Economic Data Watch and Market Outlook

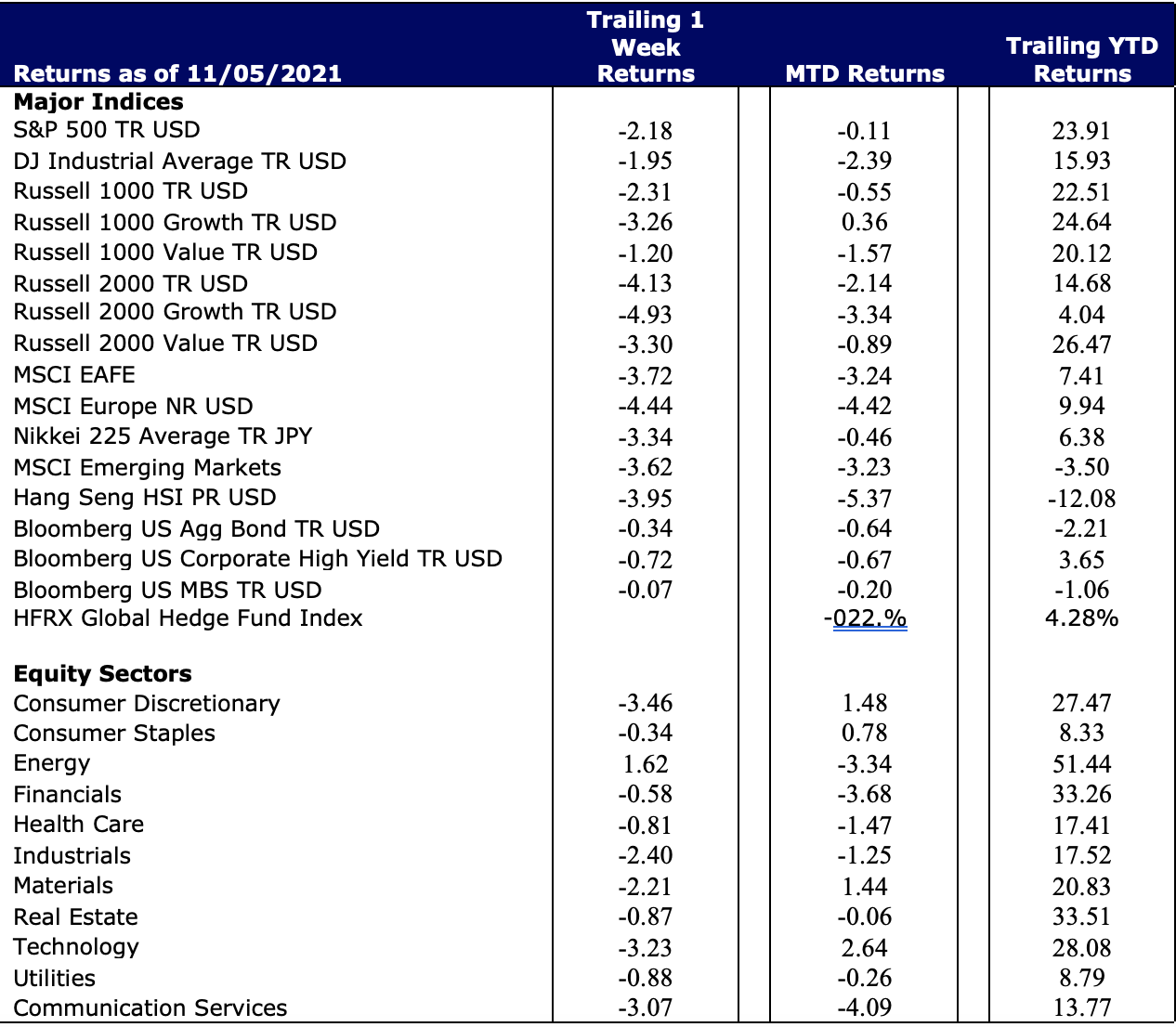

Coming into the week, most expected the week to be a quiet one. Jerome Powell was nominated for a second term on Monday. There was much speculation leading up to the choice surrounded his nomination or Lael Brainard. The Biden Administration announced on Friday that Brainard was nominated to Vice Chairwoman. Most data was released on Wednesday with GDP mostly in line with estimates. Black Friday was the largest drop on record as the Dow fell 2.53%. The S&P fell 2.27% and small caps fell even further (Russell 2000, -3.66%). Investors did digest a much lower than expected Weekly Jobless Claims result, the first time since 1969 that it’s been under 200,000 claims. Fear crept into the market after the Thanksgiving holiday as news of a new variant of COVID 19, the Omicron variant, dominated global markets. Friday’s drop drove the weekly return into negative territory and erased most equity index gains on a month-to-date basis.

