Economic Data Watch and Market Outlook

Global equity markets rose in the first week of 2023 as the MSCI World jumped 1.83% and the US Aggregate Bond index rose 54 basis points. As most outlooks from larger banks have telegraphed a looming recession, market data that was released tell the story of a resilient economy. PMI prices and manufacturing data fell slightly more than expected, evidence that rising rates are helping cool inflation whereas PMI employment rose more than expected. Some evidence of layoffs are occurring in the tech sector but other areas of the economy continue to add jobs. Jobless claims on Thursday fell more than expected and nonfarm payrolls increased.

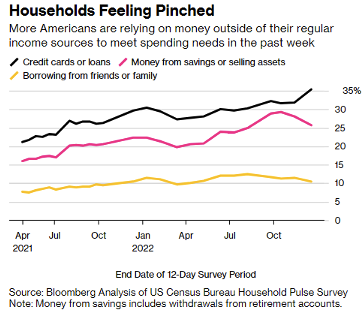

While labor markets remain healthy, the number of Americans relying on credit cards rose in December. Data released Thursday by the US Census Bureau’s Household Pulse survey found that over 35% of households used credit cards or loans in December to help ease spending pressure. This is up from 32% in November 2022, and up from 21% in April 2021.

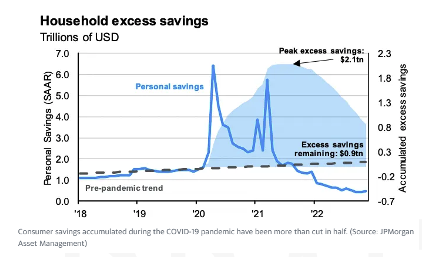

Americans are also saving less. Savings rates hit their lowest point since 2005 in November at 2.4%, down from a peak of 33.6% in March 2020. Consumers have spent more than the $1T saved up during the pandemic with excess savings sitting at $900B to start the year, down from a peak of $2.1T in 2021 and $1.9T to start 2022.

Updated consumer credit results are released on Monday, Jan 9th. We’ll be watching US CPI results released on Thursday. Abroad, we’ll monitor unrest in Brazil and inflation trade data from China. While that data point from China is important, the country has fully re-opened and removed all Covid restrictions. Can the nation’s manufacturing capability recover or will the re-opening occur just as the rest of the world’s economies slow?

Equities

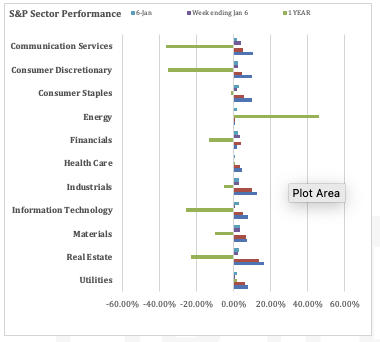

All three major indices were up for the day on Friday (Dow: +2.13%; S&P: +2.28%; Nasdaq: +2.60%) and finished the first week of 2023 with gains (Dow: +1.50%; S&P: +1.47%; Nasdaq: +0.95%) as the market reported that hiring rose higher than expected but wage growth slowed and the services industry contracted in December. It was the best day for the Dow and S&P 500 since November 30 and best for the Nasdaq since Dec 29. All sectors of the S&P 500 posted gains for the day with materials having the largest gain of 3.45%.

FDA accelerated approval on Friday for Eisai (ESALY: +4.10%) and Biogen’s (BIIB: +2.82%) Alzheimer’s disease treatments, which both showed that they can slow the progression of the disease in clinical trials. Over the past year both Eisai and Biogen’s shares have both gained 18.6% and 18.5%, respectively. GE (GE: +0.91%) spun off their healthcare unit as the GE Healthcare Technologies (GEHC: -0.08%) that began trading Wednesday. GE Healthcare makes MRI and other hospital equipment. Other spinoffs that seem to be in the works include Johnson and Johnson’s (JNJ: +0.81%) consumer unit Kenvu, Novartis’ (NVS: +1.64%) generic business Sandoz and Baxter’s (BAX: -7.84%) kidney care unit.

