Economic Data Watch and Market Outlook

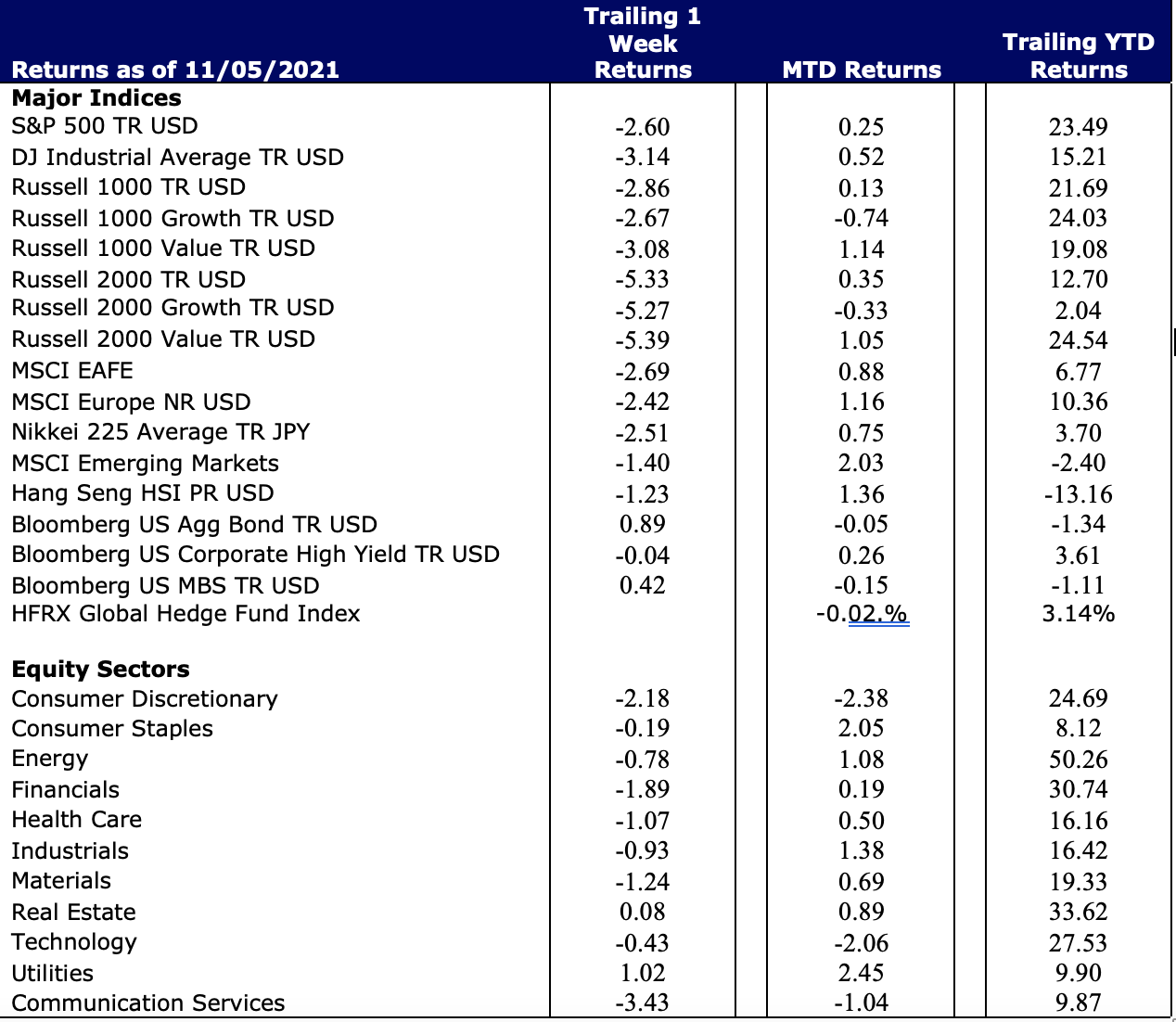

This week marked the second straight week that global stocks declined. The MSCI World Index fell 2.8% while the S&P 500 fell 2.6% after the previous week’s 2.27% decline. Small caps fell even further (Russell 2000, -5.33%). Economists proffer information based on models of historical data and various algorithms of certain data that roll up into a forecast, yes like weather commentators. There are many ways for slippage as well, as some data points are definitive while others are assumptive. For example, the ADP data which showed a large increase on Wednesday is based on the paychecks ADP pays out for automated companies. The non-farm payroll data and unemployment rate are essentially surveys based on phone canvassing. The point is that although investors look at these reports as gospel, they are still different measurements. The way they are viewed will determine buyers or sellers. Essentially, the employment outlook is improving and there seems to be an ample pool of potential employees if they chose to take available jobs, not necessarily dream careers. An increase in non-farm employment of 210,000 is less than the models and the inference from the ADP data, but still a solid increase.

The new strain of Covid, the Omicron virus, has raised alerts and concern for the globe. Factually, we still don’t really know what it is or how to combat it but at this point it does not appear to be as deadly as other variants which could cause irreversible lung and respiratory damage. Most countries and governments were severely criticized for whatever responses were done last year so the bias is to lock-down, ban and quarantine. Hopefully this strain will not continue to build in infection or severity.

This time of year is always a challenge. Credit lines are modified to reflect year-end financial statements. Most major investment accounts spend December preparing for meetings in January for asset allocation changes. It is hard to separate the wheat from the chaff in data for positioning, but what was significant this week was the statement by Chairman Powell that perhaps inflation is not as transitory as thought. One example is how to view the price of crude oil. The actual price of oil in the US in 2021 has fluctuated from about $50 a barrel, to a high of $84 and now hovers at about $67. This affects buyers who will take delivery or need to post collateral for futures contracts. This can be compared to the oil ETF – OILF – with a YTD low of $40, a high of $65 and is at $42 this past week. This ETF is for investors who want a liquid, low cost and transparent way to play crude oil prices. It demonstrates a very different perspective of oil prices and expectations.

