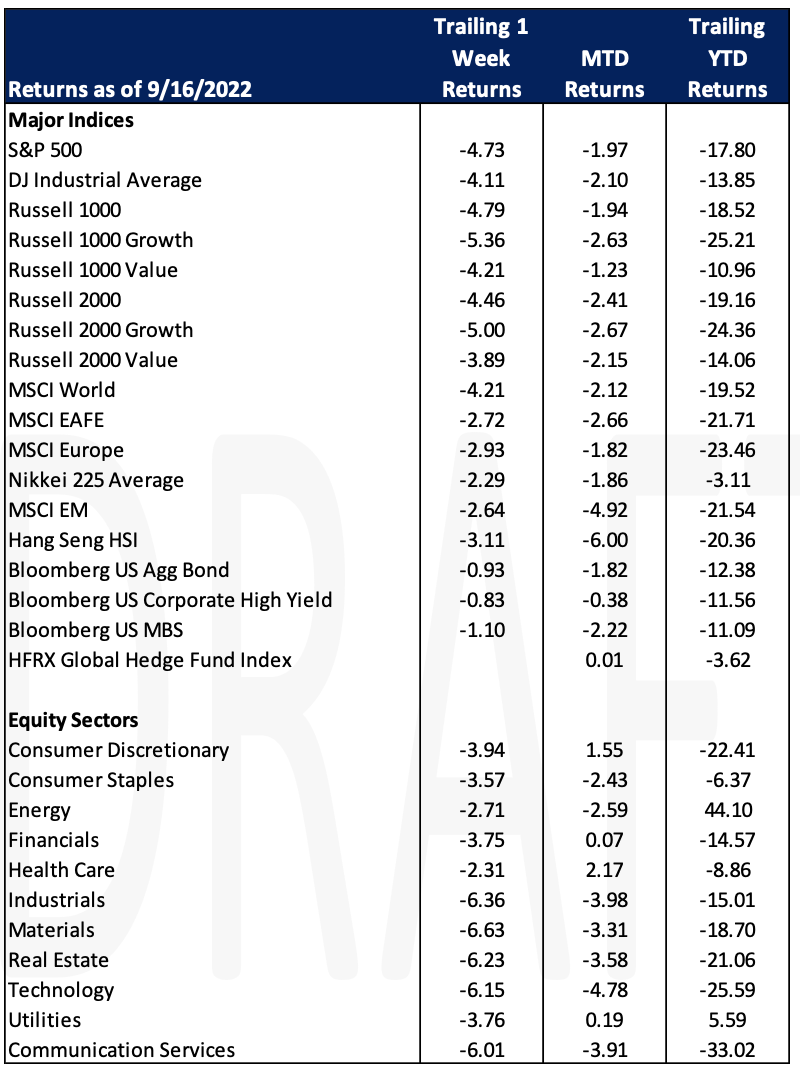

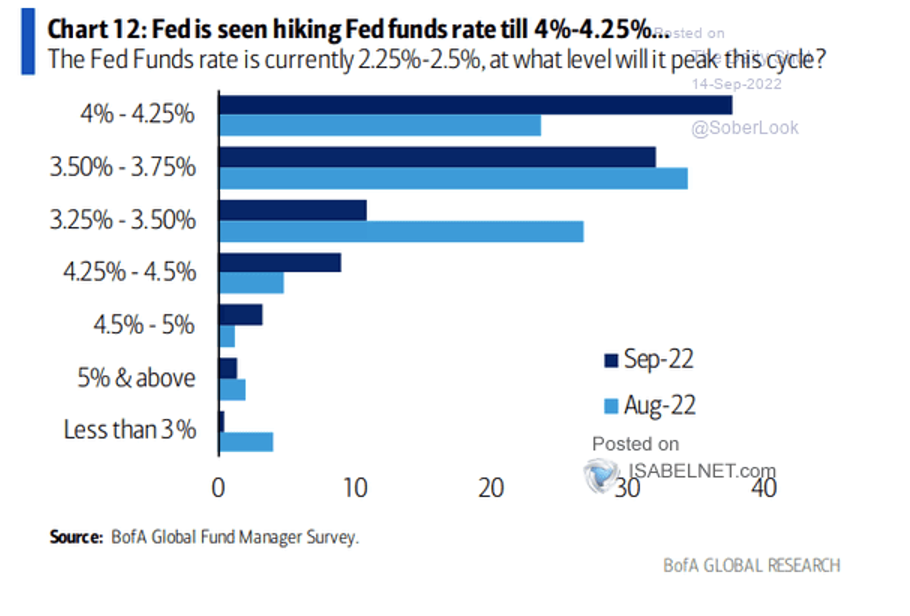

Global equity prices sank this past week as eyes turned to the upcoming fed meeting. The S&P 500 fell 4.73% while the MSCI EAFE index dropped 2.72%. The US Aggregate Bond Index declined as well falling 93 bps. The Fed has communicated that they will do everything in their power to control inflation. The recent poll by Bank of America of fund managers shows that investors believe they will go farther than the survey conveyed one year ago. Thinking at that time was that inflation was transitory but geopolitical factors and perhaps the underestimation of consumer strength changed the dynamic.

The US housing market continues to be top of mind; for the first time since March 2021, the average home is selling for less than its list price. However, high mortgage rates are still impacting what people can afford. Mortgage rates surpassed 6% this week – the first time since 2008 – meaning that borrowing costs have doubled in the past nine months as the Fed has been increasing rates. For context, assuming 20% down, a $2,500 per month payment equated to a $500,000 purchase price. Today, it equates to roughly a $300,000 purchase price.

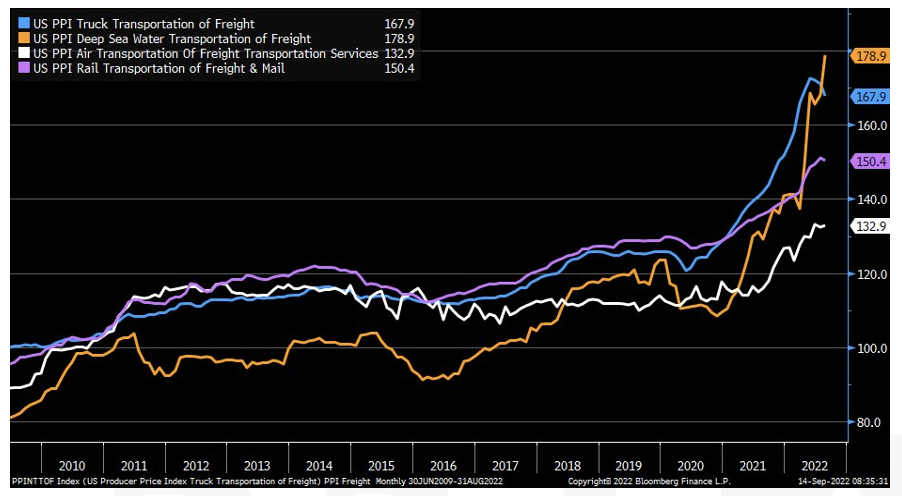

Freight rates continue to remain high as the chart below indicates. Further pressure on shipping will likely increase as Egypt plans to raise fees for cargo ships passing through the Suez Canal by 15% in 2023. Bulk and tourist ships will see a 10% increase and the increase will be applied January 1, 2023. Shipping container prices have almost doubled in 2022 and an increase in fees will only add to the large increase we have seen since the pandemic.

World leaders will convene in London early this week for Queen Elizabeth’s funeral and then gather in New York City for the 77th session of the UN General Assembly. On the data front we’ll learn about multiple countries’ CPI equivalents, building permits in the US and the US Fed’s interest rate decision 2pm on Wednesday.

Equities

The S&P 500 is officially in bear market territory as it dropped below 3,900 Friday to 3,873.33 (-0.72% for the day; -4.73% for the week), while the Dow dropped 0.45% (-4.14% for the week) and the Nasdaq dropped 0.90%

(-5.48% for the week). Friday was also quadruple witching day with the expiration of individual stock options, stock index options, stock index futures and single stock futures. All other indices were down for the week as well.

