Economic Data Watch and Market Outlook

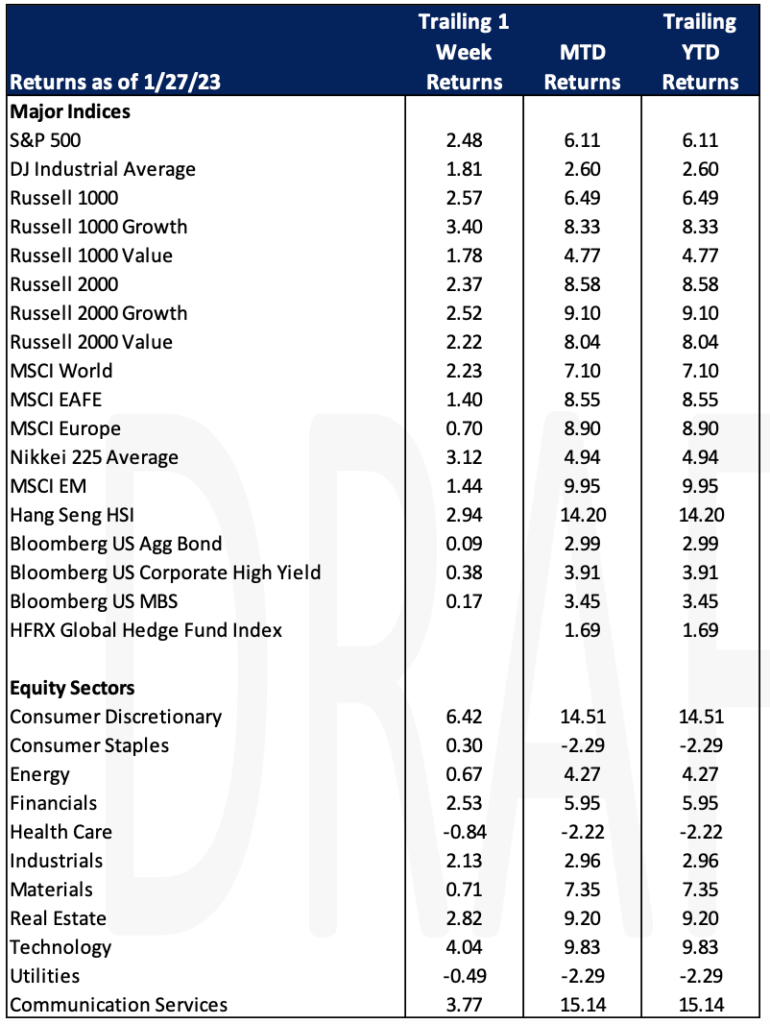

Global equity markets jumped as the MSCI World rose 2.23% on the week. Year-to-date, the index has advanced 7.10% as positive earnings have given hope that a recession may be short and shallow. The US Aggregate Bond index rose 9 basis points and is up 2.99% on a year-to-date basis.

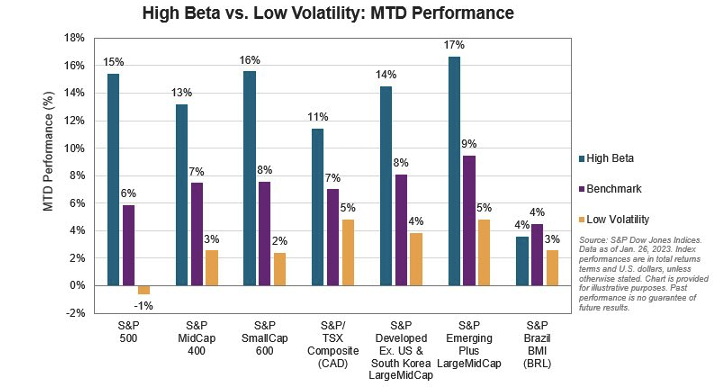

Investors are favoring higher beta stocks as that same hope is favoring risk-oriented assets.

