Economic Data Watch and Market Outlook

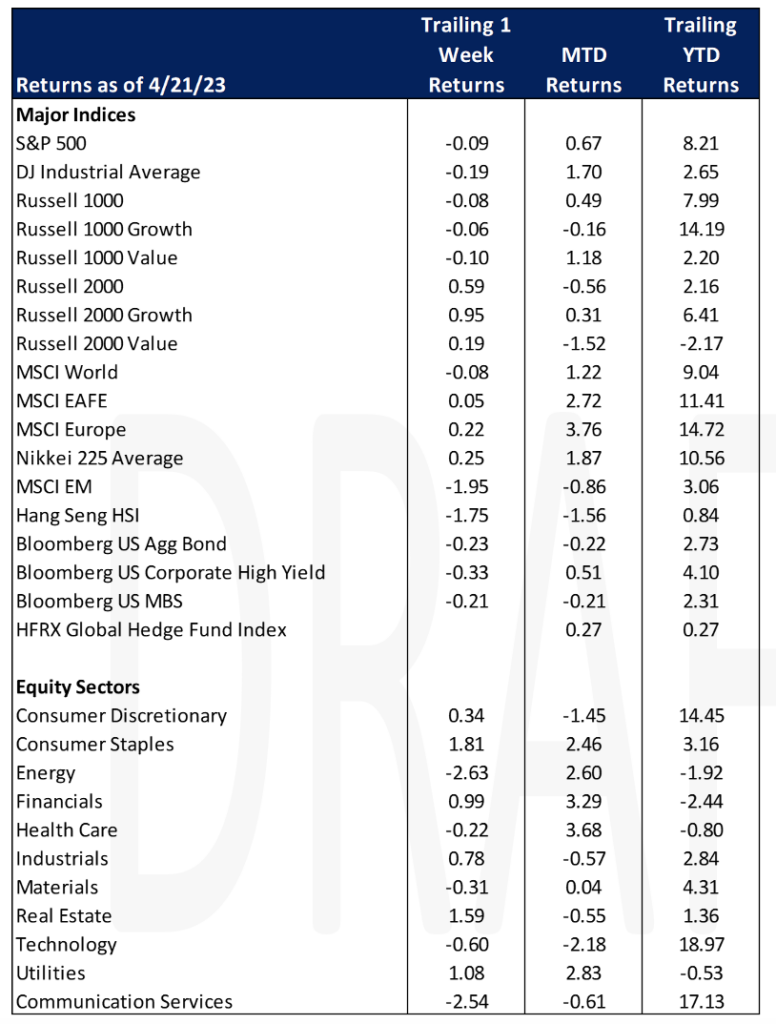

Developed global equities were flat for the week (MSCI World -0.08%) while bonds declined slightly (Bloomberg AGG -0.23%). Emerging markets fell 1.95%.

