Economic Data Watch and Market Outlook

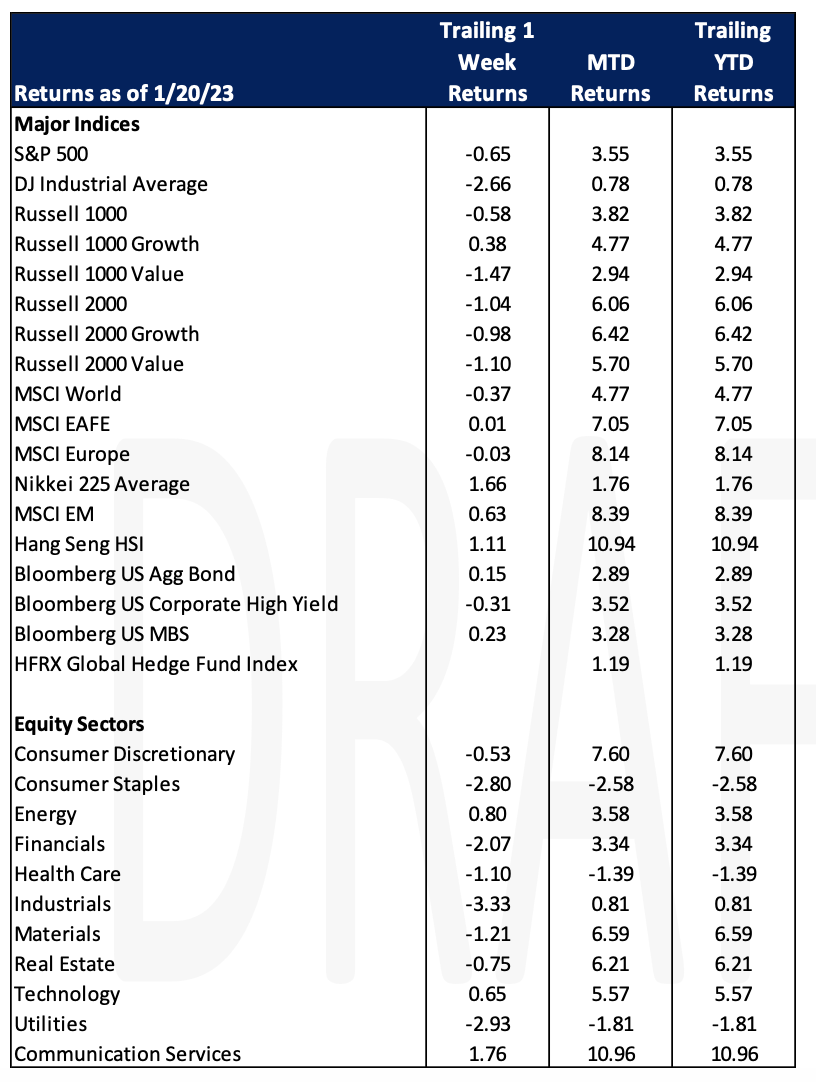

Global equity markets were slightly negative this week as the MSCI World fell 37 basis points. US stocks accounted for most of the decline as the S&P 500 fell 65 basis points and the MSCI EAFE was up one basis point. The US Aggregate Bond index rose 15 basis points.

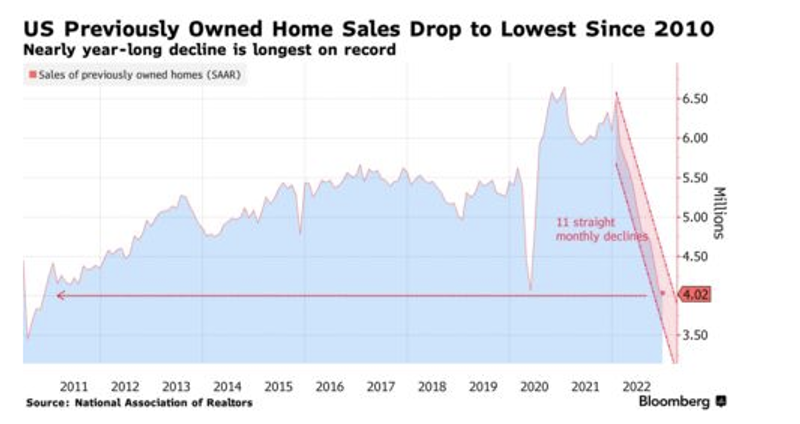

Existing home sales fell for an 11th straight month in December. Contract closings decreased 1.5% to 4.02M closings, the slowest rate since 2010. In 2022, just over 5 million existing homes were sold, a 17.8% decrease from 2021 and the largest decrease since 2008. Sales fell in three of four regions with the west remaining unchanged. First-time buyers made up 31% of purchases for the month of December, and cash sales represented 28% of total sales.

