Economic Data Watch and Market Outlook

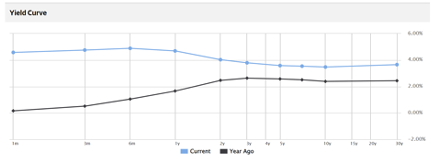

The MSCI World surged 3.77% for the week as both International and US stocks posted gains. Bonds fell slightly, declining 46 basis points as the bank panic eased. The curve is still inverted with the two-year Treasuries yielding 4.027% and the 10-year yielding 3.471%.

February Core PCE Price Index fell slightly from the previous year (4.6% versus 4.7%) and came in below consensus (4.7%). The PCE is a data point often relied upon and referenced by Powell and is an indicator of the average increase in prices for all domestic personal consumption.

Economic data released by Japan and the EU (and its member countries) indicated that there is a slowing of economies globally. Bank of Japan’s Core CPI result came in lower than expected (2.7% vs 3.5% consensus) while Germany’s CPI year-over-year was slightly higher than consensus (7.4% versus 7.3%) but showed a decline. Consumer data dropped precipitously and retail sales dropped far more than expected (-7.1% versus – 6.1% estimate).

US initial jobless claims came in at 198,000, slightly more than the 196,000 expected. Sentiment surveys in the US and abroad declined as consumers start to feel the impacts of inflation via job cuts and curtailed spending.

On March 28th, China and France completed their first yuan-settled trade of 65,000 tons of liquified natural gas. The trade was between the China National Offshore Oil Corporation and Frances Total Energies and was settled on the Shanghai Petroleum and Natural Gas Exchange.

Equities

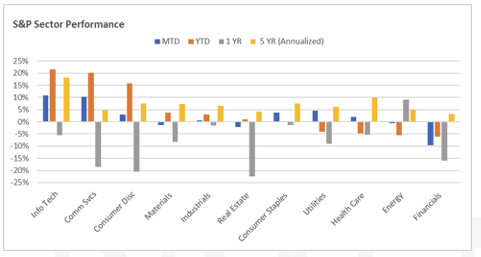

The S&P’s +3.50% gain this week was the highest since November. Sectors that outperformed with the largest year-to-date gains included: technology (+21.49%), communications services (+20.81%) and consumer discretionary (+15.76).

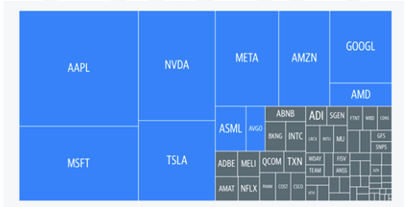

The Nasdaq had its largest quarterly gain since June 2020 posting its best performance since the second quarter of 2020 largely outperforming the S&P 500 and Dow Jones Industrial Average. The 17% jump for the quarter was the widest outperformance margin versus the Dow since 2001. The top 10 stocks accounted for 88% of the gains.

Through a different lens, growth stocks have significantly outperformed value stocks on a YTD basis with the Russell 1000 Growth Index advancing 14.37% versus the Russell 100 Value’s jump of only 1.01%. While the margin was not as significant, small caps saw similar disparities with the Russell 2000 Growth, up 6.07% versus a drop of 66 basis points for the Russell 2000 Value.

European equity markets were up slightly Friday and for the week (FTSE 100: -+3.15%; DAX: +4.58%; Euro STOXX 600: +4.03%). The FTSE closed higher on gains in healthcare and consumer staples on Friday, while the Euro STOXX 600 rallied on technology stocks.

Asian equity markets were up for the week (Hang Seng: +2.58%; Nikkei: -+2.40%; Shanghai +0.22%). Alibaba (BABA:

-1.16%/Friday; +17.75% / week) announced that it will split the company into six independently run companies as follows: cloud computing and intelligence group, global digital commerce; digital media and entertainment, local services business and core Chinese e-commerce operations. Each of the companies will have its own CEO and board of directors and will also be able to raise outside capital and seek IPO’s except for the core Chinese e-commerce operations, which will remain wholly owned subsidiaries of Alibaba.

