Economic Data Watch and Market Outlook

Earnings season usually brings out “strategy completion” trading as strategies either worked or failed. In addition, the guidance given provides the initial read on how sentiment will be perceived with investors’ outlook. Positions such as DISH Networks and Peloton highlighted how Covid spending is slowing as people start to return to work. Want a bike – try eBay or Craig’s list. By the way, did you know Peloton is a “media company?” Active security selection seems at the cusp of regaining significance as third quarter GDP was slower than estimated which has tempered enthusiasm. Countering the weak performance stated above, Qualcomm and Samsung surprised on the upside. The focus of investors will now shift to consumer spending as we watch for indications into the holiday season. At this point in time, there appears to be a great deal of cash to buy, asset appreciation to provide confidence and pent up demand to have more gatherings than last year. Since the mutated strains of Covid still exist with expanding infection in China there is ample data to be cautious into 2022 but the holidays always seem to override fear. Given Friday’s stronger than expected employment report, more economic sensitive stocks may have seen their individual corrections and renewed interest may develop if the economy does improve as witnessed by the bounce in Visa – strong employment, strong spending. Too bad you cannot short physical US currency.

One of the topics in the forefront of the media is the supply chain issues. Problems always seem to get the greatest media attention. A recent article by Time Magazine surmised that the real issue to the port troubles are the container chassis – the part that carries the containers. There have been various stories about lack of drivers, but in the end, there are various aspects in the delivery system which all have friction points to slow the process.

Another interesting theorem that will be hotly debated for the balance of the year is the change of the FOMC easing strategy as a global fiscal initiative. In addition to local challenges of Covid, emerging markets are dealing with fiscal blows in China, a strong USD, rising energy prices and slowing global consumption. We point this out as pundits frequently preach a rotation strategy which is simply a shrouded statement to buy what is lagging and sell what is working. The only problem with this strategy is it requires balancing the age-old theorem of whether you are too early or just wrong.

