Economic Data Watch and Market Outlook

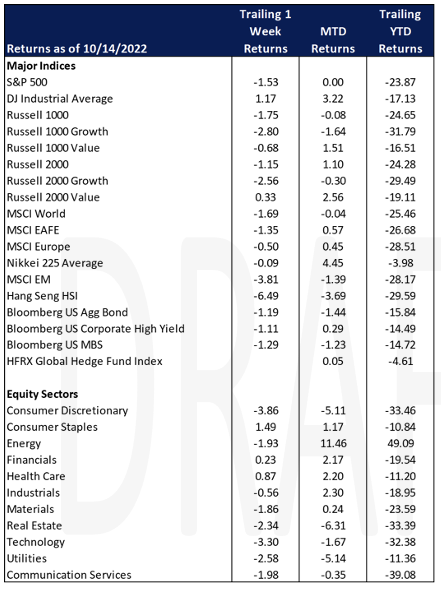

Global asset prices were down for the week as the MSCI World Index fell 1.69%. The US Aggregate bond index fell another 119 basis points. CPI data was released on Wednesday rising 8.2%, higher than expected with core rising 6.6%, the highest in 40 years. After the release, equity markets sank, falling 2.39% at their low but reversed during the day to close up 2.60%. It represented the fifth largest reversal in the S&P 500’s history. The NASDAQ sank 3.13% then finished the day up 2.23%

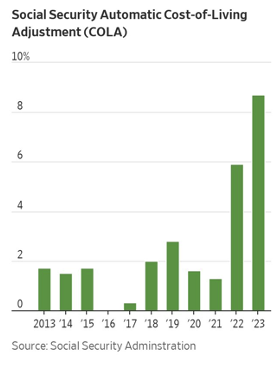

As rates increase so does the interest cost to service the US debt. Additionally, this week the US Social Security Administration announced a remarkable 8.7% Cost of Living Adjustment increase for senior citizens starting in 2023.

China’s 20th National Congress meeting began on October 16th. A large rate of turnover in positions is expected and many vital roles are up for election. Traders will be focused on who president XI surrounds himself with going forward as China hopes to contend with challenges created by it’s zero tolerance Covid policy, Taiwan, and the current dispute with the US regarding semiconductors.

This week we’ll learn about the US Housing market on Wednesday and later in the week about retail sales.

Equities

Equity prices remain volatile this week with a 1,400-point swing for the Dow on Thursday, then finished the week with a 1.17% gain. The S&P and Nasdaq both declined on the week 1.53% and 3.11%, respectively as equities continue to be hit with concerns over a recession due to inflation and rise of interest rates. Value stocks continues to fare better than growth stocks as Russell 1000 Value -0.68% vs Growth -2.80% and Russell 2000 Value +0.33% vs Growth -2.56%.

On Friday Kroger announced the merger with Albertsons in an all-cash agreement for $24.6B, subject to regulatory clearance. The combined company will employ more than 700,000 people across 5,000 stores.

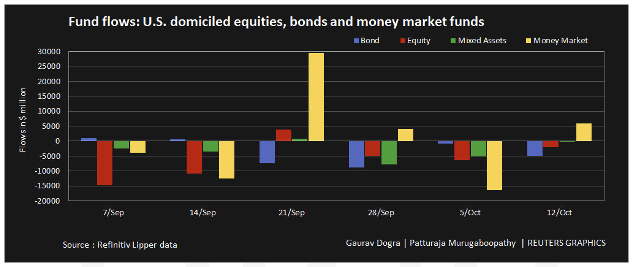

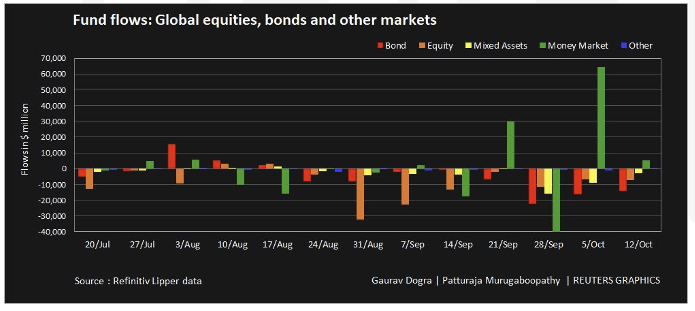

As of Wednesday, 10/12, US equity funds had continued outflows for the third consecutive week. The outflows were worth $2.1 billion in the week, after a combined $11.1 billion in the previous two weeks, according to Refinitiv Lipper data. The outflows come after continued rising inflation and a surprise rise in September US producer prices as well as caution ahead of the Fed’s minutes release. Global equity funds showed outflows for the eighth time in a row in the week as investors sold $7.3 billion of global equity funds and $14.27 billion of bond funds. On the other hand, lower risk US money market funds attracted an inflow of $5.8 billion, while US government bonds pulled in $3.7 billion.

