Economic Data Watch and Market Outlook

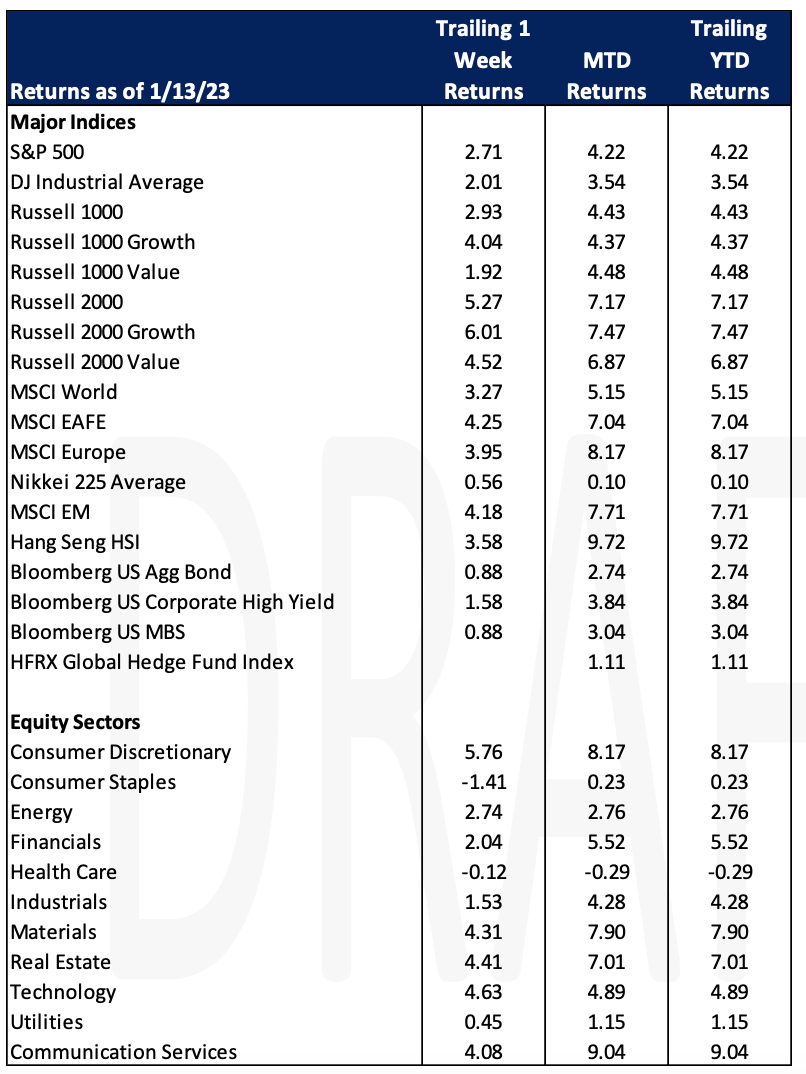

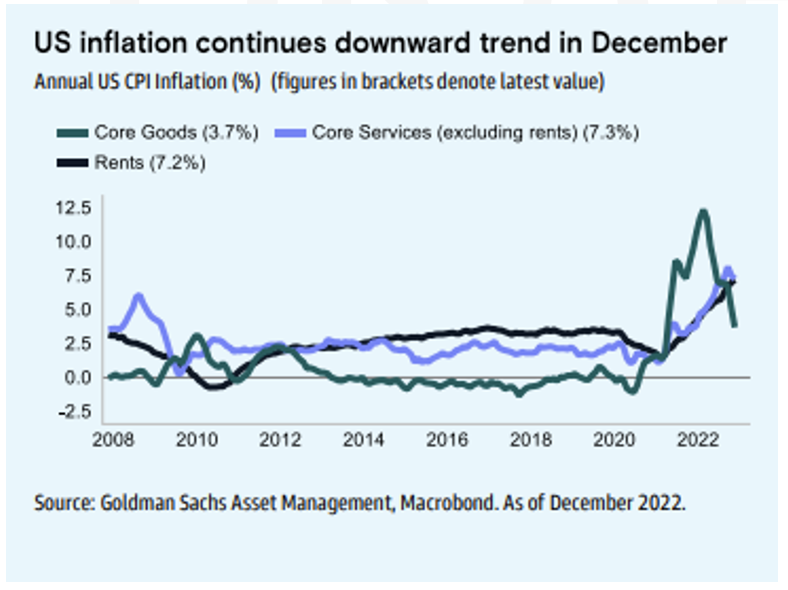

Global equity markets surged this week as the MSCI World rose 3.27% while the US Aggregate Bond index rose 88 basis points. The story of the resilient economy continued but markets breathed a sigh of relief after the CPI report was in line with expectations as the December Core CPI year over year was 5.7%. Jobless claims were slightly lower than