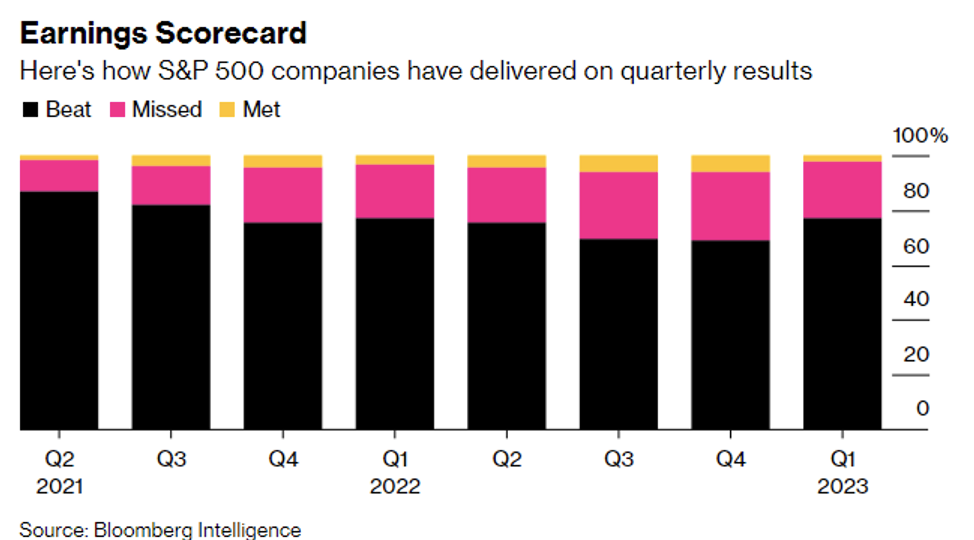

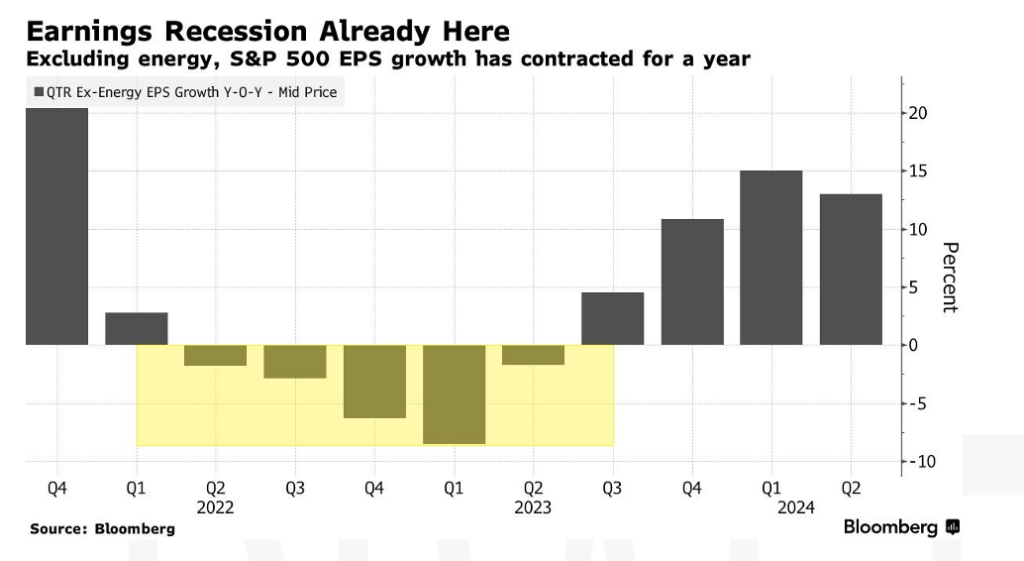

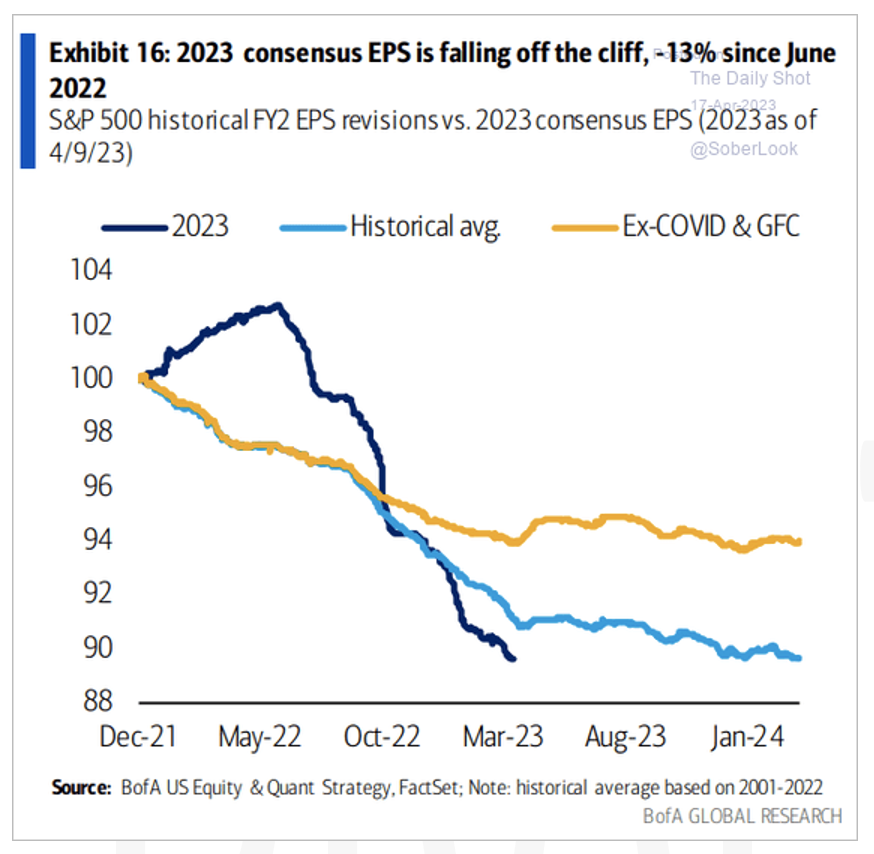

Roughly 20% of the S&P 500 Index constituents have reported Q1 earnings so far with more than 77% of the reports exceeding expectations. Bank of America had previously estimated a 2023 EPS target of $200 for the S&P 500, with the consensus earnings forecast for the next 12 months now showing EPS at $219 according to Bloomberg.

