Economic Data and Market Highlights

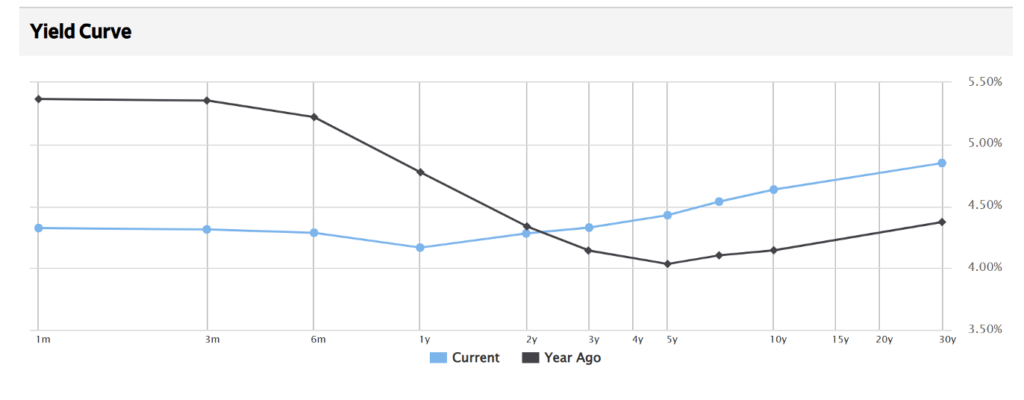

The US equity markets continued to climb with the S&P 500 advancing and the DJIA rising 2.19%. Headlines were dominated globally by the President Trump taking office and a steady flow of executive orders being instituted and the confirmation of the Treasury Secretary and Secretary of State taking place on day one. Developed market equities rose 3.17% for the week. President Trump had a more muted tone during the week related to China related to tariffs and Chinese equities climbed 3.01% in USD terms. At week’s end, the ten-year Treasury stood at 4.65% with longer rates just under 5%. The Fed meets in the upcoming week and it is expected that they will leave rates unchanged given the more solid economic news that continues to be reported.

Source: Wall Street Journal 1/25/25

European stocks have outperformed so far in 2025, with Germany’s DAX and France’s CAC 40 indices rising about 8% each—roughly double the gains of the U.S. S&P 500 and Nasdaq Composite. Key drivers include reduced fears of U.S. tariffs under Trump’s administration, as DAX-listed companies derive more revenue from the U.S. than Germany. Luxury stocks, like Burberry, have also surged, supported by strong U.S. demand offsetting weak Chinese sales. European stocks remain undervalued, with the DAX and Stoxx Europe 600 trading at 13 times projected earnings versus the S&P 500’s 22, making them more attractive to investors.

Vanguard’s S&P 500 ETF (VOO) is closing in on becoming the world’s largest ETF, with assets reaching $626 billion after pulling in nearly $18 billion in inflows in early 2025. This follows a record-breaking $116 billion in inflows last year, putting VOO just behind the $637 billion SPDR S&P 500 ETF Trust (SPY). VOO’s success lies in its appeal to cost-conscious retail investors and financial advisers, boasting a minute 0.03% fee and consistent inflows since its 2010 inception. In contrast, SPY, with a higher 0.095% fee, is favored by professional traders for its superior liquidity and trading volume but has seen net outflows in five of the past 15 years. Meanwhile, BlackRock’s iShares Core S&P 500 ETF (IVV) is also rapidly growing, with $610 billion in assets and $87 billion in inflows last year, matching VOO’s fee at 0.03%. Experts predict that BlackRock may further lower IVV’s fees to compete for dominance in the $7.5 trillion ETF market.

The dividend yield on Chinese stocks have risen to roughly 3%, the highest in three years. The Chinese markets may be headed for more stress after Trump’s win to office due to the imposing tariffs, but this dividend yield jump marks a culture shift as policy makers and regulators are trying help incentivize investment into the region. Chinese firms had record of 2.4 trillion yuan distributed of dividends in 2024 and buybacks rose to a record high of 147.6 billion yuan. The Chinese securities regulation commission said Thursday that over 310 companies are expected to total over 340 billion yuan paid in dividends for December and January. This is 9x more in the number of companies and 7.6x more in the amount of dividends when compared to the same period in the prior year. Shareholders have been flocking to dividend ETFs in the region over the past few years. Since 2020 these ETFS have seen $8 billion of inflow versus 273 million in the previous 5 years per LSEG data. Rising yield in Chinese stocks have also led investors to flock there over bonds as the 10-year yield on the Chinese government bonds are around 1.7% which you can get well above from equities in the region.

Sources: Reuters, LSEG Lipper

The Past Week’s Notable US data points (with revisions)

The Upcoming Week’s notable US data points

Data Source: Blackrock, Bloomberg, Charles Schwab, CNBC, Goldman Sachs, J.P. Morgan, Jim Bianco Research, Morningstar, MarketWatch, Standard & Poor’s, and the Wall Street Journal.

Authors:

Jon Chesshire, Managing Director

Michael McNamara, Analyst

Sam Morris, Analyst