The World Health Organization noted that this variant seems to be more transmissible than the Delta Variant which spread fear among traders that we may see a rise in cases and potentially future lockdowns. The US, among other countries, announced Friday that it was restricting travel to South Africa, which seems to be the source, and seven other neighboring countries on the African continent. Cases are already popping up, with Australia, Belgium, Britain, Israel, Italy, and the Netherlands reporting cases in recent days.

For the last several weeks, there has been discussion of a release of the US’s Strategic Petroleum Reserve. Often, we hear threats by an administration to do this but typically it tends to be the proverbial ‘boy who cried wolf‘ scenario. On Tuesday, the Biden Administration released 50 million barrels of the roughly 650 million barrels held. The move was done in coordination with reserves of nations including China, India, Japan, Korea, and the United Kingdom and is an attempt to lower gas prices.

U.S. Equities

Global stocks fell over 2.5% during the week with most of the drop occurring on Friday. As noted in last week’s write-up, US markets tend to have less trading volume as most traders and investors are spending time out of the office. News tends to amplify price swings when trading volume is lower because there are fewer buyers and sellers. However, Black Friday’s volume was not a result of lower trading activity. Several of the ETF’s that track the S&P 500 had volume significantly higher than their 30-day averages. The VIX, a measure of the volatility of the S&P 500, surged 58% during the week, with most of the surge occurring Friday. An article in the Wall Street Journal on November 27th suggested that margin may have contributed to the volatility on Friday, noting that margin borrowing jumped 42% in October. Noting that in percentage terms, it accounts for just 2.4% of the S&P’s market cap. As noted in past discussions, individuals trading options has increase significantly during the pandemic and has also added leverage to markets. However, most of the option volume with retail investors seems to be in single stock securities, unlike most institutional investors that use index options.

Energy was the only sector to finish positively at the end of the week up 1.62% despite falling 4.06% on Friday. Consumer Discretionary and Technology fell 3.46% and 3.07% respectively.

Fixed Income

The Bloomberg US Aggregate Bond index rose 22 bps on Friday to end the week down 34 basis points. Fixed income markets were closed in the US on Thursday and, like equity markets, closed at 1pm on Friday. Bonds were considered a safe asset as equity markets fell on Friday. The yield on the 10-year fell 15 bps to 1.485%. Yields on the 30-year fell 14 bps to 1.826%.

Hedge Funds and Private Equity

Publicly traded private equity and asset management firms have seen a substantial increase in performance over the last few quarters, beating the S&P 500’s performance over a 12-month period. In fact, the five largest public firms (Blackstone, KKR, The Carlye Group, Apollo Global Management, Ares Management) all outperformed the market index between September 2020 and September 2021. Additionally, four out of the five firms posted total returns of approximately 80% or more over the past year, more than double the S&P’s return.

Large public PE firms continue to see strong performance as these companies have continued to grow assets under management as well as lengthen the duration of capital– driving up revenue and increasing the quality of earnings.

The gap in performance between public firms and the market index has become increasingly apparent over the last five years. Over this timeframe, the S&P 500 grew about 115% compared to the lowest publicly traded private equity firm Apollo Global Management at 290% growth and the highest – Blackstone whose growth hit 445%.

Data Source: Bloomberg, Bureau of Labor Statistics, CDC, CNBC, The Daily Shot, Deutsche Bank, Haver Economics, HFR (returns have a two-day lag), Morningstar, Pension and Investments, Pitchbook, Redfin, Standard & Poor’s, US Census Bureau, and the Wall Street Journal

This report discusses general market activity, industry, or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice. It is for informational purposes only and does not constitute, and is not to be construed as, an offer or solicitation to buy or sell any securities or related financial instruments. Opinions expressed in this report reflect current opinions of Clearbrook as of the date appearing in this material only. This report is based on information obtained from sources believed to be reliable, but no independent verification has been made and Clearbrook does not guarantee its accuracy or completeness. Clearbrook does not make any representations in this material regarding the suitability of any security for a particular investor or the tax-exempt nature or taxability of payments made in respect to any security. Investors are urged to consult with their financial advisors before buying or selling any securities. The information in this report may not be current and Clearbrook has no obligation to provide any updates or changes.