Economic Data Watch and Market Outlook

As of the writing of this commentary on Sunday, March 12th, at 2:30pm, investors are keeping tabs on how the closure of the Silicon Valley Bank and the assets of depositors will be handled following the FDIC announcing that it is auctioning assets of the failed bank. The failure is the second largest in US history after the 2008 failure of Washington Mutual. The situation continues to be fluid and we will continue to update our clients regarding any impact on their portfolios. During a time of historically low rates as well as a frenetic tech landscape, SVB was dealing with clients flushed with cash. The bank’s total deposits went from $62B to $124B in 12 months as of March 2021. When interest rates where near historical lows, the bank purchased a large amount of seemingly low risk long dated Treasuries, but as rates rose the values of the newly purchased assets fell and the bank was sitting on large unrealized losses. As the economy transitioned to a rising rate environment, by the end of 2022, the bank was facing losses of $15B on securities held to maturity, nearly equivalent to the banks equity base of $16.2B. As SVB’s client base began to face a more difficult funding environment, they began to pull money from the bank. The bank tried to address this by going to the capital markets via a secondary offering which failed and created more panic.

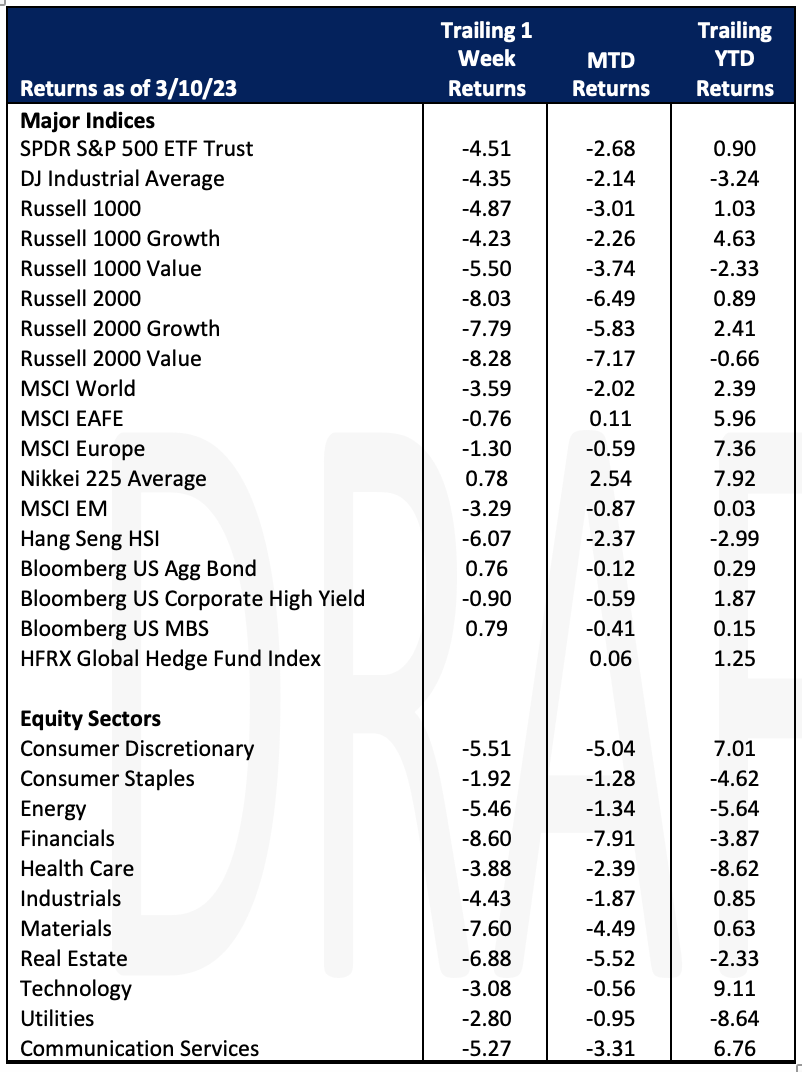

Markets were already on edge with Silvergate Bank failing earlier in the week. The bank had significant exposure to the crypto industry and had exposure to FTX. As concerns grew about the bank during the week, investors’ anxiety increased. At week’s end, global markets were down 3.59% as indicated by the MSCI World. Some markets had already closed by the time of the SVB announcement. US stocks fell sharply with the Russell 1000 index down 4.87%.

