Economic Data Watch and Market Outlook

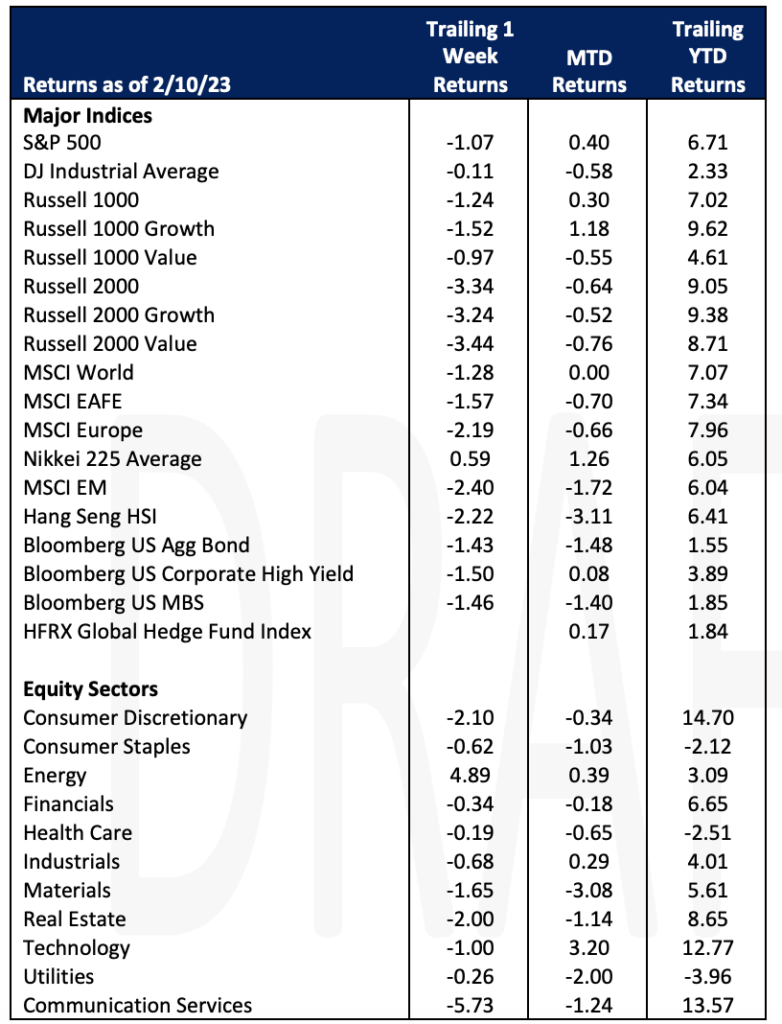

Global asset prices fell for the week as the MSCI World dropped 1.28% and the US Aggregate Bond index fell 1.43%. Much of this past week’s news cycle was dominated by geopolitical events notably a balloon from China that passed over the US and President Biden’s State of the Union address. Both led to nonstop coverage and debate around the US national security and fiscal health related to our debt limit. Two data points were interesting but were met with limited discussion. Consumer Credit came in much lower than expected for the period at $11.56 billion versus the forecast of $25 billion and jobless claims were slightly higher than expected. Abroad, German industrial production fell 3.1% versus an expectation of a 0.7% decrease and German inflation CPI was 8.7% year over year versus and 8.9% expectation. Japan’s household spending fell more than expected, down 1.3% YoY versus an expected 0.7% decrease while their average earnings grew 4.8% versus an expectation of 2.5%.

With a majority of S&P 500 stocks having reported Q4 earnings, per-share earnings of companies in the index were down 2.3% for the last quarter of 2022 which was the first decline since Q3 2020. Sales growth for S&P 500 companies slowed to 4.5% in Q4 as well, less than half the rate of the previous quarter.