U.S. Equities

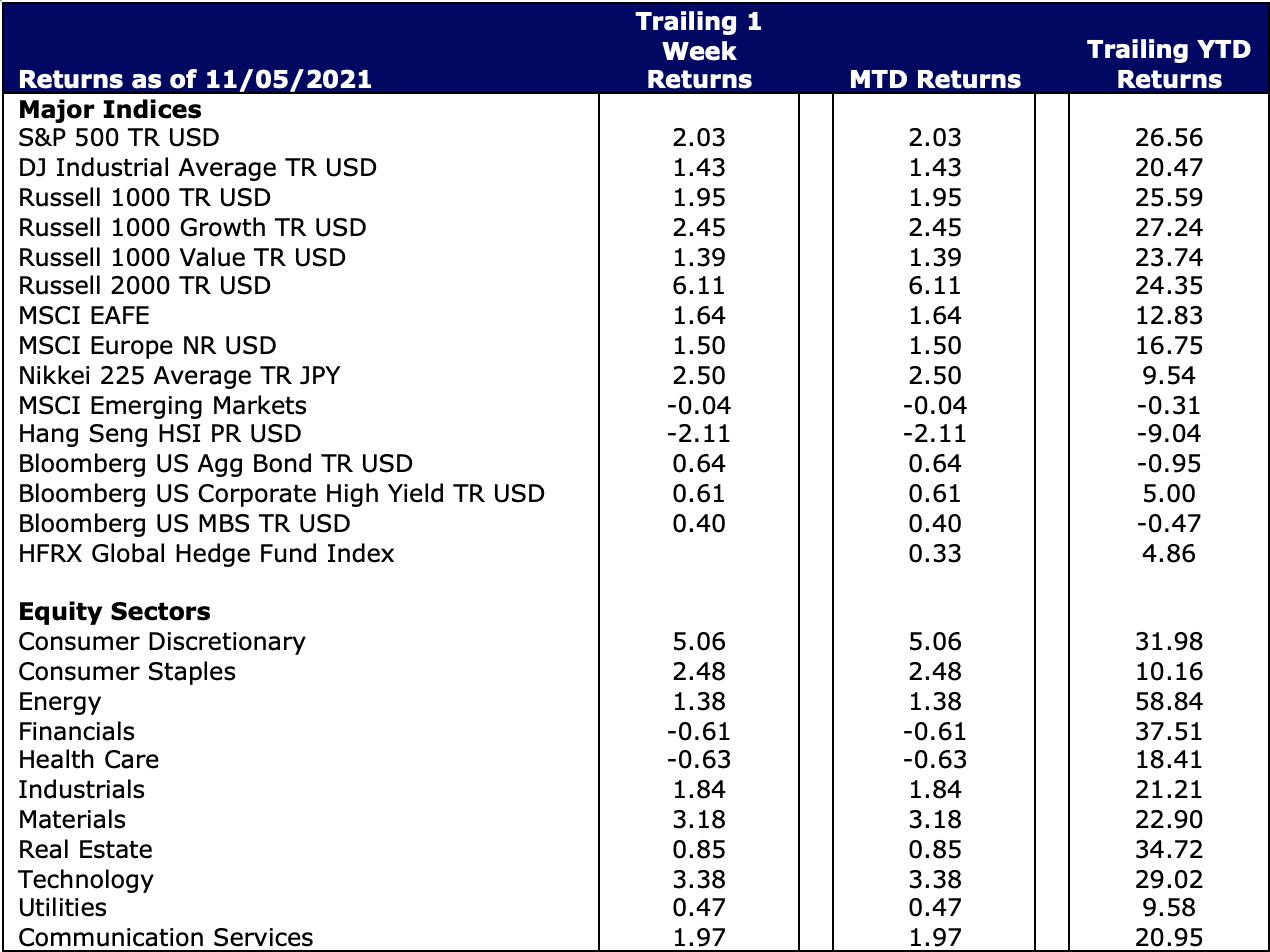

Often we use terms like surged and jumped to indicate modest rises in investment movements but this past week’s equity performance truly fits the bill. Equites continued their upward movement into November with the S&P 500 rising 2.03% with Growth Stocks leading the charge upward. The Russell 1000 Growth Index rose 2.45% for the week while the Russell 1000 Value Index rose 1.39%. Consumer Discretionary stocks surged 5.06% for the week. Technology stocks were also a key driver rising 3.38% for the week. As noted, earlier, Pelton being considered a media company, there are often blurred lines in how stocks are classified. Many of the FAAMG stocks are either Consumer Discretionary or Communication Services.

US Small Caps as indicated by the Russell 2000 had a truly impressive advance jumping 6.11%. Again, Growth stocks played a key role.

International Equities

Developed Market equities rose a modest 1.64 in US Dollar terms with stocks in Europe rising 1.50% for the week. Emerging Market Equities were essentially flat losing 0.04%.

Clearbrook continues its bias toward US equities and the theme has played out. Relative performance visible in the figure below shows the gap. We expect this theme to continue to play out as more people continue to return to work. While we don’t see supply chain issues settling down for some time, we believe the US is better equipped to handle such issues.

Fixed Income

It is hard to imagine a stronger economic recovery than what we have witnessed during the last several months. The much-anticipated unemployment report showed non-farm payrolls increasing by well over 500,000, exceeding estimates. The unemployment rate at 4.6% was the lowest recorded since the onset of the pandemic in early 2020. There were also positive revisions to past employment statistics adding to the strong demand for labor across the board. Of course, all of this has produced some stubborn inflation, particularly in hard goods from energy to autos.

Meanwhile, back at the Fed, recent comments by Central Bank officials including Chairman Powell, suggested there was no rush to tighten credit. However, the well-advertised “tapering” of bond purchases is set to begin this month removing some of the excess liquidity which served to stabilize the bond markets during the height of the pandemic. One might think that all of this would put upward pressure on bond yields across the yield curve – and yet, the opposite appears to be the case. As of this writing, the benchmark 10-year Treasury yield had FALLEN to below 1.5% and even short-term rates, as measured by the 2-year Treasury benchmark yield, fell below its recent highs to a current rate of .41% down about 10 basis points over the last several weeks. All of this would seem to suggest we are indeed operating in a new world where interest rates remain historically low leaving investors little choice but to own risk assets.

Hedge Funds

As November has seen a big start for equity indices, de-grossing continued for a 3rd straight week spread across single-name equities and index level products. Much of the de-grossing came from both longs and shorts rising therefore managers wanted to keep leverage intact. Once again, the spread between crowded names was negative in North America and this week included Europe. Asia saw a slight positive spread. The only two sectors that had gross added was financials (long buying) and energy (short selling). Asia (both AxJ and Japan) was the only region that saw a small amount of net buying. In AxJ it was driven by China (both A shares and ADRs).

Private Equity

On the venture capital front, demand for low-cost, convenient and environmentally oriented tech solutions has continued to drive robust investment into the mobility industry. In the first three quarters of 2021, venture investors have poured a staggering $74.5 billion into global mobility tech startups—more than the total amount raised in any prior year.

As COVID-19 continues to force the rapid acceleration and adoption of new technologies and ultimately the transformation of many industries worldwide it has paved the way for companies that are innovating and scaling at an unprecedented pace. This surge of technology adoption coupled with the fact that companies are staying private longer has also paved the way for another sensation: venture growth equity.

Traditionally, venture growth equity has been perceived to sit at the corner of venture capital and private equity. However, in today’s evolving market an increased number of late-stage capital rounds are giving investors access to high potential companies that are achieving growth rates in excess of 70%, have high margins and hold an attractive risk-return profile.

Given investor’s eagerness to deploy capital to these high growth, high margin companies the venture growth equity space is facing intense competition amongst investors and placing a heavy upward pressure on valuations. With 75% of all investment dollars allocated to growth equity stage deals in 2021, the attention on these investments will certainly continue as the private markets capitalize on the upside returns.

Data Source: Bloomberg, CNBC, The Daily Shot, HFR (returns have a two-day lag), Morningstar, Pension and Investments, Standard & Poor’s, Trading Economics, US Census Bureau, and the Wall Street Journal