Expertise + access + agility = Alpha 2.0

The traditional Outsourced Chief Investment Officer approach focuses on model portfolios and reducing management and administrative burdens. Clearbrook takes a different view. To us, OCIO is a business of generating alpha. And we have the experience, the research, the manager relationships, and the agility that enable us to deliver.

Alpha is traditionally defined as the excess return of a portfolio above that of its benchmark, and often associated with big risks and non-correlated investments. Those views may have been adequate at one time. But a black swan world requires new thinking.

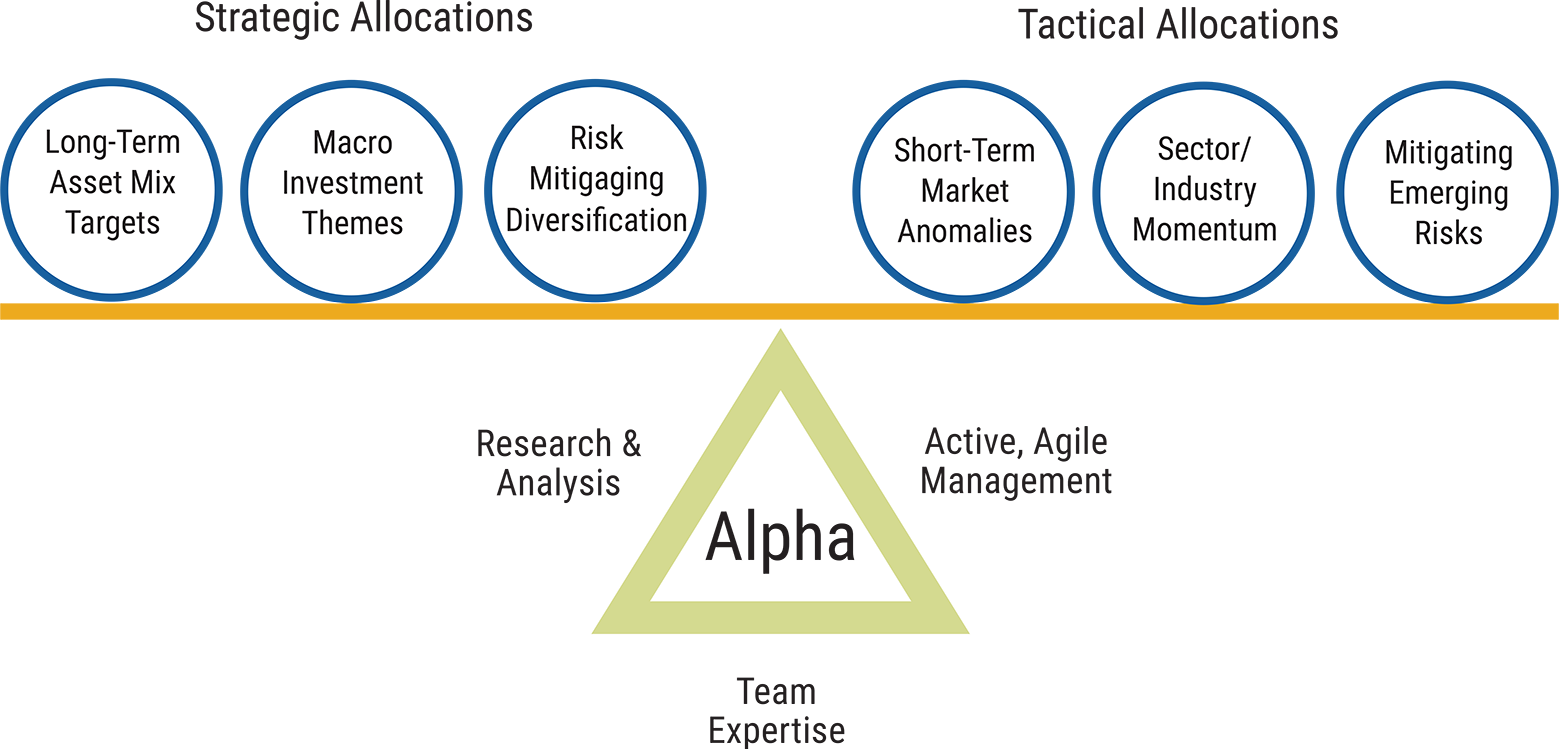

In reality, alpha isn’t generated by consistently hitting home runs or sinking 30-foot putts. Alpha is generated by asking the right questions, making the right decisions and protecting against the right “what ifs”, day-in and day-out. Alpha is about having a clear long-term vision, integrated with the experience and agility to take advantage of short-term opportunities before they disappear. And alpha is about building resilience into your portfolio against foreseeable and unforeseeable risk.

Long-term vision, tactical agility and a relentless focus on risk

- Clearbrook’s independence enables our research team to select the best research from any source, and our experience, expertise and team approach enable us to uncover, analyze and implement strategies across asset classes, sectors and markets worldwide.

- In today’s markets, there is growing investor demand chasing a limited supply of good opportunities. Clearbrook’s size and agility enable us to quickly allocate to asset classes, managers and opportunities with limited capacity.

- Clearbrook’s “open architecture” culture means we welcome investment concepts from all participants in our investment relationships. We aren’t trying to scale model portfolios, and we’re smart enough to know we don’t have a monopoly on good ideas.

- Clearbrook is laser-focused on risk. Mitigating your downside risk can be even more important than upside return in ensuring that you’ll have the income and assets to meet your obligations.

Generating Alpha

Enhancing Long-Term Return with Short-Term Opportunity

Risk & Resilience

Alpha 2.0- Mitigation strategies

- Tactical volatility management

- Accelerating recovery

Long-Term Return

- Asset allocation

- Manager selection

- Allocation & manager changes

Client Partnership

- Customized benchmarking

- Ongoing progress reporting

- Consistent communication & education

What this means for you

Clearbrook’s focus on consistent incremental gain and risk mitigation – Alpha 2.0 – isn’t just theory. We’ve put it into practice, and the long-term results speak for themselves.

A Clearbrook OCIO solution can bring you the investment talent and resources you need to meet your fiduciary duties in an increasingly complex and volatile investment environment. From your investment policy statement, through strategic and tactical asset allocation, manager selection and risk mitigation, to administration and compliance, Clearbrook may be the right investment partner for a more challenging world.

Invest in a meeting with us.

We would welcome the opportunity to talk with you

about your current portfolio and how an OCIO relationship with Clearbrook could help you better prepare for what’s ahead.

We won’t just bring our credentials. We’ll bring our

best ideas.

To discover how Clearbrook can connect you with opportunity, contact: info@clrbrk.com or use our contact form.