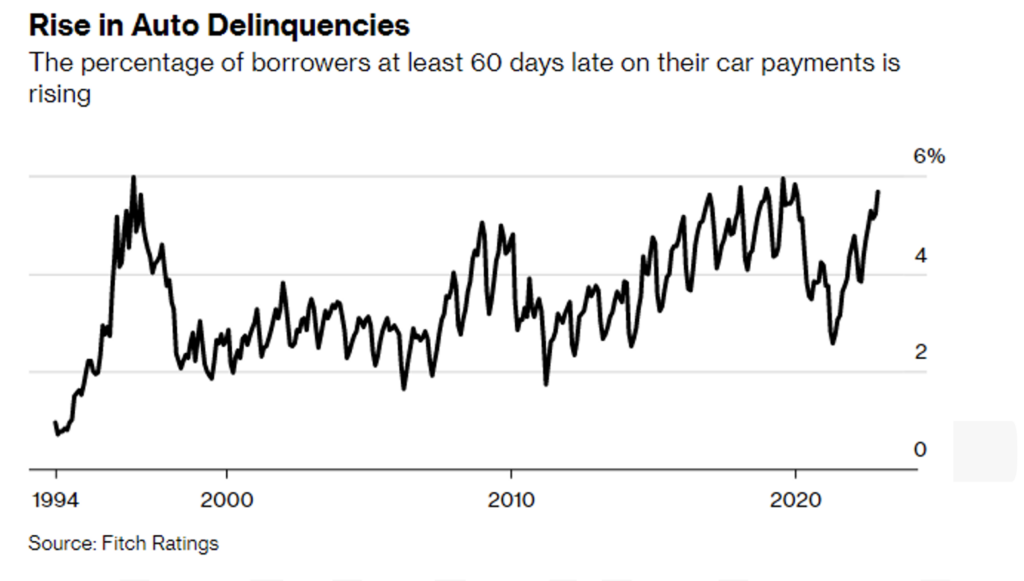

Americans are falling behind on car payments at a higher rate than 2009. In December, the percentage of subprime auto borrowers who were at least 60 days late on their bills climbed to 5.67% up from a seven-year low of 2.58% in April 2021. Comparatively, the peak during the GFC was 5.04% in January 2009.

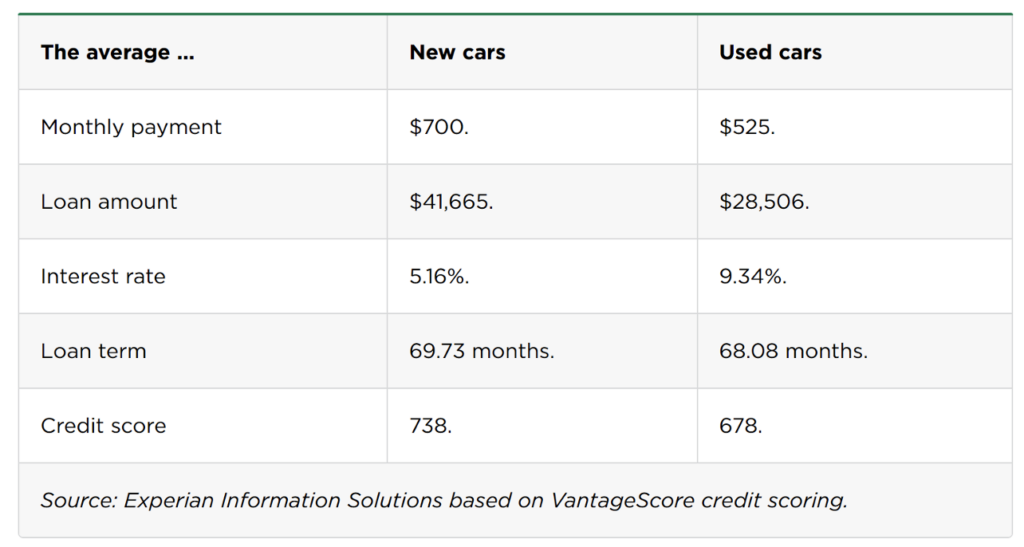

Experian collects data on the consumer and their car payments. Fourth quarter data is still being collected and organized while third quarter data is below. The average new car payment is over $700 and is 13% higher than last year. Note also that the loan terms are biased toward 72-month payment plans.

Tesla’s stock rose +33.34% for the week and 11.10% Friday for its best week in a decade. Tesla reported better than expected fourth quarter earnings and announced their plans to make about 1.8 million cars in 2023, a 31% increase in production. Musk also said that orders were outpacing production two to one. Meanwhile the SEC is probing whether CEO Musk may have inappropriately made forward looking statements.

The political debate around ESG continues as a coalition of 25 states are challenging the Biden administration rule allowing retirement plans to consider ESG when selecting investments. While the debate to mandate classification continues, most managers we speak with are incorporating some facets of ESG into their risk analysis process.

