Economic Data Watch and Market Outlook

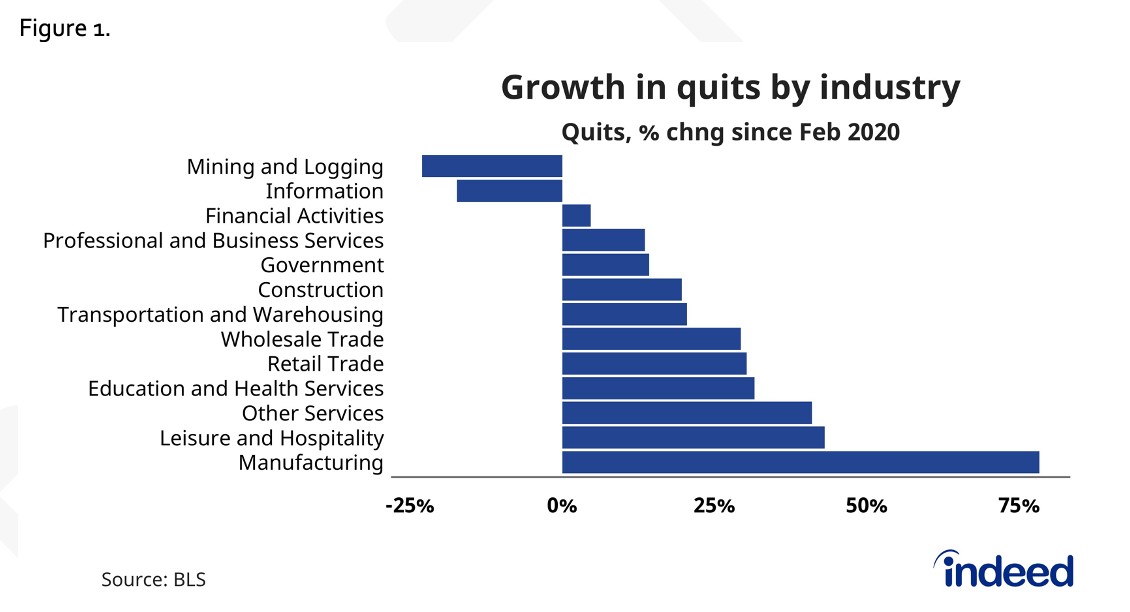

Investors focused on inflation, economic growth, Covid data and Tesla this week. There is growing skepticism that inflation is indeed transitory based on energy prices, rent and employment. The FOMC has insisted that it is transitory, but there is not a set number of days that determines transitory versus permanent. Economic growth and employment seem to both be expanding, but at uneven rates. Workers seem to be increasing their acceptance in returning to work but it is very specific to industry and geography. There are still material shortages in healthcare especially for nursing care. On Friday, we saw the Labor Department’s Job Openings and Labor Turnover Survey (JOLTS) release for September. It showed that 4.4 million people QUIT their jobs in September leaving their jobs for greener pastures and ultimately adding to wage inflation. As Figure One points out, a recent report from Indeed that reviewed the data, shows which industries are being hit the hardest.

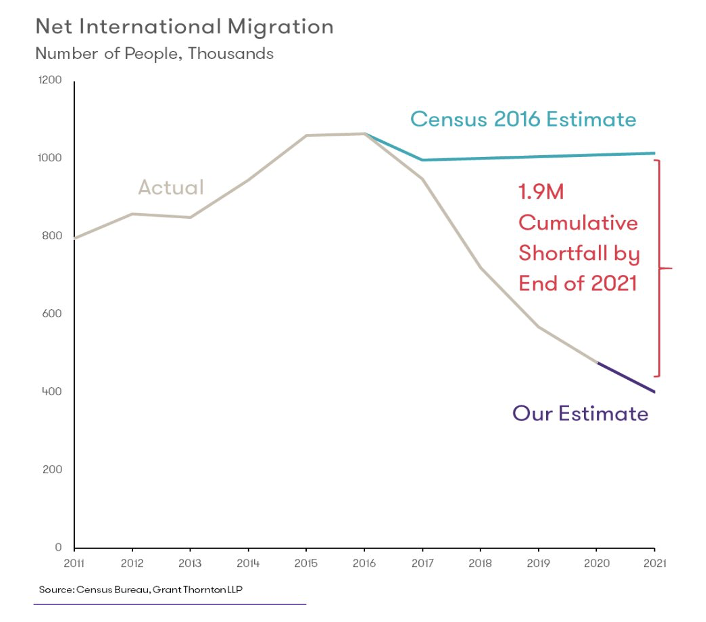

An analysis by accounting firm Grant Thornton further examined how changes in the US immigration policy have affected the labor force suggesting a 1.9 million worker shortfall in Figure 2. The Cato Institute did a similar study and estimated a 4.8 million shortfall.