A tremendous amount of emotional energy focuses on supply chain issues. Inherent in that analysis is that for some reason, consumers must have immediate access to what they want, especially if it is imported. When you look deeper into the supply chain issues, a major consideration is in fact the bottlenecks that are simply the lack of space to stack empty containers. Is a delay in receiving what you want a bottleneck or simply an imbalance of supply and demand in items that are too expensive to stockpile? If there was such a shortage for cars, why has there been a material increase in commercials showcasing the “Toyotathon Sales” and various other car incentives?

Valuations are not cheap, but the question is why will companies be penalized for backlogs instead of realized revenues? The primary question for investors is whether backlogs and increases in unfilled orders are a tailwind to keep the economy strong and an elongation of the recovery or will consumers decide to cancel orders and thus individual company outlooks are challenged. In a recent call discussing the real estate market and exploring different ways our clients can participate in higher yielding investments that may have modest positive appreciation, but it is clear that industrial real estate – cold storage, medical business needs, warehouse storage, multi-family development and infrastructure opportunities are in very strong demand. Traditionally overpopulated cities with limited expansion potential are still lagging.

Equities

Global stocks fell 2.82% during the week. The VIX on the S&P 500 jumped another 9.73% settling at just above 30. Growth stocks finished slightly better than value stocks but both lost more than 2.6% (Russell 1000 Growth2.67%, Russell 1000 Value -3.08%). Most sectors were down during the week except for Real Estate (+0.08%) and Utilities

(+1.02%).

Emerging markets sank 1.4% for the week and are down 1.34% year-to-date. Stocks trading on the Hang Seng exchange have fallen just over 13% year-to-date. Emerging market companies, excluding China, are up 6.26% year-to-date as represented by the MSCI ex- China benchmark. Stress between Chinese Tech and the Xi’s leadership continues. One such example occurred this week as ride-share company, Didi, explored ways to delist from the NYSE just months after its IPO. We continue to poll managers as to their views around the declines. Some have signaled that while from a purely financial perspective there are opportunities, the wild card is the Chinese government and how it intends to reign in corporate behavior to align with its political course.