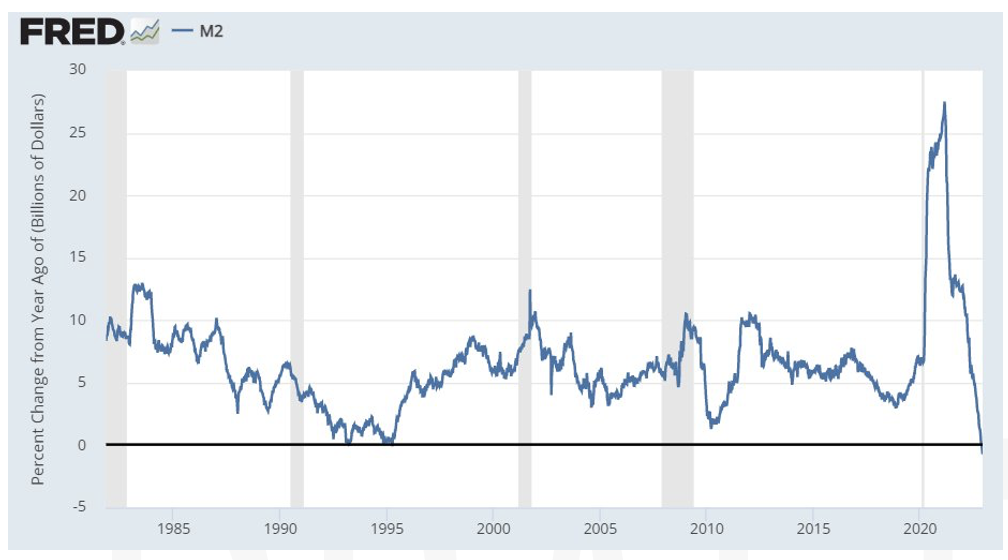

This upcoming week in the US, Manufacturing PMI and Consumer Durables will be reported. We’ll also see weekly mortgage data and consumer spending. We’ll discuss holiday spending in the equity update. Rising rates have curtailed borrowing and lending. Year-over-Year M2 has declined precipitously as the chart below indicates.

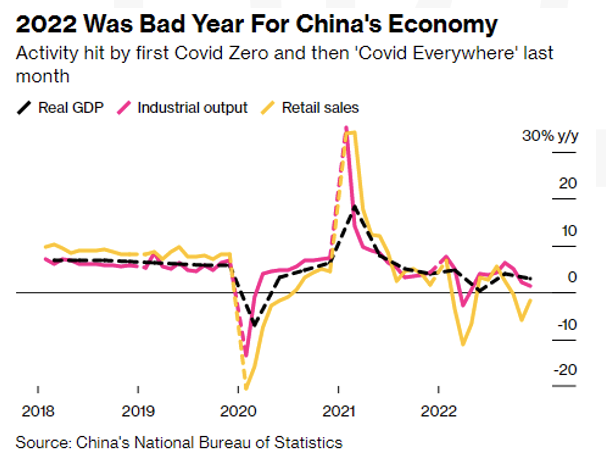

Chinese economic growth slowed in 2022, posting the second worst year in terms of growth since 1970. Record low consumer confidence, a shrinking population, and poor performance in property markets are largely to blame.

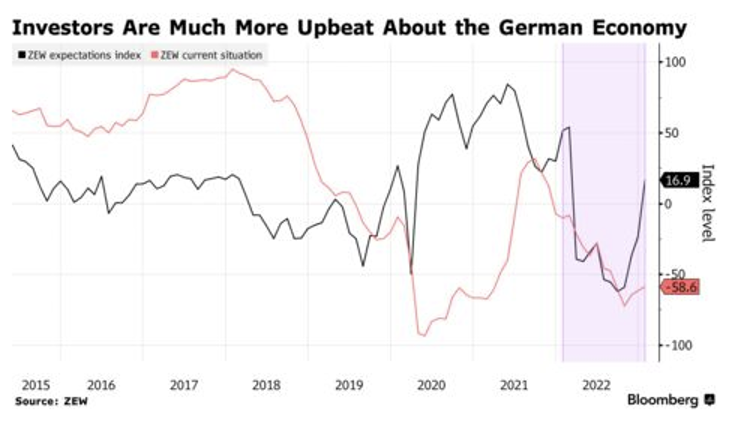

Investor sentiment in Germany jumped to the highest level in almost a year signaling an increase in confidence in the region. Germany’s chancellor, Olaf Scholz, said he is sure the country will avoid recession in 2023.