Initial reports are encouraging about air travel and tourism returning before the holidays and the surging USD is the prime beneficiary. The rise in the USD hit a 16-month high on Thursday relative to the Euro and other currencies largely sparked by recent inflation numbers and expectations that the Fed may raise rates sooner than expected. While promising, we continue to watch a slight surge in COVID cases occur in Europe and to a lesser extent the US.

Next week is the last week before the launch of the holidays which will be scrutinized based on retail spending, gas prices and air travel. Historically, equities have slowly appreciated at year end as people become more focused on family, good thoughts and thanks rather than worrying about life’s issues. A recent survey highlights that over 50% of holiday sales will be on-line. Shop early!

U.S. Equities

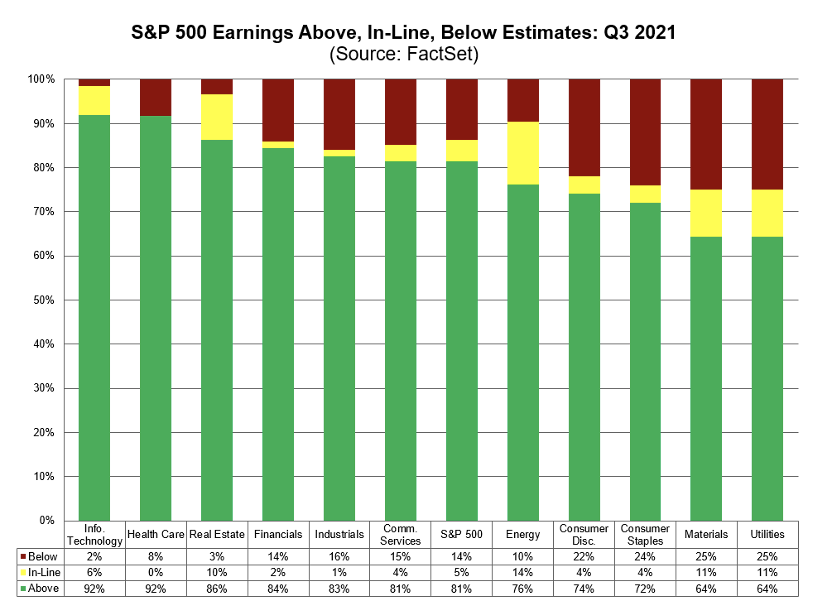

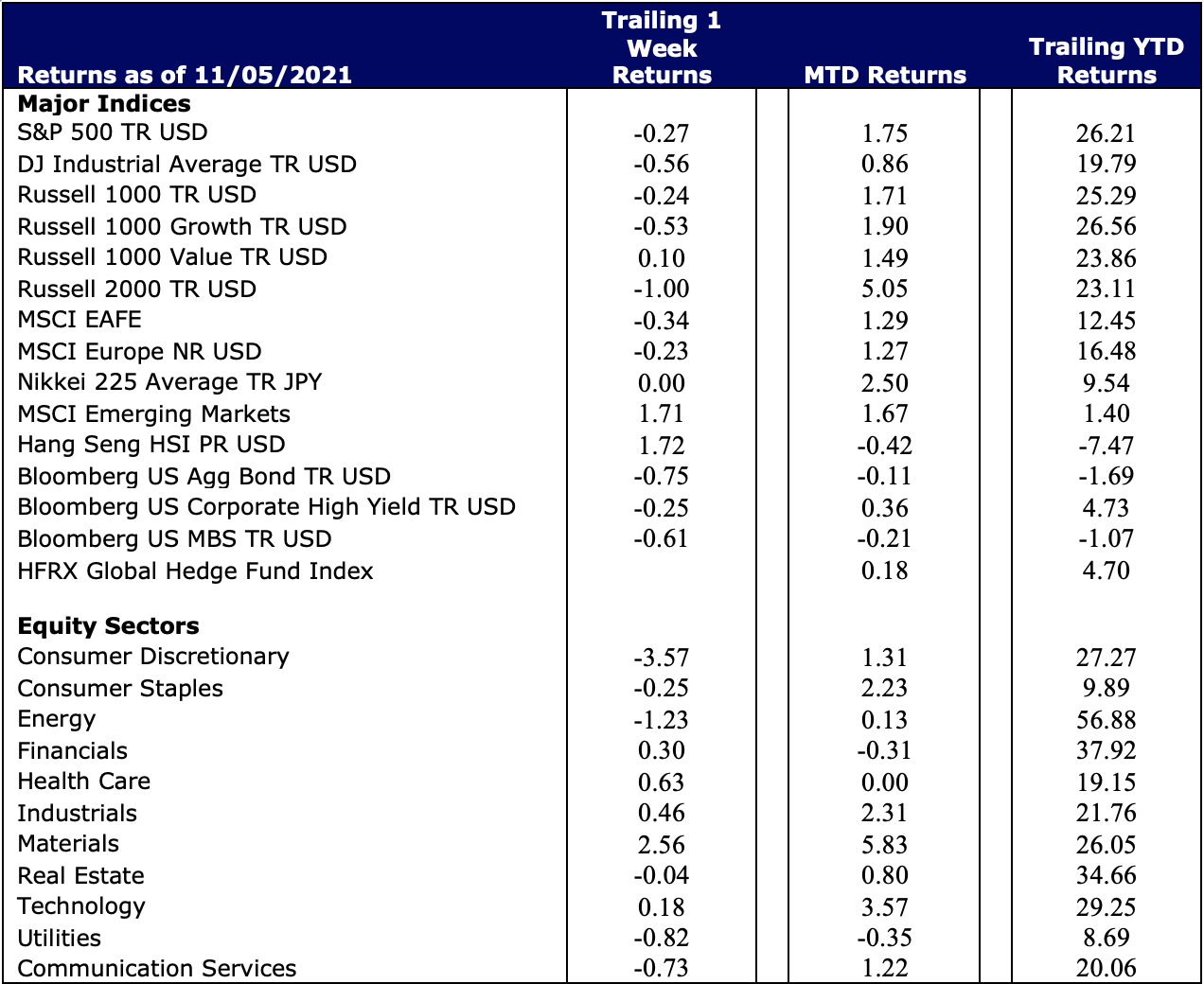

The S&P500 was off slightly for the week, down 27 basis points. On a year-to-date basis, the index is up 26.21%. As we wind down the earnings season, a majority of companies reported earnings above expectations (Figure 3) but future quarters will become more challenging as cost pressures will play a role in impacting corporate margins and will likely see a separation over the next few quarters between those companies with stronger balance sheets.

Growth stocks fell slightly for the week (Russell 1000 Growth -0.53%) while value stocks (Russell 1000 Value) rose a slight 10 basis points. After the significant rise the previous week, the Russell 2000 fell 1.00%, but is up 5.05% month to date.

Giving credit to Mr. Musk, his shout out on social media sites looking for advice on selling some shares of Tesla to pay for the taxes on expiring options, probably smoothed some volatility, but it was effectively a secondary offering. Shares sold both by him and those concerned about how long it would take to absorb the extra supply caused the price drop. One must also wonder if the Rivian IPO also led some investors to sell Tesla to buy Rivian. Another interesting aspect to note this week was the reorganization of both J&J and GE.

International Equities

Developed markets as represented by the MSCI EAFE index fell 34 basis points. Growth stocks have outpaced value stocks month to date (2.06% vs 0.47%) and have similar characteristics on a year-to-date basis ( 12.65% versus 11.88%). We have started to hear some conversations among managers regarding valuations becoming attractive in non-US developed and emerging markets. We continue to watch valuations and growth prospects both in the US and abroad and in areas where we have allocated to active managers. Our emphasis will continue to be directed to those with a fundamental approach who continue to search for companies with attractive fundamentals over the longer term.