Fixed Income

The Bloomberg US Aggregate Bond index rose 89 bps for the week. The yield on the 10-year fell to 1.342%. Yields on the 30-year fell 14 bps to 1.826%. This was due to, a weaker than expected jobs report as noted above (210,000 jobs added versus estimates of 573,000) the Omicron variant and potentially tighter a Fed policy. The Fed is walking a thin line as it does not want to tighten and make it harder for borrowers and perhaps stifle a fragile economy versus inflation rising faster than expected. Determining how serious the Omicron variant is will help shed light on Fed policy in the short and medium term and this data should be available in the coming weeks as we monitor the spread.

Hedge Funds and Private Equity

Last week’s Black Friday volatility continued this week with investors changing their minds almost daily regarding Omicron risks. On Wednesday of this week, the Goldman Sachs prime book saw the largest drop in net leverage since April 2020 with performance continuing to weaken. North American long alpha also deteriorated and is on track to be the worst year in over 10 years, with crowded names leading the way. There has been some selling of the “reopening” stocks due to Omicron fears, with some managers adding them as shorts. Most of the net selling has come from adding shorts (macro products-ETFs/index and single-name) than selling longs. Hedge funds are also still overweight growth/high multiple TMT contributing to the declining performance. On the flip side, systematic long/short was positive in November, positive month-to-date in December and outperforming the MSCI total return index year-to-date.

COVID continues to force abrupt shifts in buying patterns causing havoc on the world’s supply chain. This volatility has provided an exciting opportunity for both startups as well as venture capital as they seek to develop and fund solutions that bring order to the highly fragmented eco-system of supply chain tech. Emerging supply chain tech is enabling a shift towards connected networks that coordinate data related to supply, demand, inventory and capacity.

VC investment into supply chain tech was $7.8B in Q3 alone. Valuations for early and late-stage supply chain tech startups have increased significantly in each quarter of 2021. The median pre-money valuation for early-stage supply chain tech startups rose by 19.5% YoY to $35M while the median pre-money valuation for late-stage increased by 41.2% YoY to $120M. Maritime tech has seen an increased level of investment (7.4% of total VC investment in supply chain tech, up from 2.5% in 2020) as this industry races to fill its technology gap. Additionally, freight and delivery aggregator tech which provides booking platforms for shippers and carriers is also becoming one of the fastest growing sectors within supply chain tech.

The pandemic has highlighted many vulnerabilities within our global supply chain and will have a lasting effect on this industry including how it integrates new technologies. Current market conditions are providing a plethora of opportunities for new entrants seeking to address technology gaps in the status quo. Venture capital spend in this space is expected to see continued growth in coming quarters.

Data Source: Bloomberg, Bureau of Labor Statistics, CDC, CNBC, The Daily Shot, Deutsche Bank, Haver Economics, HFR (returns have a two-day lag), Morningstar, Pension and Investments, Pitchbook, Redfin, Standard & Poor’s, US Census Bureau, and the Wall Street Journal

This report discusses general market activity, industry, or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice. It is for informational purposes only and does not constitute, and is not to be construed as, an offer or solicitation to buy or sell any securities or related financial instruments. Opinions expressed in this report reflect current opinions of Clearbrook as of the date appearing in this material only. This report is based on information obtained from sources believed to be reliable, but no independent verification has been made and Clearbrook does not guarantee its accuracy or completeness. Clearbrook does not make any representations in this material regarding the suitability of any security for a particular investor or the tax-exempt nature or taxability of payments made in respect to any security. Investors are urged to consult with their financial advisors before buying or selling any securities. The information in this report may not be current and Clearbrook has no obligation to provide any updates or changes.