While this is good news keep in mind that analysts had reduced the earnings expectations from previous guidance.

Further, those expectations are likely to decline versus historical norms.

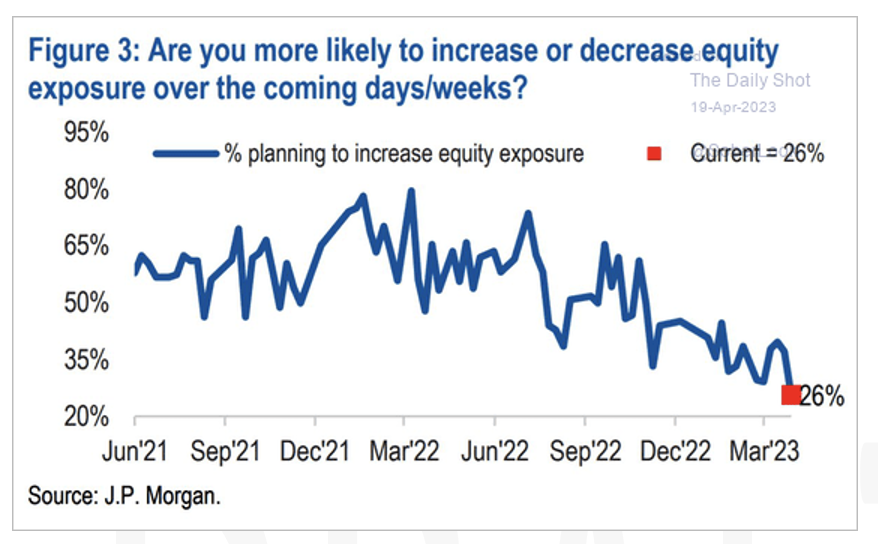

JP Morgan and Bank of America noted in recent reports that their investors are starting to favor more cash and less equities.

Equities

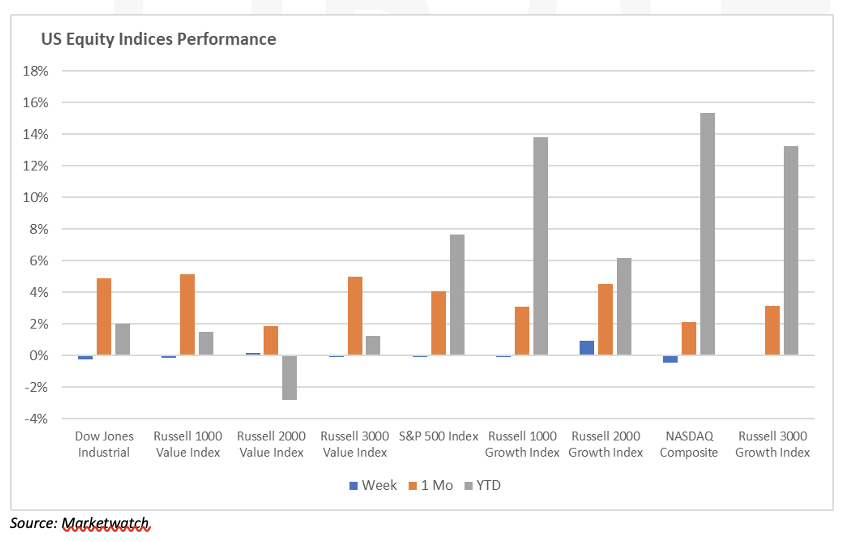

US equity markets ended down for the week (Dow: -0.19%; S&P: -0.09%; Nasdaq: -0.60%).