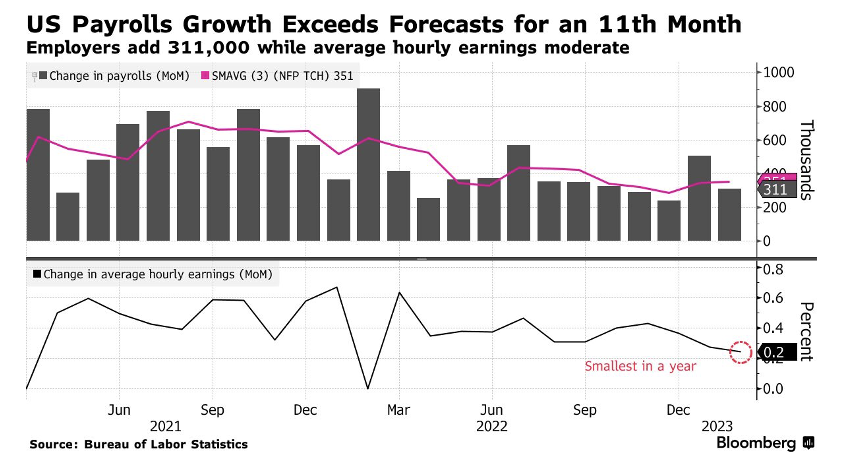

The US labor market showed signs of continued strength in 2023. Payrolls beat estimates for an 11th straight month. Separately, jobs data showed that while job openings are still at a historically high level, they fell in January, and that layoffs reached their highest since the end of 2020. Vacancies fell to 10.8M in January. On Friday, President Biden stated that he is optimistic that next week’s CPI will be in “solid shape”.

As of this writing, the yield on a two-year Treasury is 89 basis points higher than the 10 year. The spread is slightly narrower than after Powell’s testimony, when it stood at 105 basis points. Before the fallout from SVB, the probability of a 50 basis point increase surged to almost 65%.

Equities

The broad equity markets dropped this week (Dow: -4.35%; S&P: -4.55%; Nasdaq: -4.71%) after earlier in the week Chairman Powell said inflation was strong and rates need to go higher. On Friday the jobs report showed wage inflation cooling and unemployment rising two tenths of a percent to 3.6% from 3.4%.

GM (GM: -3.44%) announced buyouts of salaried employees with at least five years of service and global executives with at least two years of service as a way to bring down structured costs of ~$1.5B.

On Friday bank stocks fell triggered by SVB’s inability to raise capital and being shut down by regulators. KBW Bank Index fell -3.91% / Friday and -15.73% / week. Markets are concerned about the emerging risk of financial instability of the banking industry as trading was halted Friday due to volatility for some regional banking stocks (Signature Bank, First Republic, etc.). Circle, a US cryptocurrency firm disclosed that it has $3.3 billion of its $40 billion of USD Coin (USDC) reserves at SVB but stated that it will operate normally as it waits to see how SVB’s receivership will affect its depositors. Circle also disclosed that it had held USDC reserve deposits at Silvergate, which it had moved to other banking partners. Silvergate Capital (SI: -10.56%) disclosed plans to wind down operations and voluntarily liquidate this week after the stock fell last week -59.74%.

European stocks lagged at the beginning of the week reflecting disappointment around China flagging a lower than expected 5% target for economic growth. European equity markets (FTSE 100: -1.67%; DAX: -1.31%; Euro STOXX 600: -1.35%) were down for the week following US markets.

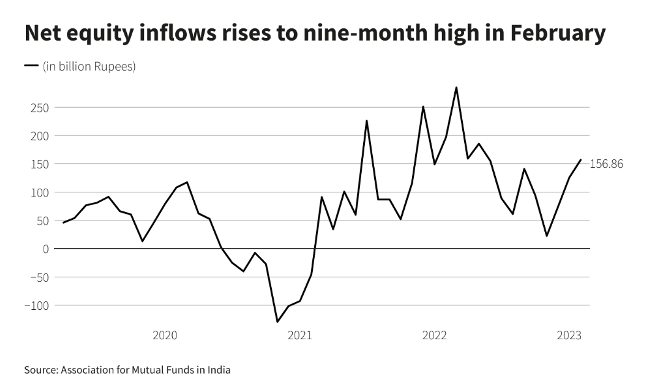

The Association of Mutual Funds in India (AMFI) showed that Indian mutual funds had inflows of $1.91 billion (156.86 billion rupees), the highest in nine months.

