ECONOMICS

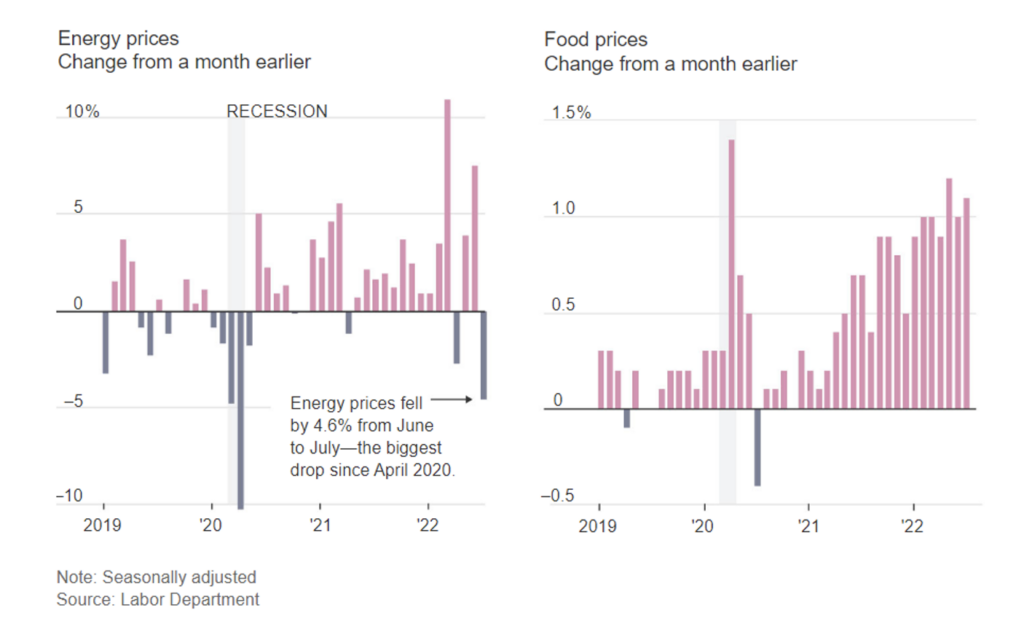

Despite inflation slightly declining, the Fed is expected to continue increasing rates until data shows further slowing. US inflation eased somewhat to 8.5% in July per The Labor Department’s release of the consumer-price index on Wednesday. Food prices overall rose 1.1% in July, climbing across all major categories along with material price increases in electricity and alcohol consumed at home. The CPI was flat after rising for 25 consecutive months – helped by falling energy prices such as gasoline. Gasoline dropped below an average of $4 a gallon for the first time in five months on Wednesday delivering an unexpected boost to the economy. On the supplier side, inflation has been at its slowest pace since last fall. The producer-price index showed a July deceleration signaling cost pressures have eased slightly; down 0.5% from the prior month and the first decline since April 2020. Considering the CPI and PPI data together suggests that inflation pressures could be easing.

Future inflation expectations improved but remain elevated according to the consumer sentiment index; rising in early August and continuing to climb from a record low earlier in the summer. Applications for unemployment benefits climbed to a new 2022 high since reaching a 50-year low in March. The Labor Department said claims increased by 262k last week; these new figures come as other economic indicators point to a strong US labor market however some economists believe that the tide could be turning.

The House of Representatives passed the Inflation Reduction act on Friday which is now going to Biden’s desk. The bill is sized at $750 Billion and would make sweeping changes to the health and climate sectors. The bill includes a measure to place a 15% minimum tax on large corporations, and a 1% tax on stock buybacks.