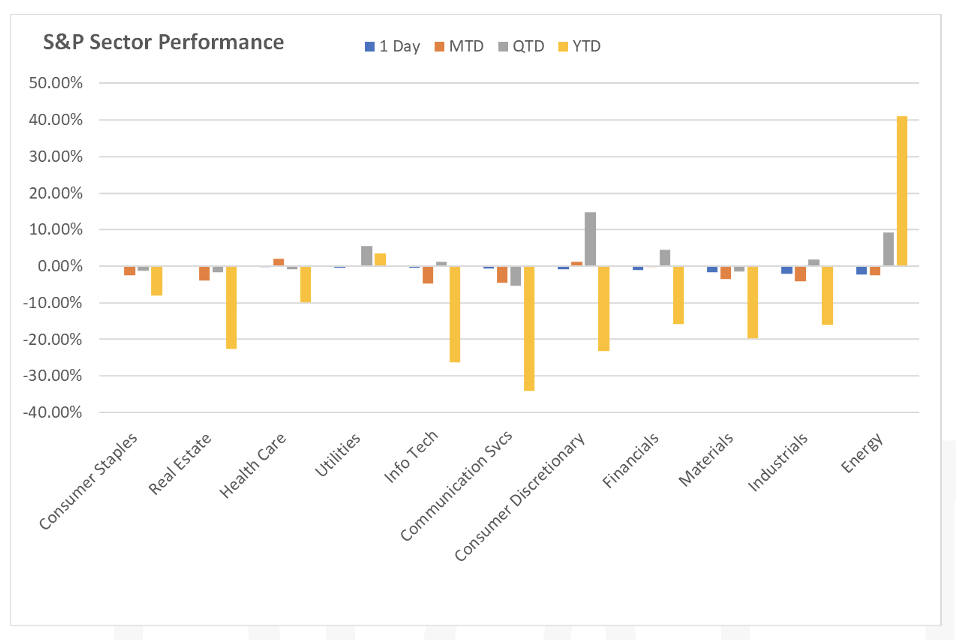

All sectors except consumer staples and real estate were down for the day on Friday.

Many companies’ stock prices were dismal on Friday as management teams are starting to provide news of slowdowns in their industries. The FedEx (-21.40%), CEO stated that “global volumes declined as macroeconomic trends significantly worsened later in the quarter”, which may have also led to the declines of companies that make corrugated cardboard such as International Paper (-11.24%), WestRock Company (-11.48%). GE (-3.66%) warned that extended supply chain disruptions is threatening deliveries and pushing up costs.

Meanwhile, the US PCAOB and SEC are about to begin their regulatory inspections of all audit papers on Monday of the China based or Hong Kong based audit firms with the inspections of firms such as Alibaba Group Holding (BABA), JD.com (JD), Yum China Holdings (YUMC). If PCAOB are prohibited from conducting complete investigations ~200 China based issuers will face trading prohibitions in the US that has approximately $1-$2 trillion in market capitalization.

Asian and European markets indices finished broadly lower on Friday.

Fixed Income

The week started off with a very important CPI report, a key inflation metric which showed a YoY rate of 8.3%. In response, bond prices fell, and yields jumped after the report was released. The 2-year Treasury yield rose 25-bps to 3.74% and the 10-year rose 13-bps to 3.42% in response to the unexpected CPI report. The 10-year Treasury yield is at its highest point since 2007. Shorter term yields rose slightly throughout the rest of the week while longer terms stayed relatively flat. With the Fed’s next meeting coming up this week, a 75-bps increase to the benchmark rate is expected. Many different estimates of how far the Fed will go on interest rates are being floated. Refinitiv data showed that the terminal rate now stands at 4.45%, which is more than 200 bps higher than the current benchmark. Yields on the 10-year Treasury Inflation-Projected Securities (TIPS) reached their highest point since January 2019 at 1.03%.

Indian government bonds have seen a flurry of purchases over the past six weeks due to the anticipated inclusion of Indian debt in global bond indexes. Investors have bought bonds worth $836M and primarily in the 5-year and the 2031 benchmark rate. Goldman Sachs expects inflows of around $30B from the inclusion in JPM’s emerging markets index while Barclays expects inflows to come to around $25B. Flows into Indian bond markets could hurt other markets like Indonesia. Indonesian bonds could possibly be affected due to foreign investors having exposure to Indonesian bonds. The upcoming inclusion of Indian bonds in the indices could pull investors away from Indonesia in an attempt to diversify.

