Economic Data Watch and Market Outlook

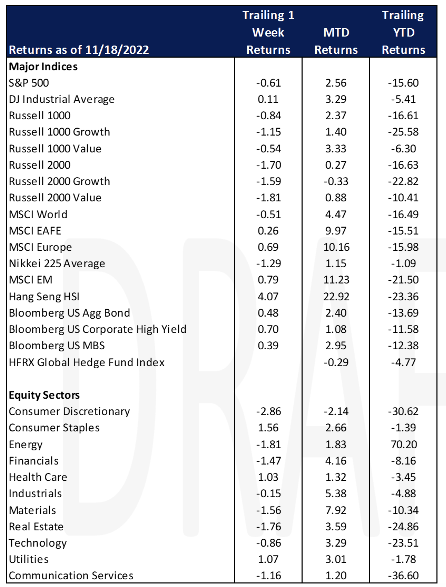

Global equity prices were flattish for the week with the MSCI World index falling 51 bps and the US Aggregate Bond index rising 48 bps.

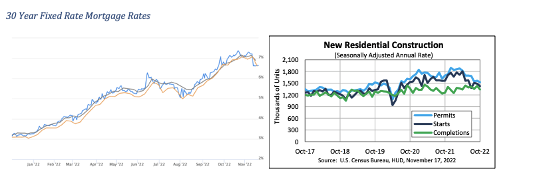

October housing starts come in lower than expected for the ninth consecutive month, falling 4.2% month-over-month, which is the longest string of declines in data going back to 1999. Contract closings slid 5.9% in October to the lowest level since 2020. Sales declined in all four regions of the US. With mortgage rates continuing to sit in the 6.5% – 7.0% range the housing market has been one of the hardest hit industries in the last 10 months. Rates have fallen from their highs in the last two weeks, with the average 30-Year fixed rate mortgage landing at 6.63% on Friday, still more than double January 2021’s record lows of below 3.0%. The number of homes for sale slipped from September to 1.22 million, the third straight drop. In addition to the sizable pullback in housing demand, homeowners who have locked in lower mortgage rates may be hesitant to list their homes. At the current sales pace, it would take 3.3 months to sell all the homes on the market, up from 2.4 months in October 2021.

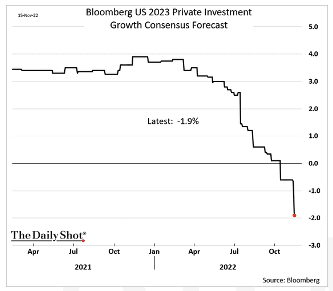

This slump in housing is causing business investment expectations to plummet but this is muted as other business-related investment is not expected to be as negative.

US Oil futures are pointing to an oversupply for the first time this year – the latest indicator of the scale of the dramatic slump in the nearest section of the oil futures market. The front-month spread, which reflects short-term supply-demand balances, traded bearishly, ahead of the December contract’s expiry on Monday. One other subsequent spread also flipped to contango. The rest remain in the opposite bullish structure, known as backwardation, indicating the move could yet be a short-term one. Underlying physical market weakness and short-term factors such as Texas pipeline outage and high freight rates have also led to collapse in time spreads, while WTI futures fell below $80 for the first time since September. Energy stocks are up 70.20% year-to-date but slipped 1.81% this week.

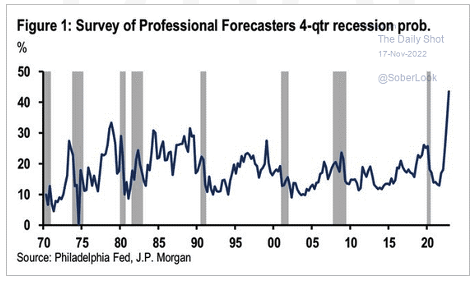

Weaker economic data has pushed the consensus in forecasters. However, note the historical trends relative to crises in the past highlighted in gray. The consensus during these crises was far less and often wrong.

Limited data this week coming out of the US as Thanksgiving is celebrated on Thursday, but we will see manufacturing data (Manufacturing PMI) and mortgage data.

Equities

Equity markets closed up for the day Friday (Dow: +0.59%; S&P +0.48%; NASDAQ: +0.01%) but ended flattish for the week (Dow: +0.11%; S&P -0.61%; NASDAQ: -1.13%). The S&P Utilities was the best performing sector for the day (+2.00%) / week (+0.84%) while the S&P Energy sector was the worst performing for the day (-0.88%) /week (-2.34%). Energy fell on concerns about weakening demand in China and further increases to US interest rates.