consensus (205,000 vs 215,000(e)). The Fed’s next possible rate change will occur on February 1st and consensus estimates now are suggesting a 25basis point hike.

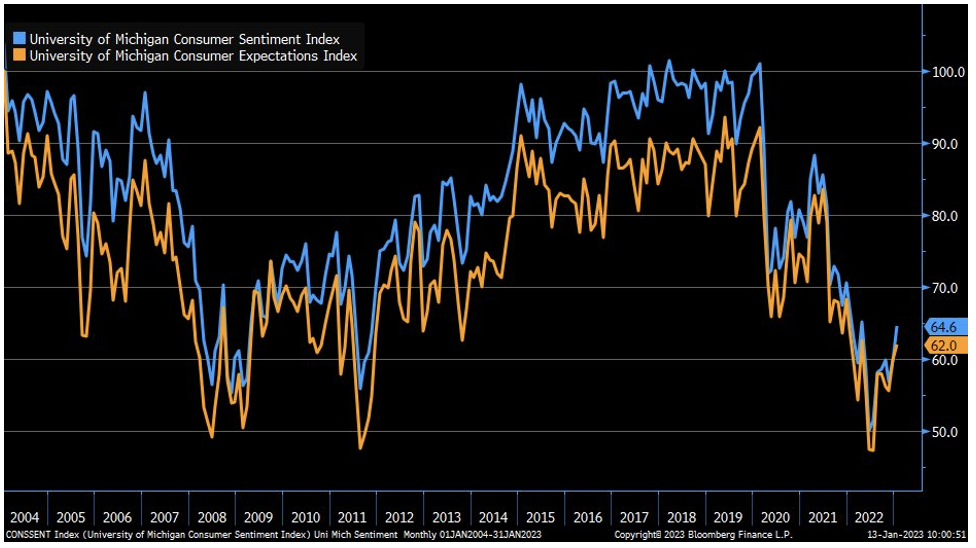

The University of Michigan Consumer survey came in above expectations at 64.6 versus an estimate of 60.7 and a prior month recording of 59.7. Expectations are also up. The survey is a nationwide exercise performed on more than 400 cellphone numbers across the country.