According to Bloomberg, the US has been working with Japan and the Netherlands to restrict exports of some advanced chip making machinery to China. As the House of Representatives has changed control, Kevin McCarthy has vowed to crack down on China and maintain the US competitive advantage.

Equities

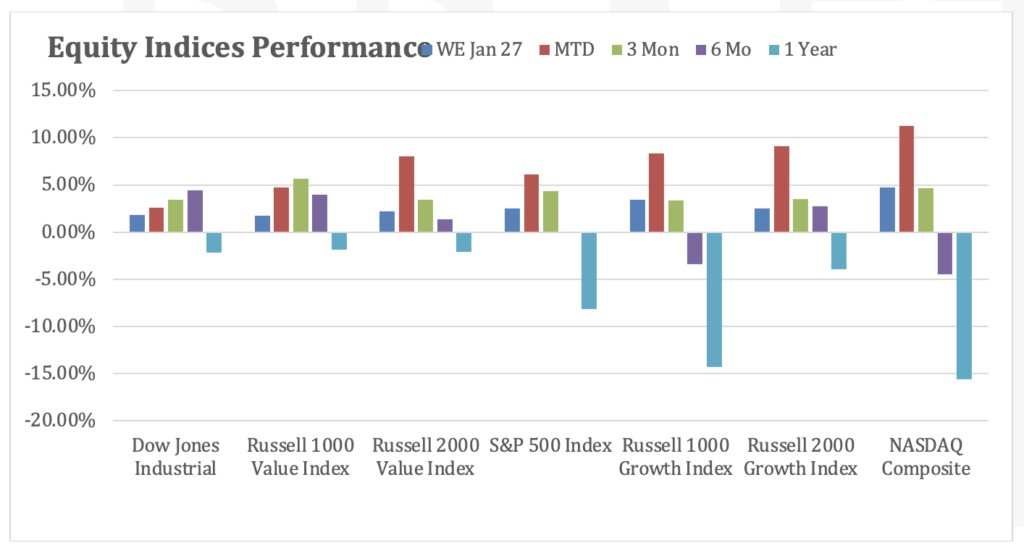

Stocks finished higher Friday with Nasdaq gaining 0.95%, S&P 500: +0.25% and Dow: +0.08% as personal consumption price index (PCE) was in line with year-over-year estimates. The indices have had a strong January with Nasdaq +11.25%, S&P: +6.11% and Dow: +2.60%.

American Express revenues reached all time highs for both quarter and year by 25% at $52.9 billion. They also expect revenue growth of 15-17% for the year ahead and announced a boost in dividend by 15%. Revenue was buoyed by strong spending levels and Millennial and Gen Z customer client acquisitions that is providing a “premium mix of customers”.

Intel Corp had about $8 billion market value erased as they reported disappointing earnings and a decrease in sales of 32% to $14 billion due to the broad industry downturn, stiff competition and costly turnaround plan.

European (FTSE 100: 0.05% DAX: +0.11%; European STOXX 600: +0.26%) and Asian (Hang Seng: +0.58%; Nikkei: +0.07%; Shanghai +0.50%) indices were all up slightly on Friday. European markets (FTSE 100: -0.14% DAX: +0.11%; European STOXX 600: +0.73%) were flat for the week while the Asian markets (Hang Seng: +4.96%; Nikkei: +3.12%; Shanghai +1.15%) did slightly better.