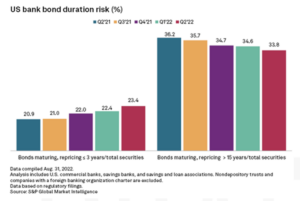

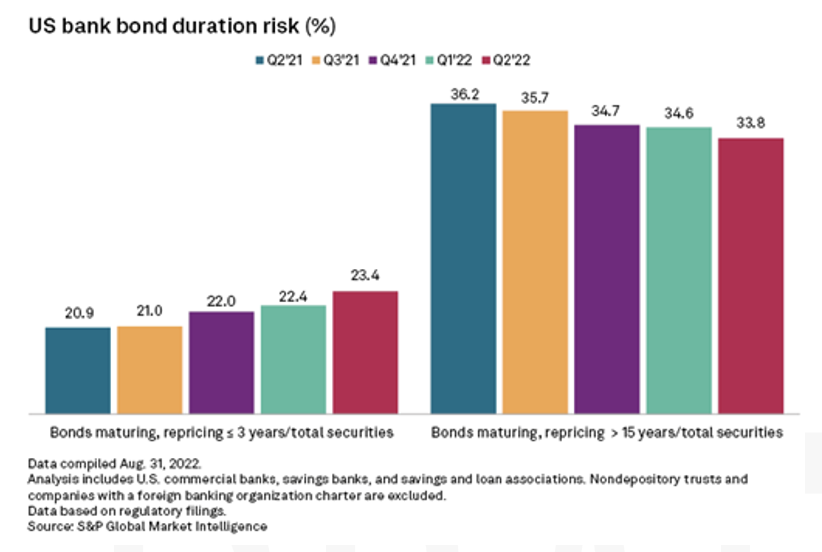

Banks have slowed on bond purchases due to a decline in Q2 deposits. Banks have continued to allocate less cash to the long end of the yield curve due to the liabilities these investments face when rates rise. Bonds set to expire in 15 years or more have seen a drop off in allocation, down 33.8% of bank held securities from 36.2% in the same quarter a year ago.

Hedge Funds (through Thursday, September 15th)

Similar to the second half of August’s market sell-off, hedge funds once again earned their keep this past week with the average global fund down 60 bps compared to 310 bps for the MSCI World. NA long/short equity funds fared a little worse, declining 130 bps but that is compared to -410 bps for the S&P 500. EU and Asian funds were down less than 100 bps each. Crowded longs and shorts performed in line with their relative benchmarks in all regions. With global equities selling off for the week, hedge funds tilted towards net selling, lowering net leverage. The selling came more from short additions, than long reductions leading to gross exposure inching higher. The net selling was concentrated in North American equities followed by the EU with much of the NA selling in index products. Looking at single-names, financials were the most net sold which was predominantly banks. TMT contributed to the net selling mostly in software and IT services. Flows to traditionally defensive sectors were more muted and were actually slightly net bought for the week. In Europe, the selling was more even between short additions and long reductions. Multi-strategy and macro funds accounted for the lion share of the selling with long/short equity and quant funds more muted. Unlike NA, selling in Europe was in more defensive sectors as well as energy where there was more net selling than has occurred in months. Hedge funds were small net buyers of Japan and Asia ex-Japan.

Private Equity

Amidst a complex macroeconomic and geopolitical backdrop, US middle-market private equity firms deal activity remained modest during Q2 despite high inflation and continued interest rate hikes. Although middle-market deal making has experienced a sharp decrease compared to the record-breaking levels in 2021, 2022 remains on pace for a healthy year according to historical standards.

Analysts suspect that with abundant dry powder available, private equity firms are well positioned to pursue deals that have become cheaper due to falling prices and lower valuations trickling into private assets. Large GP’s are also likely to pursue middle-market deals as many have become less willing to make massive bets and are turning to smaller, tuck-in investment opportunities.

Fundraising slowed during Q2 as many middle market firms wrestled with an increasingly crowded fundraising landscape. High demands for capital have pushed LPs to their allocation limits while a decline in exits has reduced capital flow back to investors to recycle into new fundraises. The current environment is likely to most negatively affect middle-market firms as institutional investors tend to prioritize larger, more established managers during times of limited capital. As a result, many middle-market GPs will have to adopt flexible fundraising playbooks and look for new avenues of capital.

Data Source: Bloomberg, BBC, Charles Schwab, CNBC, the Daily Shot HFR (returns have a two-day lag), Jim Bianco Research, Market Watch, Morningstar, Pitchbook, Standard & Poor’s and the Wall Street Journal.