EQUITIES

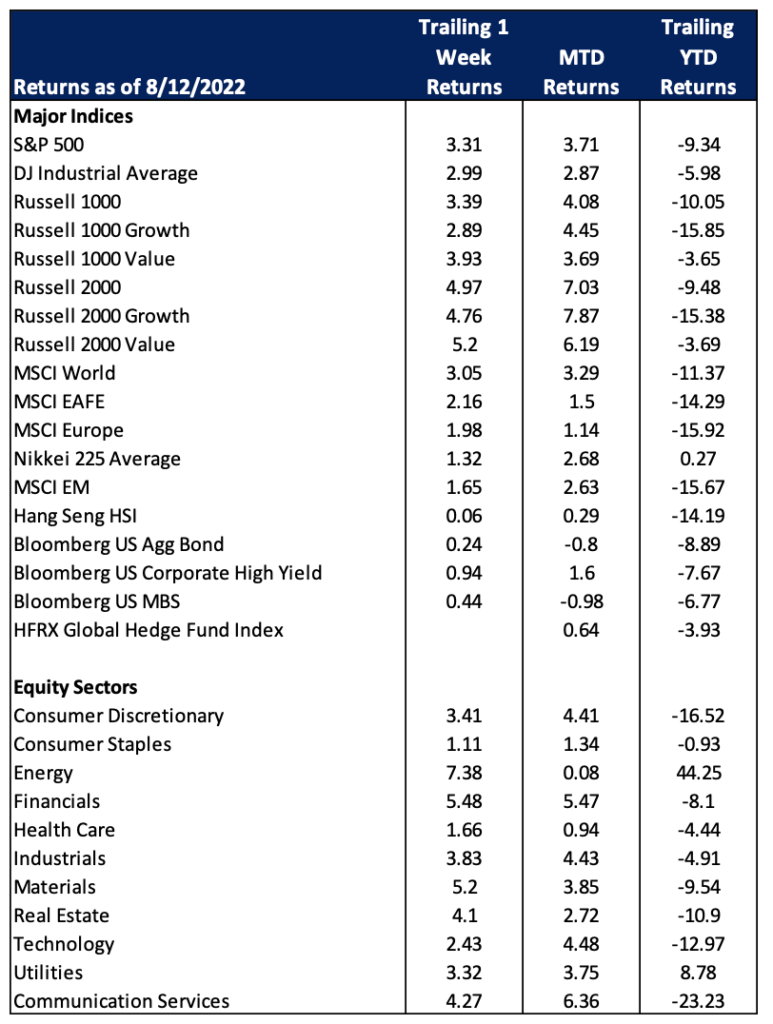

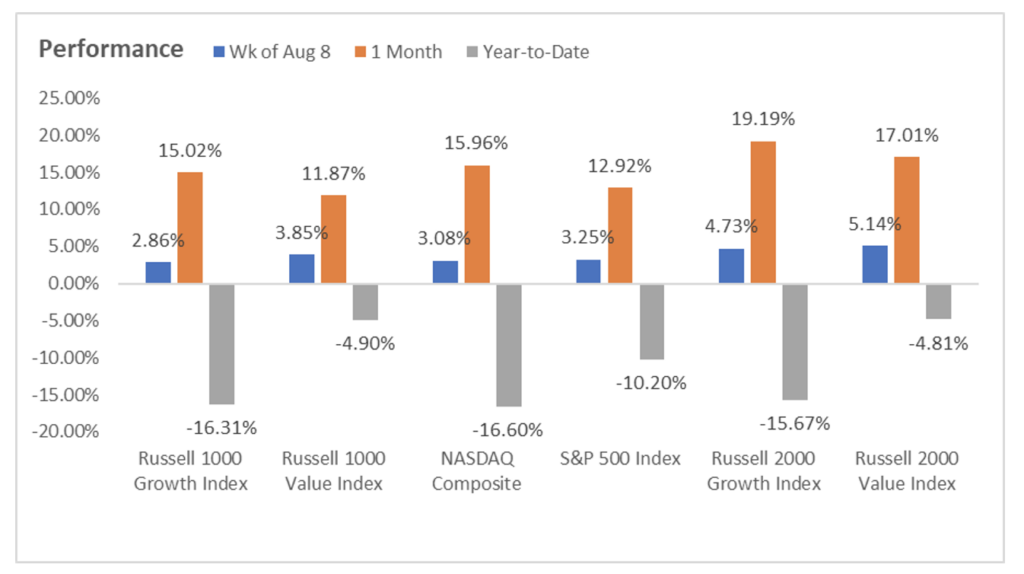

The Nasdaq is officially in a new bull market! Stocks had their best week since November 2021 and has its 4th straight week of gains. Dow closed up 2.9% for the week, while the S&P was up 3.24% and the NASDAQ was up 3.08%. The rally added more than $5Tn to US stock values from June’s low.

The S&P technology sub-sector was up 2.4% for the week though there are signs of weakness as Micron Technology slashed guidance that it provided expressing near term concern of laptop sales slumping. This could be a sign of wider and sharper slowdown for semiconductors as Nvidia also warned that results for its fiscal second quarter ended July 31 would be dramatically below expectations, due to an unexpected decline for graphics chips targeted at videogames but are also used for cryptocurrency mining.

