Economic Data Watch and Market Outlook

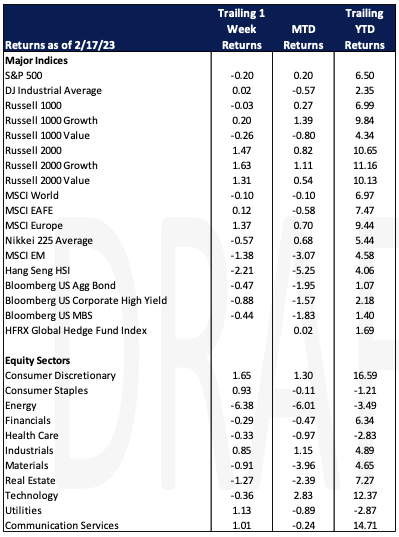

Global equity prices were mixed for the week. The MSCI World Index fell just 10 basis points as the S&P 500 declined slightly at 20 basis points, the Nikkei index dropped 57 basis points but European stocks advanced 1.37%.

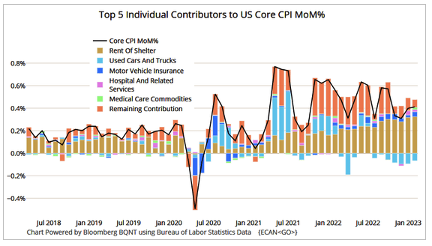

CPI results were reported this week with the Core CPI for the month coming in on target but was a bit hotter on a year over year basis at 5.4% vs. an estimate of 4.9%. The bigger and more concerning surprise was the PPI result reported on Thursday. The month of January result came in at 0.5% versus an expectation of 0.3% signaling the Fed still has more work to do. The graphic below indicates the key drivers of inflation.

US retail sales rebounded to start the year with sales rising at the fastest rate since March 2021. Strong demand is keeping inflation elevated and putting pressure on the Fed to raise rates more aggressively throughout the year. Furthermore, manufacturing measures came in stronger than expected for the month of January.

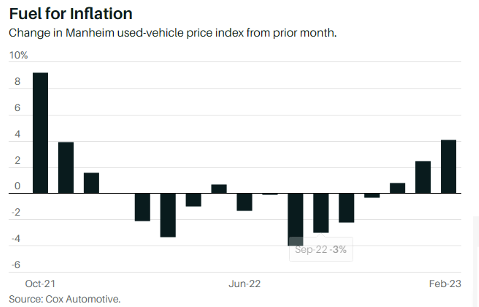

Used car prices are climbing quickly to start 2023. On Friday, Cox Automotive released its Manheim used-vehicle pricing index which showed a 4.1% increase in the first 15 days of February, the largest gain since October 2021.

US markets will celebrate President’s Day on Monday, February 20th and markets will be closed. Also, this upcoming week, Canada will celebrate Family Day and Brazil will start Carnival. Italy, Germany and the EU will report inflation results.

Equities

As noted above, the S&P 500 fell 20 basis points on the week and the Russell 1000 fell just 3 basis points. However, smaller names as represented by the Russell 2000 were up 1.47%. Growth stocks outpaced value in both large and small names (R1000G up 0.20% vs R1000V down 0.26% and the R2000G up 1.63% vs R2000V up 1.31%.

Sector performance varied on the week with Consumer Discretionary stocks rising the most, up 1.65%. Energy gave back its performance from last week, and then some, falling 6.38%. The Global Industry Classification Standards better known as GICS will be changing next month. Some changes seem obvious such as Visa and Mastercard will be moving from the Information Technology sector to Financials but others such as data processing stocks like ADP and Paychex are moving from Information Technology to Industrials. The total move accounts for about 15.5% of the current benchmark and the new allocation will account for 31.1% of the new weighting scheme.

International markets were mixed with emerging markets getting hit the hardest falling 1.38%. Most of the decline was attributable to Chinese equities with the Hang Seng index falling 2.21% for the week. Optimism initially increased regarding the opening of Chinese markets, but tensions increased last week regarding surveillance by China’s government via a series of balloons that the US ultimately shot down. Further over the last few days speculation has grown that the Chinese government is proposing providing Russia with ammunition to aid in its war with Ukraine.

Fixed Income

Treasury yields rose throughout the week, with the 2-year Treasury yield rising 10 bps, the 10-year Treasury yield rising 8 bps, and the 30-year Treasury yield rising 8 bps. The Bloomberg US Aggregate Bond Index fell -0.47%. Mortgage rates increased for their second consecutive week with Freddie Mac’s Primary Mortgage Market Survey showing 30-year Fixed Rate mortgages sitting at 6.32%.