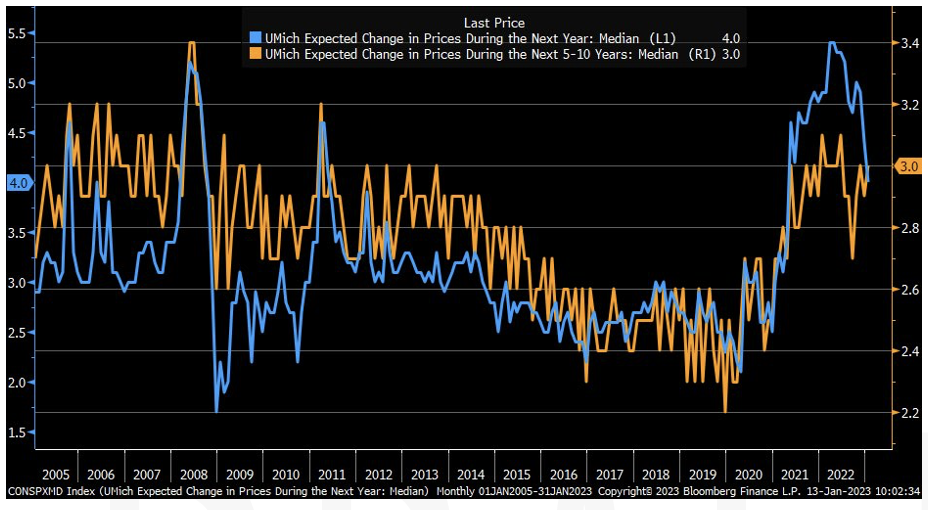

Additional survey data shows consumers are optimistic about inflation falling too.

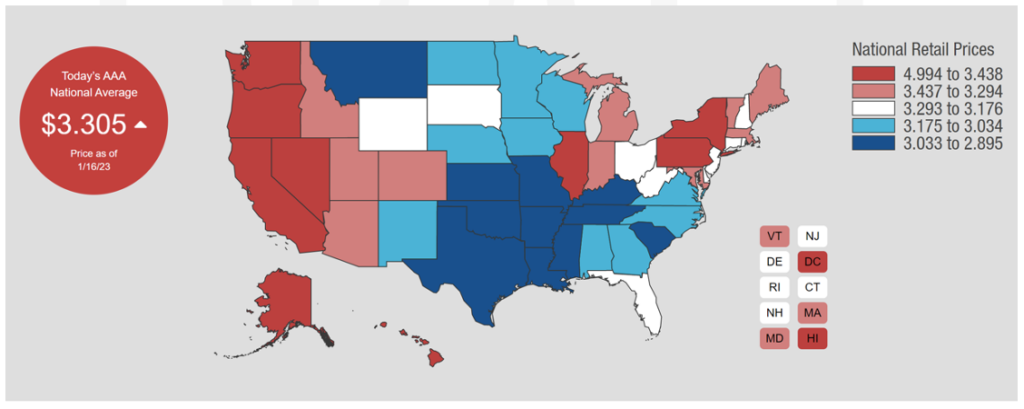

Consumers experienced a rise in prices at the pump during the holidays. AAA notes that the rise was due to holiday travel and freezing temperatures the caused some disruptions at refineries. Those prices have receded and the national average is now lower than they were one month ago.

On Friday, Treasury Secretary Janet Yellen said that the US Federal Government is expected to reach its debt ceiling on January 19th. Reports showed that the government is close to reaching its $31.4T limit and is less than $100B away from breaching the limit. Yellen went on to emphasize that an increase in the debt ceiling does not mean an increase in spending but allows for the financing of existing obligations. As rates have increased, so will the financing of US debt.

The upcoming week will have an abbreviated trading week in the US as markets are closed to celebrate Martin Luther King Jr. Later in the week the US will report PPI, Jobless Claims, Retail Sales, and Housing Starts. Outside of the US, China will report GDP results, the ECB will report inflation as will Canada and Great Britain.

Equities

It’s a “back-and-forth market” said David Donabedian, Chief Investment Officer at CIBC Private Wealth US. This week’s volatility was due to investor sentiment regarding potential action that will be taken by the Fed in the coming months. By Wednesday, investors were awaiting CPI data that would be released on Thursday. Thursday’s data showed a slowing of inflation and potentially sustaining a downward trend but in line with economists’ expectations. Earnings season began on Friday with reporting from the bank sector with mixed results that investors seem to shrug off. The week finished up on Friday (Dow: +0.33%; S&P: +0.40%; Nasdaq: +0.71%) and for the week (Dow: +2.00%; S&P: +2.67%; Nasdaq: +4.82%). The S&P and Nasdaq finished at their highest levels in a month on Friday.