Fixed Income

March saw the sharpest rally in US government debt in years after a tumultuous month for the financial sector. Throughout the last week of March, Treasury yields on the shorter end of the curve jumped, with the 2-year Treasury yield rising 30 bps, the 10-year Treasury yield rising 10 bps, and the 30-year Treasury yield rising 3 bps. The Bloomberg US Aggregate Bond index has risen 2.54% MTD but fell 0.46% for the week while the Bloomberg US Corporate High Yield Index has risen 0.23% MTD and 0.55% for the week. Lastly, and the Bloomberg US MBS index climbed 1.95% MTD but fell 0.88% for the week.

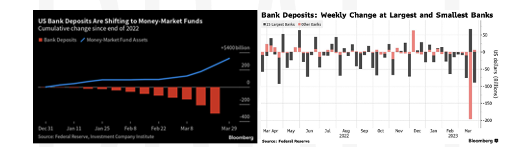

Money-market funds have seen large inflows since the start of 2023 as investors have chosen to capitalize on attractive risk-free rates with returns near 4%. Total assets held in money-market funds have reached $5.2T according to data from the Investment Company Institute, with $300B added in the last several weeks. Commercial bank deposits have fallen in the weeks following the bank collapse early this month, losing $125.7B as of the week ending March 22nd, marking the ninth-straight week of declines which began in early 2023. Deposits at domestically chartered banks fell $84B, decreasing deposits at the top 25 largest institutions, while deposits at small banks have increased slightly.

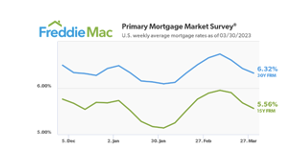

Mortgage rates have fallen for the third straight week with the rate on a 30-year fixed mortgage falling to 6.32% from 6.42% from a week prior. Rates have fallen 41 bps since March 9th. In turn, mortgage applications to purchase a home jumped by 2% for the week ending March 24th, while refinance activity increased 5% from the previous week. According to Redfins chief economist Daryl Fairweather, “Mortgage rates are unlikely to increase again unless the next inflation report is worse than expected”.

Hedge Funds As of Thursday, March 30th

Following several weeks of challenging performance, many hedge funds were able to capture a sizable amount of the week’s gains with Americas-based and Asia-based the best performers. The average global fund was up 80 bps compared to 250 bps for the MSCI World while, global long/short equity funds returned +140 bps. As mentioned previously, Americas-based funds captured a significant portion of the upside gaining 170 bps for the week compared to +200 bps for the S&P 500 with a net leverage of 48%. Asia-based funds performed quite well with the average fund in the region gaining 100 bps and average long/short equity fund +110 bps vs. +110 bps for the MSCI-Asia. Contributing to this return was the top 50 crowded longs that outperformed the index by ~ 2%, mostly from US listed Chinese internet names (the Morgan Stanley China Internet Index was up 4.9% WoW). European funds posted the smallest gains for the week despite European equities outperforming (+30 bps for the average fund vs. +350 bps for the index). That said, Europe is the only region where funds are outperforming their relative index MTD.Regarding flows in NA, on a factor level, funds were sellers of quality, size and growth after these factors were steadily bought for most of the month. Funds were net buyers of NA equities which was almost all short covering in ETFs (macro products were the largest net buyers). Funds continue to sell TMT and related industries and buyers of industrials and materials. HF were also sellers of healthcare and consumer staples which was a reversal of trend from the rest of the month.Outside NA, HF continue to be net sellers of Europe but at a much slower pace than previous weeks, mostly from selling longs in industrials and adding to healthcare shorts. Lastly in Asia, HF were net sellers of Japanese equities and also reduced gross exposure by selling longs and covering shorts. AxJ was net bought in small amounts mostly Korea, China (ADRs) and Hong Kong.