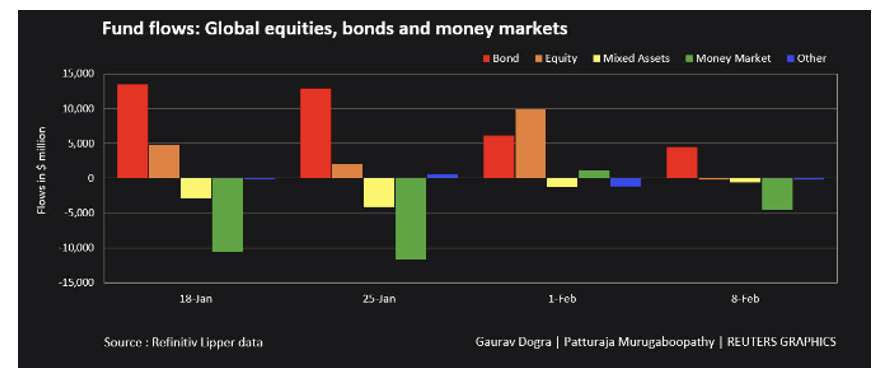

Global equity funds saw their first weekly outflows since the first week of 2023. Definitive data showed a withdrawal of $209M.

US equity funds saw outflows of $470M, and European and Asian funds saw outflows of $100M each.

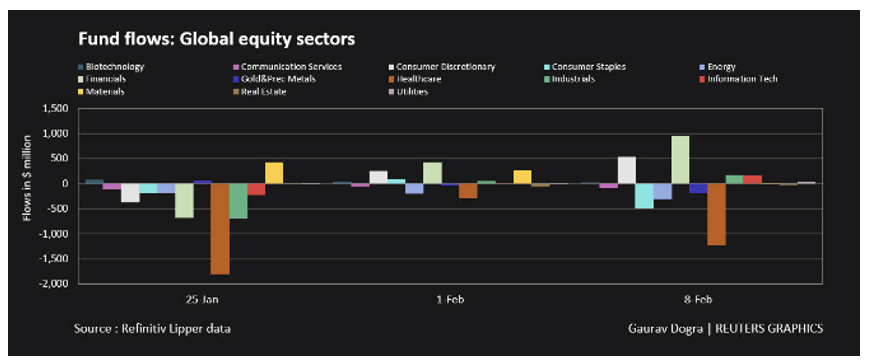

Healthcare, consumer staples, and energy sectors saw outflows of $1.23B, $501M, and $306M respectively, while financials saw inflows of $952M.

This week we’ll learn about the spending habits of the consumer and CPI releases in the US and abroad.

Equities

Equity markets were down this week (Dow: -0.11%; S&P: -1.07%; Nasdaq: -2.09%) as the market digested unemployment numbers still at pandemic era lows which supported the strong jobs report of last week. Consumer sentiment rose to a 13-month high of 66.4 but signaled worries of inflation as well as earning misses. Growth stocks were hit the hardest with the Russell 1000 Growth falling 1.52% while the Russell 1000 Value fell 0.97%. Economic sectors were for the most part in line with the broader benchmarks except for Energy, up 4.89% and Communication Services, down 5.73%.

Lyft shares fell -36.44% on Friday after the company posted an unexpected loss in the fourth quarter and said first quarter revenues would come in below expectations. Lyft said that its quarterly results were hurt by $201.3 million of stock-based compensation and related payroll tax expenses as well as restructuring charges tied to recent layoffs.

Credit Suisse Group reported Thursday a $1.5 billion loss for the fourth quarter of 2022, its fifth consecutive quarterly loss. Revenue fell 74% at its investment bank and 17% at its wealth management unit. Going forward Credit Suisse will focus around their Wealth Management Swiss Bank franchises complemented by their leading and differentiated capabilities in asset management and markets. They intend to spin-off its capital markets and advisory business under the name CS First Boston and a securitized products group is being sold to Apollo Global Management.

Meanwhile in the IPO market Nextracker, maker of software that helps orient solar panels toward the sun and a carve out of manufacturing services company Flex (FLEX: +1.14% Friday), was the biggest US IPO since October. Nextracker’s (NXT) stock rose 25% from its offering price of $24 on Wednesday and closed at $31 on Friday. Hesai Group (HSAI), a Chinese company that makes sensors for self-driving cars priced IPO’d 10 million ADRs at $19 on Thursday and closed at $21.87 Friday.