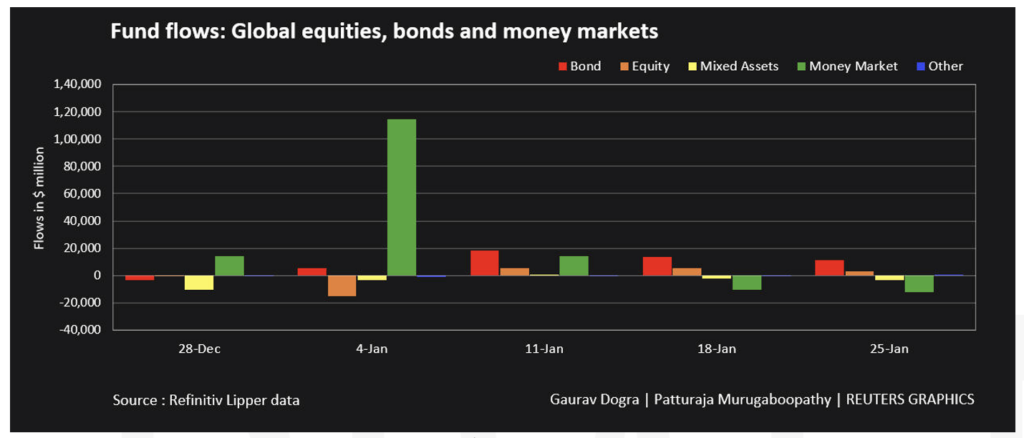

Global equity funds received inflows of $3.23 billion for the week ending January 25 vs $5.16 billion of net purchases the previous week as per Refinitiv Lipper as investors have hopes of a smaller Fed rate hike next week. Also, European and Asian equity funds received $3.15 billion and $.36 billion worth of inflows while US equity funds lost about $1.14 billion.

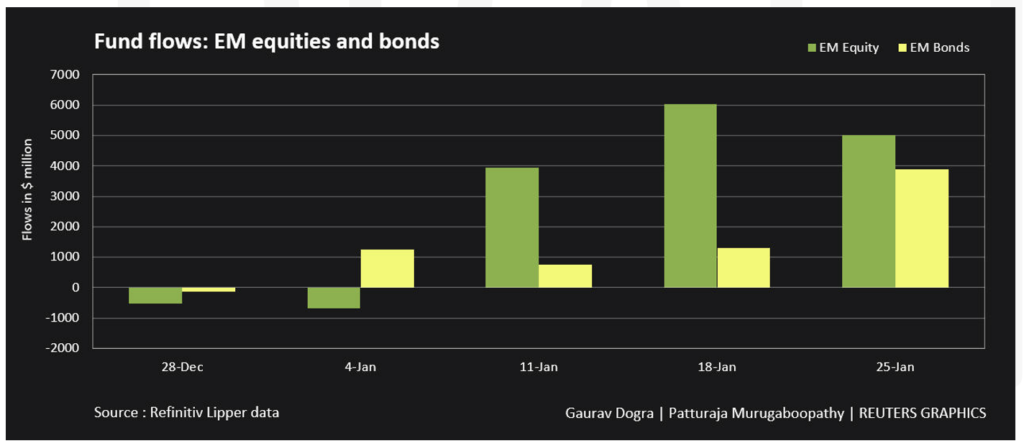

Emerging markets funds also attracted a net $5.02 billion in a third successive week of inflows as per Refinitiv Lipper.

Fixed Income

Yields traded sideways in the last full week of January. The 2-year Treasury yield fell 2 bps to 4.19%, the 10-year Treasury yield remained unchanged, starting, and ending the week at 3.52%, and the 30-year Treasury yield closed out the week down 5 bps at 3.64%. Treasury yields have fallen throughout January in response to more positive economic data for the month of December. The 2-year Treasury yield has dropped 21 bps since January 3rd, while the 10-year Treasury yield has fallen 27 bps, and the 30-year Treasury yield has fallen 24 bps.