Private Equity

This year’s biggest energy buyout took place with a team of PE firms led by Brookfield. The deal will take Australia’s largest integrated energy company, Origin Energy, private. Origin Energy retails electricity and natural gas to over 4 million customers throughout Australia. Monday, Origin’s board accepted a revised bid from EIG-backed MidOcean Energy worth A$18.7 billion. Brookfield sees the buyout as an opportunity to flex its renewable power generation buildout expertise where there is a large electric consumer base. EIG stated the deal touches on its views on liquified natural gas or LNG as a cleaner alternative to coal and oil.

The buyers’ original bid was last August at A$7.95 per share for Origin and went public in November with raised bid of A$9.00 per share that translated to a valuation of A$18.4 billion. Following further due diligence, the investor group lowered its offer by a few cents and made a requirement that Origin hedge further against oil and natural gas. Ultimately, they agreed upon a A$8.912 per share buyout. Brookfield will be funding the deal through its Global Transition Fund I which closed last June on $15 billion coupled with its corporate debt and other sources. Under the agreement Brookfield would acquire Origin’s energy markets business. The company contains Australia’s largest coal-fired power plant, its largest fleet of natural gas fired power plants, contacted renewable power generation, and a book of retail business and wholesale power customers. They also would acquire Origin’s 20% stake in software and energy provider, Octopus Energy, with backing from Generation Investment Management and the Canadian Pension Plan Investment Board.

Brookfield plans to keep Origin’s plan to invest $20 billion in additional capital towards renewable power generation. It is said that they are looping in an Indian energy company, Reliance Industries, for renewable collaboration. EIC LNG company MidOcean Energy would acquire the integrated gas business consisting of Origin’s 27.5% stake in Australia Pacific LNG, which produces gas offshore and liquifies it to sell in the domestic market. Closing is expected for early 2024 but MidOcean already agreed to sell 2.49% of its APLNG stake to US-based Conoco Philips. That share size would make it large enough that it could assume all of the operating responsibilities involved in APLNG.

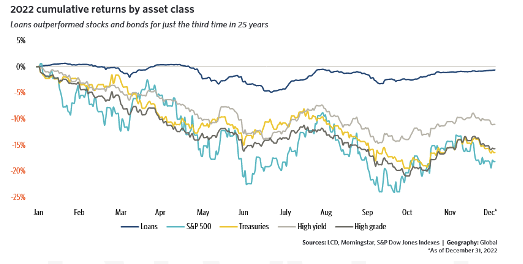

Private debt managers are seeing more opportunities for alternative lending as the debt market tightens amid financial turmoil in the banking sector. Private debt slowed last year but still raised over $200 billion in revenue for 2022 which marks the third straight year where it raised over such a mark. Within private debt, private lending is the most in demand for borrowers seeking an attractive yield. Floating rate capitalized on the moves in rates this year compared to a traditional bond portfolio. The Morningstar LSTA US Leveraged Loan Index Returned -0.6% vs a -15.7% for high grade corporate debt. This marks only the third time loans have outperformed stocks and bonds since inception of the 25 year index.

Private debt managers are starting to target areas in direct lending, distressed debt, and asset-based lending. According to PitchBook data, two of the largest funds in the market now are direct lending funds Ares Capital Europe VI and Oaktree Lending Partners.

Following the last financial crisis direct lenders have been taken up a bigger share in the leveraged loan market. the lack of funding will create more opportunities for lenders creating more structured loans with stronger covenants and larger spreads. A possible recession and more restructuring have created more opportunities in the distressed space and managers who are seeking special situations in financing.

Data Source: Bloomberg, BBC, Charles Schwab, CNBC, the Daily Shot HFR (returns have a two-day lag), Jim Bianco Research, Market Watch, Morningstar, Pitchbook, Standard & Poor’s and the Wall Street Journal.