JD.com (HK 9618: -11.5%), a Chinese retailing company, reported 4Q22 net revenue growth of 7.1% y/y but gave no clear direction for FY23 leading to the stock price decline. China Unicom (HK 762) also affected the Hang Seng Index. Asian equity markets (Hang Seng: -3.04%; Nikkei: -1.67%; Shanghai -1.40%) were down for the week with worries about possible US interest rate hikes.

Fixed Income

It was a turbulent week for bond markets. Federal Reserve Chairman Jerome Powell testified on Tuesday in front of Congress stating that the Central Bank will likely raise rates higher than was previously expected. In response, the 2-year Treasury yield closed over 5% for the first time since June 2007, the 10-year Treasury yield closed at 3.97%, and the 30-year Treasury yield closed at 3.88%. On Wednesday, Silicon Valley Bank announced it had sold a large chunk of securities at a loss and would sell $2.25B in new shares to cover its balance sheet triggering a bank run. By the close of business Thursday, the bank had a negative cash balance of -$958M. By Friday the FDIC had taken control of the bank and yields were down across the board. The 2-year Treasury yield fell by 26 bps for the week to 4.60%, the 10-year Treasury yield fell 27 bps to 3.70%, and the 30-year Treasury yield fell 20 bps to 3.70%. The Bloomberg US Aggregate Bond index rose 0.76% for the week. As noted above, the core driver of SVB’s collapse was spurred on by Treasury bets made during the pandemic.

Hedge Funds

Not surprisingly, hedge funds posted losses following a difficult week for equity markets globally. The average global fund lost 1.1% through Thursday compared to the MSCI World declining 2.3%. Performance across long/short equity funds were slightly worse down 1.7% while those based in NA were down 1.8%, vs. -3.1% for the S&P 500. In other regions, EU hedge funds were down slightly, 31 bps WoW vs. the Euro STOXX 600 down 82 bps. Asia was the most challenged for the week as funds in that region posted losses of 2.8% compared to the MSCI Asia only declining 55 bps. One of the main drivers of the challenging performance in Asia was the decline in the top 50 crowded longs that collectively lost 5.2%. The spread between crowded longs and shorts was positive in both NA and EU with most of the alpha in both regions coming from the short side. Net flows were basically muted WoW though funds leaned towards adding gross exposure to global equities mostly in NA. Interestingly, most of the long buying was in single-names while most of the short adds were in index-level products. The bulk of the buying was in tech which was the 4th consecutive week the sector was net bought. Financials and consumer discretionary were the only sectors to be net sold for the week. Like NA, funds added to both long and short exposure in European equities, albeit in small amounts. In AxJ, flows were mixed at the country level with Australia being the most net sold followed by China whereas there was buying in other parts of the region. Japan flows were flat on a net basis with a small amount of de-grossing.

Private Equity

The increased need for liquidity options has led investors to private debt secondaries, a market that has seen a substantial rise over the past three quarters. According to Pitchbook data, “The market has been pulling out all the stops to absorb big-ticket LP portfolio sales, and it’s been difficult to find buyers for some larger GP-led transactions.” In fact, according to secondaries specialist Coller Capital, “The trade in secondhand stakes of private debt funds hit $17 billion in 2022 – more than 30 times the total volume in 2012. At the current rate, the value of secondary deals is expected to reach $50 billion by 2026.”

Pitchbook analysts accredit the rise in private debt secondaries mainly to LP-led sales and the denominator effect. As stock prices rolled over this past year, many limited partners were overexposed to private and alternative asset classes leading them to sell some level of this private debt on the secondary market. Additionally, market uncertainty and financial downturn have encouraged growth in the GP-led secondaries market as GPs look to set up continuation funds to generate liquidity and secure re-ups for new funds.

Analysts expect continuing economic uncertainty and market volatility will continue to drive the need for liquidity equating to continued increase in private credit secondary activity well into 2023.

Data Source: Bloomberg, BBC, Charles Schwab, CNBC, the Daily Shot HFR (returns have a two-day lag), Jim Bianco Research, Goldman Sachs, Market Watch, Morgan Stanley, Morningstar, Pitchbook, Standard & Poor’s and the Wall Street Journal.