Nasdaq booked its third straight week of gains closing up +2.7% Friday and +0.67% for the week. The Dow and the S&P 500 closed up on Friday, +1.00% and +1.89% respectively but down for the week (Dow: -2.66%; S&P:

-0.65%). Weak economic data and mixed earnings reports from retail, airlines, banking and technology has investors worried about a slowing economy.

On Thursday, Nordstrom (JWN) was the latest retailer to report holiday sales which were softer than expected, causing shares to drop -6.2% in after-hours trading though Friday shares were up +0.11%. Erik Nordstrom, CEO, said “the holiday season was highly promotional, and sales were softer than pre-pandemic levels.” He also stated that “it’s clear that consumers are being more selective with their spending given the broader macro environment.”

United Airlines this week reported fourth quarter earnings that were well above Wall Street expectation and offered an optimistic view on 2023 as consumer demand for air travel is outpacing the industry’s ability to meet it. United Airlines (UAL) closed on Friday +2.25% though was -3.57% for the week.

Goldman Sachs missed earnings estimates while Morgan Stanley beat analysts’ forecasts on Tuesday. On Tuesday, Goldman Sachs’ stock fell for the week (GS: -7.60%) as their CEO said they have “narrowed” their ambition in the consumer business. Then on Friday, it was reported that the Federal Reserve was reviewing the bank’s consumer operations to determine whether it had proper monitoring and control systems in place for its consumer lending operations.

On Friday, Google’s parent Alphabet (GOOGL: +5.72%) joined other technology companies that have announced layoffs such as Microsoft (MSFT: +3.57%), Amazon (AMZN: +3.81%) and Intel (INTC: +2.81%). Alphabet announced a layoff of 12,000 employees while Microsoft’s number is 10,000 employees. Alphabet’s owned video platform YouTube is testing a new hub of free, ad supported streaming channels and working to become a go-to destination across various streaming formats that would put it in competition with Roku, Pluto TV, etc.

Meanwhile, in Wyoming, a group of state legislators are proposing a ban on the sales of electric cars in their state to protect Wyoming’s oil and gas industries. According to the US Energy Information Association, Wyoming has been the top producer of coal in the US since 1986, the eight largest oil producer (2% of US output), and the ninth largest natural gas producer (3% of US output). It is the second biggest consumer of energy per capita after Texas. Meanwhile, it imports electricity, largely from excess renewable energy from California and wind power in the state has doubled since 2019 and accounts for roughly 19% of net electricity generation in 2021, the last data point available.

Asian stock indices were volatile this week as the markets were trading on US economic data and growing worries of the economy slowing and the US is headed for a recession. Stocks gained Friday (Hang Seng: +1.82%%; Nikkei: +0.56%; Shanghai +0.76%) and also for the week (Hang Seng: +1.11%%; Nikkei: +1.66%; Shanghai +2.18%).

This week activist Ryan Cohen pushed Alibaba for bigger stock buybacks as he believes the company’s shares are undervalued based upon his expectation that it can achieve double digit sales and 20% free cash flow growth over the next five years. Alibaba (BABA) closed up on Friday +2.81% and +5.92% for the week. Alibaba’s stock price is down more than 50% since 2020 due to sentiment over Chinese equities as well as COVID restrictions in China.

European indices (FTSE 100: +0.30%; DAX: +0.76%; European STOXX 600: +0.37%) were up Friday but down for the week (FTSE 100: -0.95%; DAX: -0.39%; European STOXX 600: -0.09%).

Fixed Income

Yields fell throughout the week, with the 10-year Treasury yield hitting a low of 3.37% on Wednesday. Yields finished the week mixed, with the 2-year Treasury yield ending the week down 4 bps at 4.14%, the 10-year Treasury yield finished the week down 5 bps at 3.48% and the 30-year Treasury yield finished the week up 2 bps at 3.66%.