5 major Chinese corporations may voluntarily delist from US exchanges due to audit scrutiny. Sinopec, China Life Insurance, PetroChina, and Aluminum Corporation of China, and Sinopec Shanghai Petro Chem, are the companies set to delist.

FIXED INCOME

Treasury Yields bounced around this week due to several important economic reports. The talk of the town was the July CPI which was released on Wednesday. Yields dipped considerably on the announcement of the report which remained unchanged from June and maintained a rate of 8.5% over the last 12 months. After their initial fall, long term rates surged later in the week. The 30-year peaked at 3.18% and the 10-year at 2.89%. Short term bonds trended lower while mid-term bonds stayed relatively steady to close the week out. The PPI, released on Thursday showed a fall in demand for goods of -1.8% and an increase in services of +0.1%. Mary Daly, the San Francisco Federal Reserve Bank President was quoted on Thursday saying that a 50bps rate hike in September would make sense, but that she is open to larger hikes to combat inflation. Across the board, international 10-year bonds rose Friday, with Australia seeing the highest increase, and the US and UK standing out with a decrease in yield. Mortgage-backed securities climbed this week, still down from their 52-week highs. The 30-year fixed rate rose 23 bps from the prior week to 5.22% on Thursday. Last week, the 30-year rate hit its lowest point since April at 4.99%. Chinese lending in fell in July while credit growth slowed. Chinese banks provided $101 Billion in loans, falling short of analysts’ expectations. On Wednesday, a two-year payment delay on $20 billion of Ukrainian foreign-currency debt was approved. The deferrals are expected to save the Ukrainian government billions in payments on sovereign debt. These deferrals will help the Ukraine avoid defaulting and provide some relief for the country for the next few years. Ukraine’s foreign-exchange reserves have fallen to $22 Billion, down from $31 Billion to start the year.

HEDGE FUNDS (as of August 11th)

The biggest theme this week in hedge funds was the amount of short covering which was one of the largest YTD as shorts continue to weigh on alpha generation. The largest amount of covering was in North America and Europe which were the two regions with the most negative alpha based on the top 50 crowded shorts. In North America, shorts rallied ~ 3.6%, which was not only 2% more than the S&P 500 but 2.3% more than crowded longs. Europe saw similar statistics. Due to the rally in shorts, hedge funds were not able to capture a significant portion of the rally in global indices. Across all strategies globally, hedge funds were up ~ 40 bps compared to 180 bps for the MSCI World, only capturing 22%. Despite the negative alpha this past week, YTD hedge funds continue to significantly outperform their relative benchmarks. Along with short covering, hedge funds also cut back slightly on their long positions in most regions. US long/short net leverage had mark-to-market impact bringing gross leverage to 188% (bringing it back to the beginning of 2022) and net leverage unchanged. In Europe and AxJ, de-grossing was similar on the long and short sides. In Japan, the short covering outweighed the long selling leading to one of the most net bought weeks in recent months.

PRIVATE EQUITY

Market volatility and macroeconomic headwinds took a toll on global M&A activity in Q2 of 2022 as investors and portfolio companies continue to contend with supply chain issues and lower valuations. Despite last year’s record setting deal volume, global M&A deal volume declined in Q2 2022 completing an estimated $1.09 trillion worth of transitions in Q2, a decline of 26% from Q1. North America M&A deal volume fell roughly 30% from Q1 of this year.

The global M&A decline has also coincided with a decline in mega-deals, or transactions worth $5 billion or more. Mega-deal activity fell 36% in Q2 as compared to Q1 of this year. Despite this decline between Q1 and Q2, 2022’s tally of total mega-deals remains elevated relative to historic standards.

Looking ahead, analysts suspect a variety of factors could continue to influence the global M&A space. Higher interest rates in addition to increased financial uncertainty could be a challenge for corporate cash flows, deal valuations and North American M&A activity. Additionally, analysts suspect Europe will see a slowdown in M&A deal flow given prospective rate hikes by the European Central Bank, stress in junk debt markets, and elevated inflation.

Data Source: Bloomberg, BBC, Charles Schwab, CNBC, the Daily Shot HFR (returns have a two-day lag), Jim Bianco Research, Market Watch, Morningstar, Pitchbook, Standard & Poor’s, the Wall Street Journal, Morgan Stanley, Goldman Sachs and IR+M