Year to date, growth continues to outperform value, large cap and small cap has outperformed mid cap.

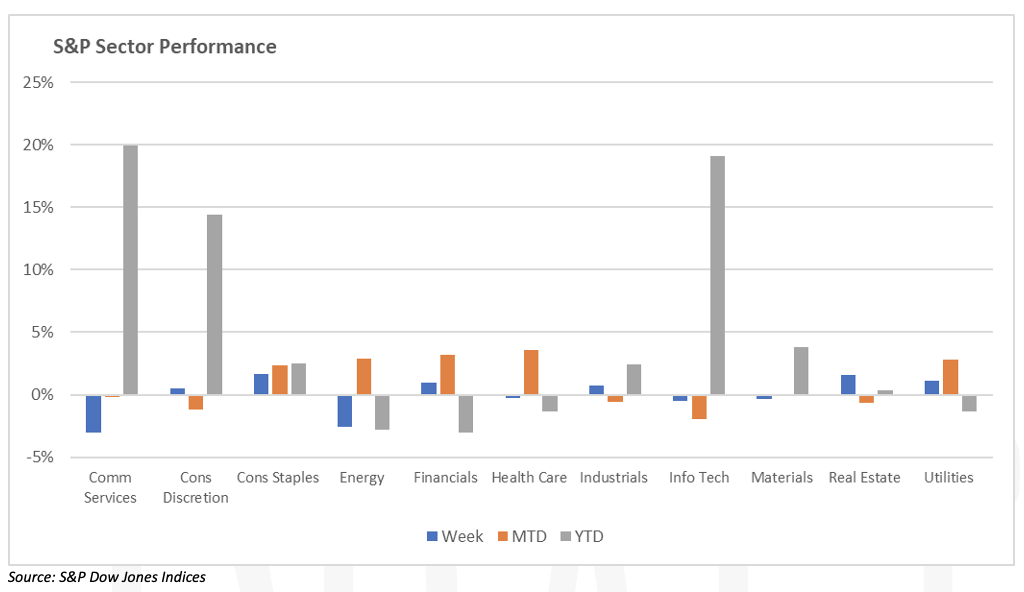

This week the top three S&P performing sectors were consumer staples, real estate and utilities while the bottom three performing sectors were communication services, energy and information technology.

Some news in the market: Goldman Sachs (GS: +1.42% / week) sold part of their Marcus portfolio with the remaining held as available for sale. Meanwhile Goldman partnered with Apple (AAPL: -0.12%/week) last week where holders of its credit card could start parking their cash back rewards in a linked high yield savings account which currently yield 4.15%. Stephen Tu from Moody’s Investor Service noted that “Apple has an ability to attract a significant amount of savings to the Apple ecosystem and away from traditional banks if it aggressively promotes the account.” Apple also recently stated the rollout of Apple Pay Later, a buy now pay later offering.

Merck (MRK: +0.06% / week) announced the acquisition of Prometheus Biosciences Inc for $10.8 billion at the beginning of the week. Prometheus (RXDX: +70.22% / week) is a clinical stage biotechnology company focusing on autoimmune treatments. This acquisition by Merck will help the company diversify its portfolio.

European equity markets for the week (FTSE 100: +0.43%; DAX: +0.41%; Euro STOXX 600: +0.45%). Asian equity markets (Hang Seng: -1.75%; Nikkei: +0.25%; Shanghai: -1.11%) for the week. India’s private lender ICICI Bank (ICBK.NS) reported a net profit for the fiscal fourth quarter ending in March of almost 30% due to improved net interest income and healthy loan grown. India’s market regulator, the Securities and Exchange Board of India (SEBI) has proposed allowing asset managers to charge performance fees in mutual funds if a fund consistently outperforms a relevant benchmark index and gives higher annualized returns.

