Economic Data Watch and Market Outlook

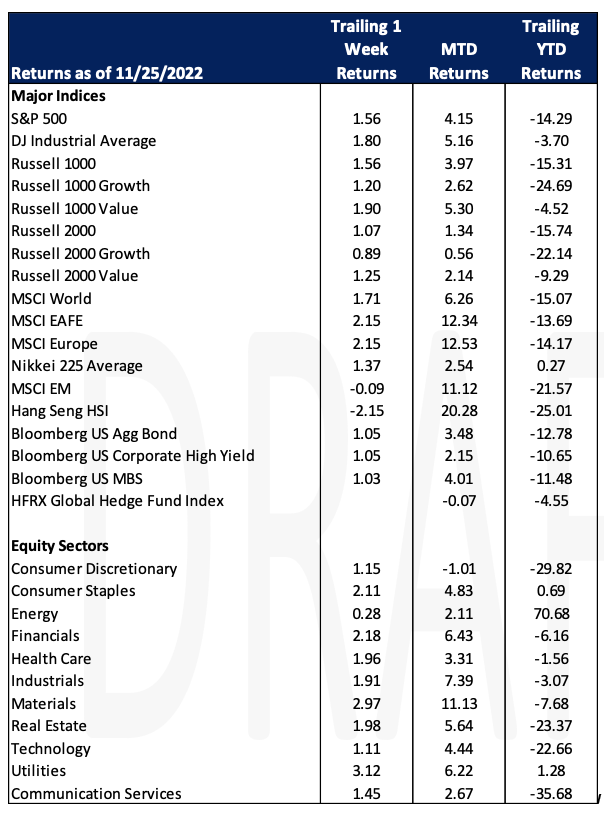

Global equity prices advanced for the week with the MSCI World index rising 171 bps and the US Aggregate Bond index rising 105 bps. US data releases were limited this week due to the Thanksgiving holiday and market volumes were considerably lighter than normal as a result. Economic data releases from international markets were mixed but generally the trend is pointing toward an economic slowdown.

While the week was slow with economic data releases in the US, investors focused on the consumer spending habits on Black Friday. This year retailers were expecting more foot traffic as the consumer is now venturing out post-COVID. Initial reports were that spending was up 2.9%. Sales may be more muted on Black Friday as larger retailers eliminated “Door Buster” sales events during COVID and chose to run sales throughout the week. That trend continued this year.

Protests against COVID lockdowns are increasing in China with some reports that protestors are starting to demand the resignation of President Xi. Lockdowns are not only causing tension inside China but are causing shipping and manufacturing delays of goods needed for the holiday season.

The upcoming week we’ll see a variety of GDP and CPI data coming from France, Germany, India, and Italy as well as the European Commission. Within the US, we’ll gain more insights on the housing market mid-week, key information on the job market from ADP and Challenger, and consumer spending. Also expect a variety of corporate release detailing weekend sales.

Data Source: Bloomberg, Charles Schwab, CNBC, the Daily Shot , HFR (returns have a two-day lag), Standard & Poor’s and the Wall Street Journal.