Retail sales slipped after hours on Friday as Macy’s (M: +2.64%; after hours -3.84%) warned that 4th quarter / holiday earnings guidance would come in at the low / middle end of guidance. Other retailers were also down after hours: Nordstrom (JWN: -1.85%), Dillard’s (DDS: -2.38%) and Kohl’s (KSS: -2.17%). Ant Group Co. founder, Jack Ma, will no longer be the controlling person of Ant. Mr. Ma owned a 10% stake in Ant, an affiliate of Alibaba Group Holdings (BABA: +2.70%), but exercised control over the company through related entities that put his ownership of Ant at 50.5%. Analysts believe the completion of this regulatory driven restructuring could clear the way for the company to revive its IPO. Tesla (TSLA:+2.72%) cut prices in China for a second time in the last three months on Friday, as well as Japan, South Korea and Australia, which brought the EV prices between 13% -24% below their September levels. Many believe that the automaker announced the cut to spur sales and support production at its Shanghai plant. Meanwhile, hundreds of Tesla owners gathered at the automaker’s showrooms and distribution centers in China demanding rebates and credit after the sudden price cuts.

Asian indices (Hang Seng: +6.43%; Nikkei: -1.39%%; Shanghai +2.73%) for the week were mixed while European indices (FTSE 100: +2.45%; DAX: +4.89%; European STOXX 600: +4.60%) were up.

Fixed Income

Treasury yields diverged to start the year with 1- through 6-month rates rising while 1-year through 30-year rates fell. The 2-year Treasury yield ended the week down 16 bps, while the 10-year Treasury yield fell 24 bps and the 30-year Treasury yield fell 21 bps. Minutes from the Fed’s December meeting were released Wednesday. After four consecutive rate hikes throughout the year, followed by a 25 bps increase in December, many investors had hoped for a quick turnaround on inflation. In response to these hopes, the minutes showed that the Fed maintains that to defeat inflation there must be sufficient tightening of financial conditions, and that there will most likely be no rate cuts in 2023.

The Bank of Japan conducted an unscheduled bond buying operation on Friday for notes maturing in five to ten years, and it has scheduled additional plans for buying notes maturing from one to 25 years. The 20-year JGB yield, which hit an eight-year high of 1.35% last month, fell 1.5 bps, the 30-year JGB yield fell 1.5 bps to 1.60%, and the 40-year JGB yield fell 1.5 bps to 1.87%.

Hedge Funds

Global funds and Americas-based L/S equity funds outperformed their benchmarks this week. The average global fund and the average global L/S equity fund were up 20 bps and 50 bps respectively compared to +10 bps for the MSCI World. Americas-based L/S funds were +20 bps vs. -80 bps for the S&P 500. This was achieved despite crowded longs and shorts declining about in-line with the S&P creating negative spread. EU funds had a challenging week, capturing only ~5% of the Euro STOXX 600 (+20 bps compared to +340 bps). This most likely can be attributed to significant negative spread in crowded longs and shorts as longs underperformed the benchmark and shorts rallied more than the benchmark, leaving the spread at -2.1%. Asia-based funds were the winners for the past week, led by China. The average Asia-based L/S equity fund was up 2.7%, the average China fund +4.6% compared to the MSCI Asia that was up 1.2%. There was also a significant positive spread as crowded longs were up 7.2% vs. crowded shorts were up 2.3%. Hedge funds were buyers of global equities led by AxJ and Europe by both adding to longs and covering shorts. In Europe, funds were buyers of industrials, materials, financials and ETFs. In AxJ, funds added to longs and covered shorts in internet retail. This was the largest buying week of consumer discretionary buying since the start of 2020. Japan was slightly net bought as funds added to longs and shorts in almost equal amounts. The only region to be net sold was NA. Tech and consumer discretionary led the way as funds trimmed longs and added to shorts mainly in tech hardware, autos, semis software and internet retail. The TMT L/S ratio is the lowest since 2016. ETFs offset some of the single-name selling as there was about a 50/50 split between long adds and short covers. US L/S funds are more cautiously positioned. Gross leverage is at the 7th percentile over the past 12 months, and 3rd percentile over the past 5 years. Flows in China have substantially increased. Through October, China was net sold for 8 of the 10 months of 2022. Since then, hedge funds have been consistent buyers of Chinese equities the past 8 of 10 weeks. To put it into context, Since November 1st, the buying has amounted to 70% of the amount sold in the first 10 months.

Data Source: Bloomberg, BBC, Charles Schwab, CNBC, the Daily Shot HFR (returns have a two-day lag), Jim Bianco Research, Market Watch, Morningstar, Pitchbook, Standard & Poor’s, Morgan Stanley, Goldman Sachs and the Wall Street Journal.