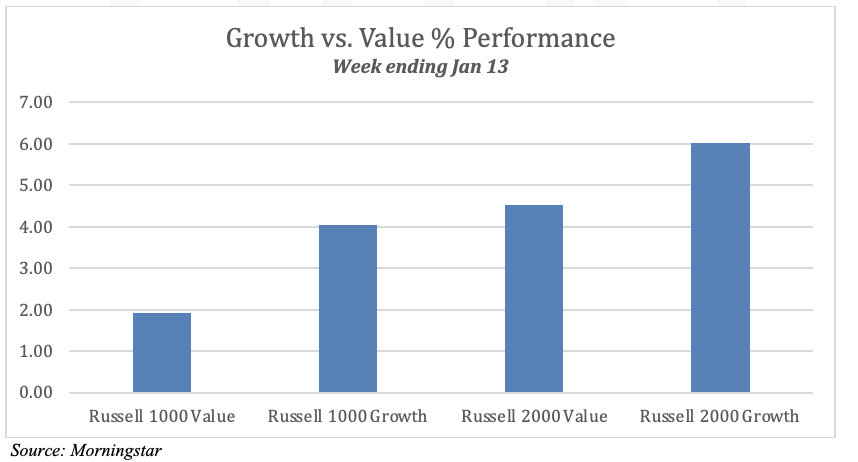

JP Morgan and Bank of America both beat quarterly earnings estimates, while Wells Fargo and Citigroup fell short of quarterly profits, though all four stocks gained on Friday (JPM: + 2.52%; BAC: +2.20%; WFC: +3.25%; C: 1.69%). Banking firms set aside more reserves to protect against potential deteriorating economic conditions. Investment banking cut into bank profits as there was less corporate lending due to falling markets and rising interest rates. S&P Financial Sector index was up Friday 0.71% for the day and +5.43% month to date. For the week growth stocks have performed better than value as demonstrated by Russell 1000 and 2000 indices.

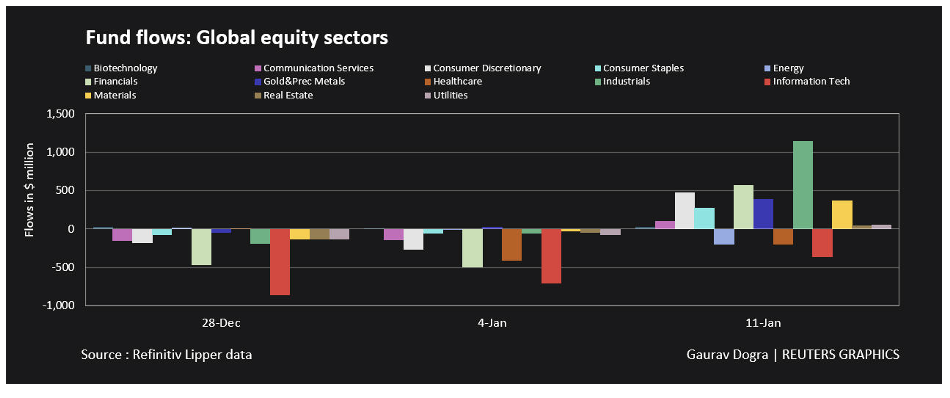

Global equity funds had their first weekly inflow in 10 weeks of $5.17 billion in net purchases on the news of easing inflation and China reopening while European and Asian funds received inflows of $7.35 billion and $1.54 billion respectively, but investors exited US funds by redeeming $2.01 billion as per Refinitiv Lipper data. Equity sector funds in industrials, financials and consumer discretionary saw $1.15 billion, $574 million and $479 million, respectively, of inflows while tech suffered a 10th weekly outflow at $365 million.