Fixed Income

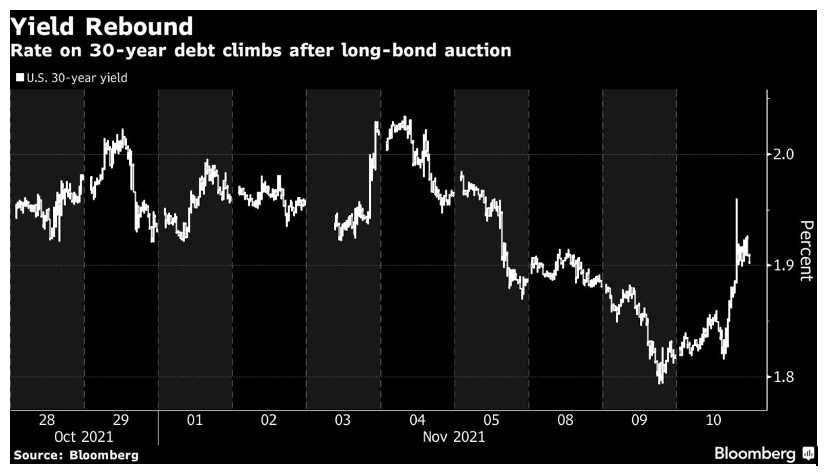

US Fixed income markets had a short trading week, closed for Veterans Day. The Bloomberg US Aggregate bond index fell 75 basis points as yields surged (Figure 4) after the bigger than expected jump in inflation. The 30-year Treasury auction on Wednesday was weaker than expected too. These factors created a surge in yields in the US and Globally.

Figure 4.

Hedge Funds

Hedge funds were net buyers of global equities this week, mostly short covering, albeit with light volumes. North America led all regions with the most buying that consisted of both short covering and adding to longs. This past week was also the largest week of North American energy buying since September 2018. Asia ex-Japan was the second most bought region led by Taiwan, China and Hong Kong (China focused funds led performance for the week). There was a pause in the de-grossing this past week with flows mixed across regions and sectors.

Private Equity

Over the past year venture debt has experienced a faster growth rate than the broader venture capital market. Venture debt has become a suitable alternative to equity-based financing for companies looking for less expensive financing. Nondilutive capital is alluring to founders and can be used as an insurance policy alongside an equity raise to help ensure the company’s continued growth ultimately leading to another round of fundraising with an increased valuation.

While most of the growth and success of venture debt has been centered on tech, the life sciences market has seen a record setting amount of venture debt deals totaling $4.5 billion in 2020 and is on pace for another record setting year in 2021. Unlike lenders in tech venture debt, lenders in the life sciences market enjoy three key factors that are contributing to the substantial growth in this market: faster IPOs, validation of product efficacy through clinical trials and product protection through intellectual property.

Returns for the venture debt industry have been steady for the past ten years averaging between 12-15% and are anticipated to remain an enticing option for investors in the future. As recent equity fundraising levels continue to drive the venture market’s growth it is anticipated venture debt will continue to grow at pace given that it has historically followed the trends of the broader VC market. Additionally, given that the stigmas attached to debt for immature companies have declined in recent years, venture debt is certainly positioned for increased growth in the near term.

Data Source: Bloomberg, CDC, CNBC, The Daily Shot, Grant Thorton, HFR (returns have a two-day lag), Morningstar, Pension and Investments, Pitchbook a Note on Venture Debt, Pitchbook venture debt in life sciences, Standard & Poor’s, US Census Bureau, and the Wall Street Journal

This report discusses general market activity, industry, or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice. It is for informational purposes only and does not constitute, and is not to be construed as, an offer or solicitation to buy or sell any securities or related financial instruments. Opinions expressed in this report reflect current opinions of Clearbrook as of the date appearing in this material only. This report is based on information obtained from sources believed to be reliable, but no independent verification has been made and Clearbrook does not guarantee its accuracy or completeness. Clearbrook does not make any representations in this material regarding the suitability of any security for a particular investor or the tax-exempt nature or taxability of payments made in respect to any security. Investors are urged to consult with their financial advisors before buying or selling any securities. The information in this report may not be current and Clearbrook has no obligation to provide any updates or changes