Fixed Income

Treasury yields rose across the board this week, with the 2-year Treasury yield rising 9 bps, the 10-year Treasury yield rising 5 bps, and the 30-year Treasury yield rising 4 bps. The Bloomberg US Aggregate Bond index fell -0.23%, the Bloomberg US Corporate High Yield Index fell -0.33%, and the Bloomberg US MBS Index fell -0.21%.

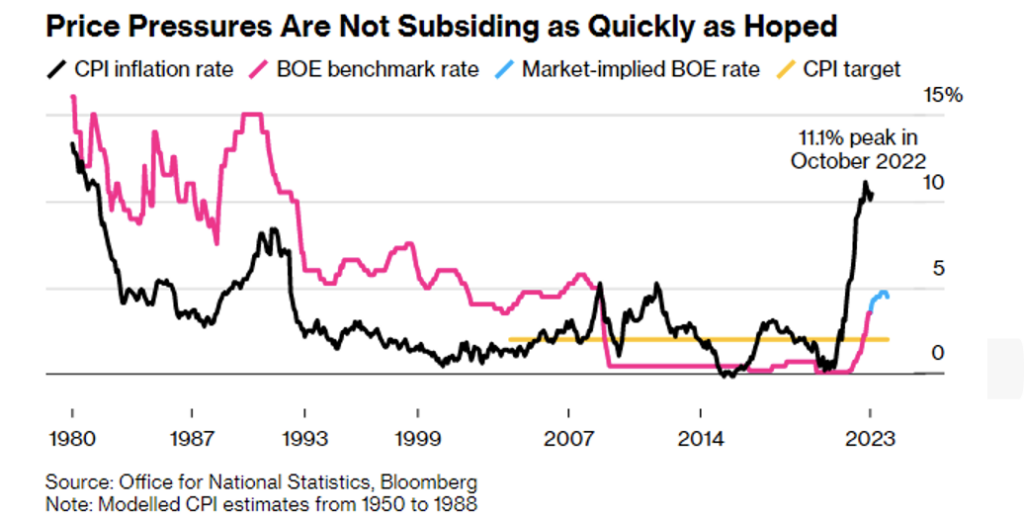

Overseas, investors expect the Bank of England to hike rates at the May 11th meeting. Inflation, wage growth, and the purchasing managers index drastically exceeded economists’ expectations this week, all but solidifying several more rate hikes to come for the UK. Traders are now pricing in 3 more rate hikes by September, which would put the BOE implied rate at 5%, the highest in 15 years. March inflation data showed that inflation is still sitting at 10.1% annually, after hitting a peak of 11.1% in October 2022.

Japanese Lender Sumitomo Mitsui has reponed their Additional Tier 1 (AT1) market with a raising of 140B Yen, or $1B USD. The AT1 segment of the bond market was called into question in the aftermath of UBS Group’s emergency takeover of Credit Suisse Group who wrote down $17B of similar bonds on March 19th.

Since the failure of Silicon Valley Bank in mid-March, banks have started to recover their March losses. Bank of America’s Q1 earnings showed that unrealized losses shrank by $9.5B from three months prior, and $17.1B from six months ago when rates were at their peak. Bank of America posted a profit of $8.16B in Q1, up 15% from a year earlier. Revenues rose 13.6% to $26.26B. US bank deposits are now at their lowest level since July 2021 with deposits falling by $76.2B in the week ending April 12. Simultaneously, commercial bank lending rose $13.8B, and on an adjusted basis, loans and leases fell $9.3B.

Hedge Funds as of Thursday April 20th

Global funds were flat for the week with the MSCI World down 21 bps. US-based long/short equity funds had a good week rising 27 bps on average with the S&P 500 down 17bps. Asia-based long/short equity funds basically tracked the MSCI Asia Pacific declining 64 bps while EU-based funds were the only region to lose money despite their index rising (-24 bps compared to the Euro STOXX rising 15bps in the same time period). Crowded names in NA were in line with each other, therefore a flat spread for the week. EU crowded shorts underperformed leaving them with a 50 bps positive spread and in Asia, the positive spread was the largest at +130 bps as crowded longs outperformed their benchmark. Flows continued to be quiet, but funds tilted towards selling global equities. In NA at the sector level, the only sectors to be net bought were industrials and materials (both cyclicals) while selling took place in traditional defensive sectors such as consumer staples, healthcare and utilities. The only cyclical sector to be net sold was energy where hedge funds were large sellers. Net flows in macro products were relatively muted for the week. Outside of NA, hedge funds took the opposite stance, buying defensive sectors (utilities and real estate) while selling defensives (energy through long sells and materials through short adds). Funds continued to sell EU tech longs and added to semiconductor shorts. In AxJ, hedge funds were small buyers of the region, mostly in China, through buying of ADRs and covering A-shares. Japanese stocks were net bought for the week.