For the week, Asian indices (Hang Seng: +3.58%; Nikkei: +1.16%; Shanghai +1.19%) as well as the European indices (FTSE 100: +1.94%; DAX: +3.31%; European STOXX 600: +1.83%) were up. The Hang Seng is trading at a six-month high while the European STOXX is trading at a nine month high.

Fixed Income

US Treasury yields fell throughout the week but spiked on Friday. The jump can be attributed to faltering assumptions that the Fed will cut rates later in 2023. The 2-year Treasury yield which tends to rise and fall with rate expectations rose 3 bps, while the 10-year Treasury yield fell 4 bps, and the 30-year Treasury yield fell 5 bps. The Bloomberg US Aggregate Bond Index ended the week up 0.88%. US inflation continued its downward trend for December falling 0.10%, largely driven by a fall in core goods. Excluding food and energy, core CPI rose 0.30%.

The yen reached a 7-month high on Friday due to speculation on the possibility of the Bank of Japan altering its relatively loose monetary policy to a more hawkish stance. The BOJ announced two separate rounds of emergency buying to lower the 10-year yield after it broke through its 50 bps cap, which was increased last month from 25 bps. Core inflation data for the Tokyo metro area showed a 4% increase in December, which is the largest month over month increase in 41 years.

Hedge Funds

As equities continued their rise this past week, global funds only captured a relatively small portion of the gains, rising 90 bps compared to 270 bps for the MSCI World. Americas-based long/short equity funds fared much better, ending the week almost even with the S&P 500 (approx. 200 bps compared to 230 bps). In other regions, European funds rose ~ 100 bps vs. 130 bps for the Euro STOXX 600. Asia-based funds lagged their counterparts posting gains of 50 bps compared to +330 bps for the MSCI Asia. Crowded names’ spread was negative in all regions, with all the negative alpha coming from the short side. The worst region was NA where shorts were +430 bps. As markets rallied, funds globally covered shorts resulting in net leverage tracking higher. Gross exposure rose in all regions, but Europe saw the largest rise in both gross and net. That said, a large majority of the covering was done in NA followed by Japan. 50% of the covering was at the index level with the balance spread across sectors. Regarding North American single-name net buying, hedge funds were net buyers of consumer discretionary (short covering), healthcare (long adds) and industrials (long adds). Sentiment on US banks remained cautious heading into earnings. On the flip side, funds were sellers of communication services and consumer staples. In Europe, hedge funds were buyers of most sectors led by industrials and consumer discretionary. Even though funds continued to buy in AxJ, the pace of buying slowed, almost all of which was driven by China. On a sector level, in AxJ tech was the leader. In Japan, almost all the flows came from funds buying financials.

Private Equity

As dry powder across the majority of private investment strategies has continued to fall, venture capital firms have seen an increase in capital. At the end of 2022, global venture firms were sitting on $585.5 billion of capital raised but not allocated according to Pitchbook data. Venture capital is the only private investment strategy that is on pace to see dry powder levels rise from 2021 levels.

Analysts suspect a few leading factors are contributing to the record stockpile of venture capital dry powder. One factor is the increased and heavy presence of nontraditional venture capital investors. This capital has increased the capital available to startups via asset managers such as hedge funds and mutual funds. Through the end of Q3 2022, the total value of venture deals with participation from nontraditional investors hit $145.1 billion, or about 74% of all venture capital deals. Another contributing factor was the strong fundraising during the first half of 2022 while the pace of investment slowed considerably with the US VC deal value dropping 31% from 2021’s numbers.

Analysts suspect 2023 to bring a slight decrease to venture dry powder as we enter a challenging fundraising market and continued capital deployment will draw down capital.

Data Source: Bloomberg, BBC, Charles Schwab, CNBC, the Daily Shot HFR (returns have a two-day lag), Jim Bianco Research, Market Watch, Morningstar, Pitchbook, Standard & Poor’s, Morgan Stanley, Goldman Sachs and the Wall Street Journal.