Live Nation Entertainment shares were down around 6% on Friday after the NYTimes reported that the Justice Department is investigating whether Live Nation had abused its power within the industry. Meanwhile, turmoil at Twitter continues as engineers exit on Musk’s demands pledge to “extremely hardcore” work or resign with severance pay.

Optimism that the Fed will not be as aggressive at the next meeting have diminished on strong retail sales as Boston Fed President Susan Collins told CNBC policymakers may need to deliver another 75 bps rate hike is needed to get inflation under control.

Inflows into equity funds hit their highest level in 35 weeks, according to BofA / EPFR data, with $22.9 billion (net) into equities fund. US equity funds saw inflows of ~$24 billion in the week to Wednesday, outflows from European equities continue for the 40th week in a row, while emerging market had inflows of $1.9 billion for the fourth week. European indices closed higher (FTSE 100: +0.53%; DAX: +1.16%; European STOXX 600: +1.16%) on Friday in a rally led by retailers and automakers. The European STOXX 600 has gained +9.35% month to date driven primarily by better than expected earnings. Asian indices were mixed as concerns that the surge in COVID 19 cases in China would challenge the recent moderation of China’s Zero COVID policy which buoyed sentiment just last week as well as indications that the Fed will raise interest rates at 75 bps at the next Fed meeting.

Fixed Income

The 2-year Treasury Yield climbed throughout the week to 4.51%, up 11 bps from Monday. The 10 and 30-year Treasury Yields fell, finishing the week at 3.82% and 3.92%. Although recent data has suggested that inflation is beginning to cool, the Fed has maintained a hard line on inflation stating that they will continue hiking rates until they are sure that inflation has peaked. Consensus believes there will be a 50-bps hike during the December 14th meeting which comes one day after the publishing of Novembers CPI data.

Hedge Funds

Net flows were generally muted, but hedge funds did take down gross exposure. Equity long/short funds led the long selling whereas short covering was led by multi-strat/macro and quant/stat arb funds. By region, hedge funds were net sellers of North America, buyers of AxJ and Europe and Japan were more muted. In NA, the selling was split between long selling and short additions with tech and consumer discretionary the most net sold by a wide margin. In addition to those two sectors, hedge funds were also sellers of energy and ETFs. On the other hand, they were buyers of materials, industrials and utilities. As mentioned above, hedge funds were large net buyers of Asia ex-Japan, mostly in China were funds covered shorts and purchased longs in almost an equal amount. Regarding performance, the average global fund was down 20 bps (compared to -90 bps for the MSCI World) and North American funds were down in line with the S&P. EU-based funds were +20 bps and Asia-based +50 bps. Crowded shorts worked well in North America and Europe with the top 50 in each region ending the week more than 2% lower than their respective indices. Crowded longs were mixed across regions. In NA, longs were down 1% more than the S&P, in Europe in line with the Euro STOXX 600 and in Asia ex-Japan, there was significant outperformance as the top 50 longs were up 3.5%+ more than the MSCI Asia Pacific.

Private Equity

As public market multiples have compressed, both median and average late-stage venture capital valuations have taken a significant fall in 2022, after the rapid rise seen in 2021. Additionally, as crossover investors and large nontraditional investors that previously flooded the venture capital market in recent years retreat, the shortage of capital is being exacerbated. Given that the largest deals in the VC market have been heavily dependent on this capital, the backup at the later stage venture market is being further impacted by the inability of companies to exit.

For those companies that do manage an exit, exit valuation step-ups have remained relatively strong, however there has been a severe lack of exit value generated. According to Pitchbook, the average public listing valuation has remained above $1billion, but the median valuations has declined to just $317.2 million which is the lowest figure in three years.

Despite market turmoil at the later venture stages, seed and early-stage valuations have remained at the elevated levels achieved in 2021. In Q3, the median pre-money valuation for seed round deals reached $10 million, while the median early-stage valuation reached $45 million. Although there has been a slowdown in deal count at these stages, a record amount of closed funds that are currently in their investment period are likely to help seed and gain early-stage venture momentum.

Data Source: Bloomberg, BBC, Charles Schwab, CNBC, the Daily Shot HFR (returns have a two-day lag), Jim Bianco Research, Market Watch, Morningstar, Pitchbook, Standard & Poor’s, Morgan Stanley, Goldman Sachs and the Wall Street Journal.

Barring any significant economic event, the Clearbrook team will be celebrating the Thanksgiving holiday with family and releasing a limited write-up next week.