Private Equity

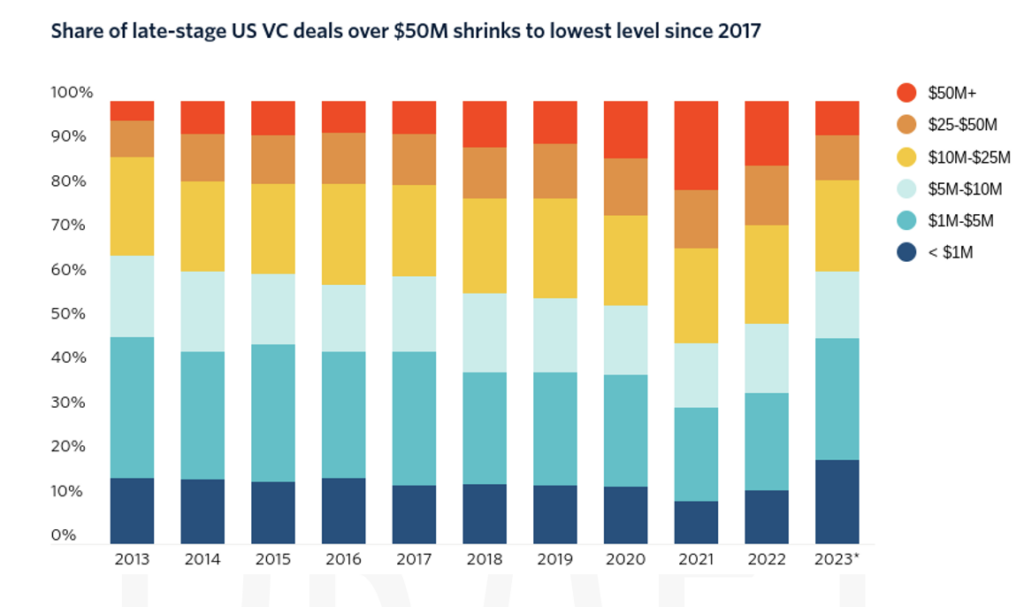

Late-stage VC deals fell for the seventh straight quarter and angel and seed-stage deals also saw a decline hitting a 10-quarter low. Investors’ confidence was impacted in Q1 due to the failure of Silicon Valley Bank impacting the VC deal activity. Q1 2023 deal activity dropped in all stages and sectors and fundraising momentum carried from 2021 is gone. Despite a drop-in deal count from Q4 2022, Q1 2023 still remains above 2020’s quarterly figures. Venture-growth deal value increased in Q1 2023, influenced mainly by Stripe’s $6.5 billion raise. On that same point, deal count in the growth-stage hit the lowest it has been since Q3 2020.

Late-stage deal value has also declined to a 21-quarter low, hitting only $11.6 billion. Deals over $50 million in late-stage VC is on pace to not meet half of 2022’s deal count. In the quarter, 55 late-stage companies closed deals over the $50 million-mark which translates to around 7.7% of deals in the space compared to an average of 14.5% last year. Deals over $100 million saw a large amount of volume in 2021 before the steep decline in 2022. This last quarter is bringing them back in line with how the environment was in 2020. The demand for capital remains high especially in late-stage venture but supply is lower than what is needed, especially in late stage venture. Per PitchBook estimates, for every $3.20 demanded by late-stage founders there is $1 available. In early-stage and venture growth it is not as dramatic as their ratio of demand to supply is 1.6x and 1.3x.

Data Source: Apollo, Bloomberg, BBC, Charles Schwab, CNBC, the Daily Shot HFR (returns have a two-day lag),Goldman Sachs, Jim Bianco Research, Market Watch, Morningstar, Morgan Stanley. Pitchbook, Standard & Poor’s and the Wall Street Journal.