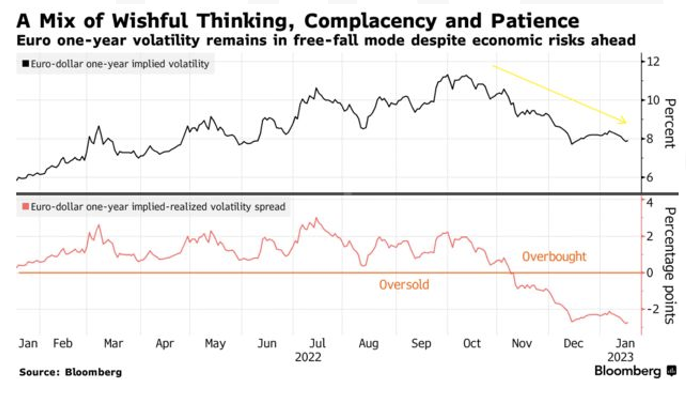

European currency traders are betting on an increase in volatility in the weeks and months to come. Hawkish comments from the ECB and more rate hikes on the horizon are making an increase in volatility more likely. Implied volatility for the next year is currently below its previous year average of under 8%. Mixed messages from the ECB have added fuel to the fire, with a Tuesday report stating that the ECB is considering slower rate hikes. In response, ECB President Christine Lagarde spoke at Davos saying that they must “stay the course”. Global currency volatility has dropped to start 2023, after a steep slide in Q4 2022, falling at the fastest pace 2020.

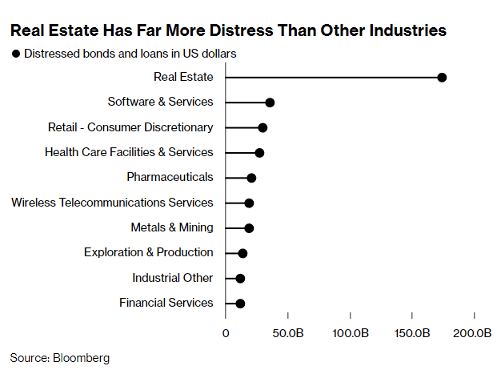

According to Bloomberg, $175B of real estate credit is already distressed. This is four times more than the next largest industry. European distressed credit levels are at their highest in a decade, primarily due to a decline in liquidity according to a study by law firm Weil, Gotshal & Manges. UK commercial property values dropped over 20% in 2022, compared to US commercial property values falling 9%.

Hedge Funds (through Thursday, January 19th)

With global equities declining for the week, hedge funds managed to limit their losses. The average global fund and global long/short equity fund declined 21 and 25 bps respectively compared to the MSCI World that was down 160 bps. North American long/short equity funds captured only 17% of the downside falling 44 bps vs. -249 bps for the S&P. MTD, global and US funds are faring quite well, with global funds up 306 bps (MSCI World +370 bps) and US L/S +250 bps (S&P +160 bps). Performance was more challenging in Europe as funds in that geography captured approximately 80% of the downside of the Euro STOXX 600. For the month, European funds are only up 1.86% compared to 6.1% for the index. Albeit tiny, the MSCI Asia index was the only one in the black for the week at +5 bps. MTD, Asia is the strongest region with funds + 570 bps, China +770 bps and the index +670 bps. The long/short crowded spread recovered this week in both North America and Europe after posting a negative spread for the past 2 prior weeks but MTD, crowded shorts are outperforming. In Asia, the spread was slightly negative for the week but MTD the spread is significantly favorable with longs up over 11% and shorts up slightly more than the index. Hedge funds were sellers of global equities with most of the selling coming at the index level as funds sold longs and added shorts at close to an equal level. Europe was the most net sold region. On a sector level in NA, most of the selling was in financials (capital markets and banks) as well as communications services (entertainment and interactive media). Hedge funds lowered net exposure this past week and took up gross exposure.

Private Equity

Despite a turbulent market throughout 2022 European private equity managed to secure a deal volume and deal value slightly higher than 2021 numbers. Pitchbook analysts attribute this blockbuster year in part because of pent-up demand as pandemic restrictions were loosened. In total, deal count for 2022 was up 13.1% to roughly 8,000 deals and deal value increased by 1.4% to roughly €738 billion. As compared to 2021 where mega-deals dominated the arena, small deals were much more prevalent in 2022. 2022 saw only 36 megadeals (deals over €1 billion) in total, less than half of the amount in 2021. Additionally, European PE assets under management ended 2022 at an all-time high of roughly €874 billion despite rising interest rates throughout Europe. Lastly, 2022 logged the highest proportion of add-ons for overall buyout deals to date at 67%. Pitchbook analysts partly attributed this to PE firms taking advantage of falling valuations to bolster existing portfolio companies with smaller acquisitions.

Although deal volume, value, dry powder, and add-ons reached record highs at the end of 2022, fundraising and exits both slowed considerably. 2022 was the slowest fundraising year since 2014 with roughly €53 billion raised across 92 funds. Furthermore, exits saw their lowest level in nine years with a total exit value of roughly €199 billion, down from a record high of roughly €388 billion in 2021.

Data Source: Bloomberg, BBC, Charles Schwab, CNBC, the Daily Shot HFR (returns have a two-day lag), Jim Bianco Research, Market Watch, Morningstar, Pitchbook, Standard & Poor’s, Morgan Stanley, Goldman Sachs and the Wall Street Journal.