Standard Charter stock soared Thursday on a report that First Abu Dhabi Bank is preparing a potential offer for the London based bank but closed down Friday (STAN: -4.98%). Adidas declined -10.88% on Friday as the German sportswear giant warned of losses following the termination of Yeezy partnership with Kanye West and the collaboration with Beyonce was stumbling. Sales in China, cited as one of their largest growth engines, was hit by a consumer boycott as part of a consortium of western brands, which included Adidas, that raised concerns about Xinjiang region labor allegations.

European equity (FTSE 100: -0.33%; DAX: -1.14%; European STOXX 600: -0.62%) was down and Asian markets were mixed (Hang Seng: -2.22%; Nikkei: +0.59%; Shanghai -0.08%) for the week.

Fixed Income

Treasuries posted their worst week since the start of 2023. This upcoming Tuesday, investors will look to January CPI numbers, which will provide insight on the Federal Reserve’s next move. Yields rose across the board this week, with the 2-year Treasury yield climbing 2 bps, the 10-year Treasury yield rising 21 bps, and the 30-year Treasury yield increasing 2 bps. Year to date, the 2-year Treasury yield is up 1 bp, the 10-year Treasury yield is down 5 bps, and the 30-year Treasury yield is down 5 bps. The Bloomberg US Aggregate Bond index ended the week down -1.43%.

Meanwhile some of the world’s largest money managers such as BlackRock, PIMCO, and Alliance Bernstein are pushing back against the idea that inflation is cooling, and that now is not the time to cut protective assets. The concern is not whether inflation is falling, but whether the pace of deceleration of falling inflation has been miscalculated.

The Yen surged over 1% on Friday after reports that Kazuo Ueda is likely to be chosen as the head of the Bank of Japan. Investors are working to gauge Ueda and the policies he will bring to the table. Recent comments from Ueda showed that he expects the road to 2% inflation will be a long one, and that the future of monetary policy easing is something that needs to be examined.

Hedge Funds (through Thursday February 9th)

Performance for global funds and US-based long/short equity funds stood out for the week as both were flat compared to over 100 bps loss for the MSCI World and S&P. European funds were also flat but that compared to a slightly up Euro STOXX 600. Asia performance was a little more challenged but not by much as Asia-based funds were down 37 bps with the MSCI Asia down 44 bps WoW. Regarding flows, the week was relatively quiet despite the momentum factor sell-off on Thursday, February 2nd. Hedge funds leaned towards adding both long and short exposure in all regions. In notional terms, the largest adds were in North America with single-name leading the charge. Most of the adds were in healthcare (all sub-sectors) and financials (capital markets) while most of the shorts were in TMT (interactive media and semiconductors) and consumer discretionary (internet retail). Hedge funds leaned towards selling European equities, mostly cyclical sectors (industrials, materials, financials) except for EU energy which was net bought. In AxJ, funds flipped to selling China and Japan saw a de-grossing with short covering outpacing long selling. The spread between crowded names was positive in all regions, with all of the alpha coming on the short side as longs performed in line with their respective indices.

Private Equity

2022 proved to be a challenging year for venture capital backed tech companies with exploding inflation, geopolitical tensions and a spiraling crypto market. Wide-spread layoffs in the tech space sent confidence plunging while the IPO market was firmly frozen shut for majority of startups. Despite the given market, Pitchbook reports that venture capital fundraising had its strongest year in the last decade, raising roughly $162 billion. This makes 2022 the second year in a row that venture capital raised surpassed $100 billion.

Notwithstanding the fundraising boom, the current market environment is taking a sharp turn from the start-up friendly environment founders have enjoyed recently to a market that favors investors. Pitchbook analysts attribute this shift to capital demand outstripping supply and the decline in valuation step-up across stages.

Not surprisingly, with valuations declining and the IPO market still frozen, exit activity plummeted in 2022. For the first time in five years, exit activity dropped below $100 billion. SPAC IPOs also hit a new low with the total amount raised dropping nearly 50% year-over-year for a total of only $10.4B in 2022 in comparison to $135B in 2021 according to Pitchbook data.

Data Source: Bloomberg, BBC, Charles Schwab, CNBC, the Daily Shot HFR (returns have a two-day lag), Jim Bianco Research, Market Watch, Morningstar, Pitchbook, Standard & Poor’s, Morgan Stanley, Goldman Sachs and the Wall Street Journal.