Goldman Sachs and Bank of America said this week that they expect the Federal Reserve to raise rates 3 more times this year and are forecasting that Fed fund rates will land in the 5.25% – 5.50% range. Goldman Sachs economists, led by Jan Hatzuis, cited stronger growth and firmer inflation on Thursday, adding an additional 25 bps hike in June to their Fed forecast. Meanwhile money markets are pricing in a terminal rate of 5.3% by July.

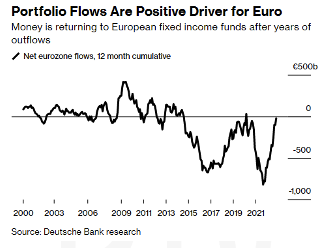

Deutsche Bank says asset flows in European bond and currency markets are improving. Capital is beginning to flow back into the asset class after net outflows hit $872B in 2021, the highest level in more than 20 years. With yields at their highest level in years, sentiment improving in regards fixed income markets, and the ECB catching up to the Federal Reserve’s rate increases, Deutsche Bank expects net flows to turn positive in 2023.

Hedge Funds (through Thursday, February 16th)

This past week, the average global fund was flat compared to the MSCI World ending down 60 bps through Thursday. Meanwhile, the average global L/S equity fund experienced ~20% of the downside in the MSCI World losing 10 bps. Faring slightly better, the average US L/S equity fund experienced ~15% of the downside of the S&P this week, losing 20 bps vs. the S&P losing ~1.1%. EU-based L/S funds were the only region to post gains this week, though MTD are still in the red, down 10 bps compared to the Euro STOXX 600 up 2.7%. In Asia, L/S equity performance was similarly challenging this week as they experienced the largest portion of the downside (~70%) in their respective benchmark. On a YTD basis, however, Asia-based funds have posted the highest absolute returns (+3.9%), followed by US-based funds. Following the CPI print on Tuesday, hedge funds continued to be buyers of NA for the 6th straight week with ~ 70/30 ratio long additions/short covers. Consumer discretionary was the most net bought as funds added longs and covered shorts in hotels and restaurants and leisure. Shorts were covered in almost all sub-sectors except autos. There was also buying in tech through short covers, but hedge funds also added to longs in IT services and hardware. Funds started adding to index hedges by being net sellers in ETFs through short adds. Hedge funds were also buyers of global equities this past week mostly through long buys with Japan the most net bought region outside the US. The top 50 longs in the US performed in line with the S&P though crowded shorts rallied over 4%. The L/S spread sits at -4% which is the largest negative spread since May 2022 and the 5th most negative spread since the beginning of 2018. In Europe and Asia, the performance of the top 50 crowded names on both sides of the book were strong, with the EU L/S spread this week sitting at 90bps, and Asia at 1.3%.

Private Equity

Amidst a looming recession and the prospect of further interest rate hikes by the Federal Reserve, investors in the private markets face a wave of uncertainty in the coming year. Although inflation has started to ease, it is still registering above the Federal Reserve’s 2% target suggesting additional interest rate hikes are imminent. Weakened consumer sentiment and decreasing business confidence also indicate consumers and investors alike are preparing for a clouded economic outlook. As of Q1 2023, PitchBook data and modeling has indicated a 67.5% probability that the US economy will go into recession in late 2023 or early 2024. A figure slightly higher than reported in Q4 of 2022 at 65.4%.

According to Pitchbook these uncertainties could substantially impact private markets. The spike in the 10-year US real yields has put substantial pressure on valuations in risk assets which is especially evident in assets that have a long holding period such as startups and growth stocks. In the year to come, investors will likely have to require a higher risk premium given the rising opportunity costs.

As banks continue to be more stringent with loans, the appetite for commercial bank debt has decreased. Lenders have demanded higher yields to compensate for increased risk which has resulted in a significant increase in yields on leveraged Single B and BB loans. With more stringent terms on commercial bank debt and new issuance of leveraged loans nearly coming to a halt in the second half of 2022, private debt funds have the opportunity to fill the fundraising gap for buyout and refinancing like never before.

Data Source: Bloomberg, BBC, Charles Schwab, CNBC, the Daily Shot HFR (returns have a two-day lag), Jim Bianco Research, Market Watch, Morningstar, Pitchbook, Standard & Poor’s, Morgan Stanley, Goldman Sachs and the Wall Street Journal.