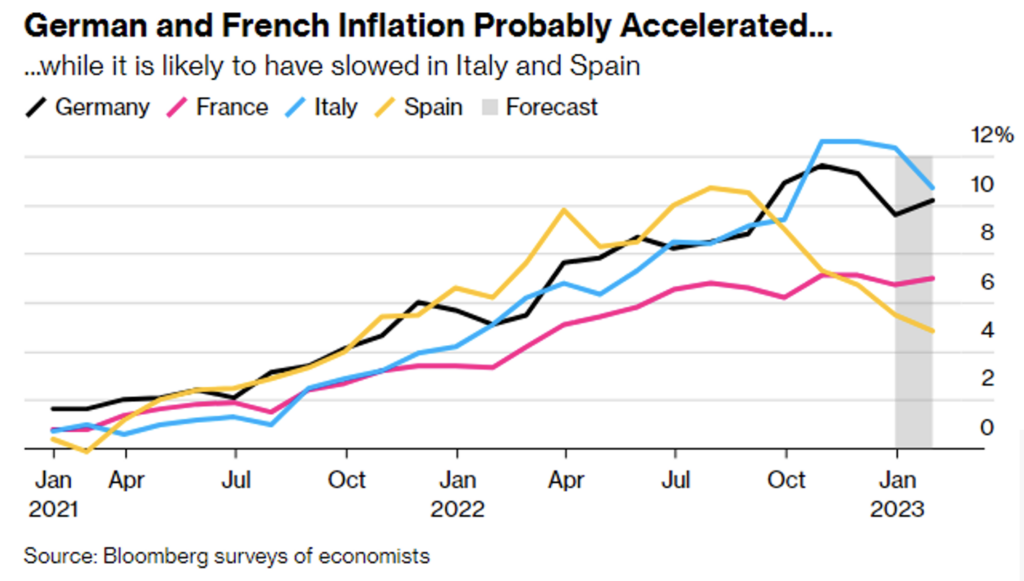

Euro-zone inflation is forecasted to have slowed marginally in January with the headline pace of consumer price growth expected to come in at 9%. Although inflation is forecasted to fall broadly, European countries are seeing divergent economic landscapes. As far as GDP growth goes, stagnation is the general expectation across the board. These estimates are an important factor in ECB policy choices and provide insight into their next move.

Brazil’s central government reported its first primary budget surplus in 9 years in 2022.. Posting a 54.1B reals or $10.7B surplus before interest payment in 2022. The last surplus by the central government was in 2013. The high performance was primarily driven by record tax revenue from a stronger economy as well as large dividends from state owned oil company Petrobras, which benefited from rising commodity prices caused by the war in Ukraine.

Hedge Funds

Positive performance continued this past week with all regions posting gains of 1.4%, capturing 60% of the S&P’s returns. Global funds were up ~ 86 bps compared to 190 bps for the MSCI World and Asia-based funds +110 bps vs. +180 bps for the MSCI Asia. Europe was the strongest relative performer as funds in that region were +56 bps, the only region to outperform their relative index which was +43 bps for the week. On an absolute basis, Americas-based L/S equity earned the largest returns as hedge funds were buyers of equities this past week with almost all of the buying through Thursday concentrated in NA while flows in other regions were muted. The pace of short covering slowed as the buying was mixed between long adds and short covers. Unlike recent previous buying, it was more concentrated in single-name stocks this past week while index level flows were reasonably quiet. The long adds were more concentrated in healthcare (biotech and equipment services), technology (software) and energy. The latter was due to continued optimism over China demand. Consumer and financials added to the net buying while materials were the only sector to be net sold. Outside of NA, hedge funds were net sellers with the largest amount in Europe mostly concentrated in single-name, notably consumer and TMT. In AxJ flows were quiet as markets were closed for a week for Lunar New Year. Hedge funds were net sellers in Japan with the selling mostly spread between consumer and financials. Crowded longs and shorts were flat for the week in NA and Europe as both longs and shorts outperformed their relative indices by ~1%. In Asia, crowded shorts outperformed longs resulting in a 1.9% negative spread. The US corporate bond long/short ratio fell for the 3rd straight week as fund rotated out of IG. After reaching a one year high in early November, the L/S ratio ended the week falling to its lowest level in ~ 5 months.

Private Equity

Private investment in both infrastructure and digital infrastructure has seen a substantial increase over the last fifteen years. Analysts accredit this largely to government regulations, the digitization of the economy, social concerns around climate change, socioeconomic equality and energy insecurity. Over the past several years capital raised by private infrastructure funds has been the highest amount raised that at any other point in history. According to PitchBook data, in 2021 roughly $128 billion had been raised across 94 funds while at the end of Q3 2022, roughly $95 billion had been raised by 44 funds. Additionally, outside of closed-end private funds there are at least sixteen evergreen funds over the $1 billion in size mark, meaning the total committed capital within this vertical is likely understated.

Typically, European private investment funds in this space receive higher investment than that of North American private funds. However, this trend saw a role reversal in 2022. According to PitchBook data through 2022 Q3 more capital was committed to funds in North America than in any other full year in history at roughly $72 billion. In contrast, Europe registered one of its least successful fundraising years in history with only $17 billion committed, or only 18% of the total global capital raised. Although funds domiciled in one geography may invest in others, PitchBook analysts suspect this role reversal may be due to North American mega-funds capitalizing on the European energy crisis and corresponding demand for energy infrastructure assets.

Given that many of the forces driving increased interest and private investment in both infrastructure and digital infrastructure, this will likely continue to further shape the space, and analysts suspect private investment in this vertical to increase significantly year over year.

Data Source: Bloomberg, BBC, Charles Schwab, CNBC, the Daily Shot HFR (returns have a two-day lag), Jim Bianco Research, Market Watch, Morningstar, Pitchbook, Standard & Poor’s, Morgan Stanley, Goldman Sachs and the Wall Street Journal.