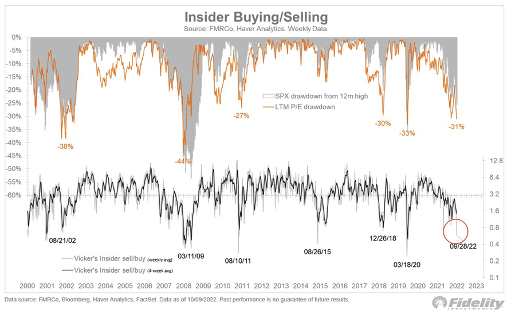

Outflows may be a result of retail investors capturing losses for tax purposes but that is likely muted given the larger market concerns. A chart recently published by Fidelity and Haver Economic seems to indicate an early trend of insider buying. We believe it is too early to consider this a trend but it’s worth watching.

The China securities regulator announced Friday plans to make it easier for listed stocks to buy back shares in a bid to bolster corporate value and protect investor interest. A proposed plan would allow buybacks when a company’s shares fall 25% within 20 consecutive trading days rather than the current 30% decline and a company can begin buybacks six months after listing instead of the 12 months in place now.

Major European and Asian indices closed down for the week, except the Shanghai Composite +1.57%.

Fixed Income

Yields traded sideways throughout the week in anticipation of the September CPI report on Thursday morning. The CPI came in at 8.2% YoY and showed a 0.4% increase for the month of September. Treasury yields reacted strongly to the report, with the 2-year Treasury yield rising 16 bps and the 10-year Treasury yield rising 12 bps. The 10-year yield came close to closing over 4% for the first time since 2008, eventually settling at 3.97% on Thursday. Friday brought more volatility. We saw another large jump at market open and yields ran back towards their Thursday highs. The CPI report solidified investors’ expectations for a 75 bps hike in November and added to the potential of another 75 bps increase in December. Interest rate derivatives showed that the chances of a 75 bps hike in December rose from 35% on Wednesday to 60% to 70% after Thursday’s report, according to the Wall Street Journal. Minutes for the Fed’s September meeting were released Tuesday. Officials showed concern that inflation was persistent and maintained the idea that hawkish policies were the best course of action. After years of historically low borrowing costs, the Fed expects the reversal to have a dramatic effect on spending, hiring, and investment.

Mortgage rates continued to trend higher, with the 30-year fixed rate mortgage hitting 6.92% on Thursday, the highest point since April 2002. 30-year fixed rate mortgages have risen 115% since the start of 2022 and are up 39% since the beginning of August. Overseas, the UK is set to endure a massive shock to their housing market. Unlike the US, fixed rate mortgages typically reset every 2 to 5 years. 2.4 million mortgages are set to expire in the coming months with average rates for new mortgages above 6% for the first time since the 2008 financial crisis. The increased volatility has caused lenders to reassess whether some of their products are worth the risk. On Friday, Liz Truss, the new UK prime minister, reversed course on the tax cuts that have been making waves in the UK markets, and fired her Treasury chief in an attempt to bolster credibility after an underwhelming start to her new position. The market’s reaction was minimal, and many saw her action as a panicked move that has only hurt her credibility.

Hedge Funds (as of Thursday October 13th)

This week was challenging for hedge funds as they captured a large portion of the earlier part of the week’s losses then did not capture the latter part of the weeks’ gains. One of the main drivers for the challenges were crowded longs, particularly in the US, as it was the 4th worst spread week YTD between longs and the S&P. Even worse was the spread between longs and shorts (worst since January 2021) as crowded shorts were actually up more the than the index. Negative spreads tend to occur in de-grossing periods, but that was not the case this past week as Thursday was the only day hedge funds did any significant lowering of their gross exposures and most was at the index level, not single-name. From a strategy level, long/short equity funds were net sellers while macro, multi-strategy and quantitative funds were net buyers. Looking at single-name flows in NA, hedge funds were buyers of financials and healthcare and large net sellers of traditionally cyclical sectors such as energy, industrials and consumer discretionary and also real estate. In other regions, hedge funds were net buyers of Europe and net sellers of Asia ex-Japan (mostly China) and Japan. In Europe, unlike the NA, funds were net buyers of cyclical sectors, driven mostly by industrials.

Private Equity

Amid complicated macroeconomic trends, rising interest rates, and fewer public listings 2022 Q3, venture capital activity fell well below the historic highs of 2021 and early 2022. However, four sectors within the venture market continue to reach historic 2020 levels. Healthcare, clean tech, energy and transportation sectors all managed to be on pace in terms of deal count with historic 2020 highs this year.

Analysts credit the durability of these four sectors in part to the passing of the Inflation Reduction Act and the CHIPS and Science Act. Passed by Congress, these acts create substantial investments in technology and infrastructure development making hundreds of billions of dollars of public money available for investment in the coming years. Additionally, the State Small Business Credit Initiative creates the ability for private fund managers to partner with public sector and academia to develop robust entrepreneurial ecosystems outside of traditional hot spots such as San Francisco or New York City.

Q3 has also highlighted points of stress in the venture market. This year, exits are down almost 50% as compared to historical norms with public listings hitting record lows. In 2022, there have been only 59 public listings in total as compared to 303 in 2021. Fundraising also seems to be a point of stress with the total capital raised at the end of Q3 totaling $150.9 billion with 62% of that going to just 6% of funds.

Data Source: Bloomberg, BBC, Charles Schwab, CNBC, the Daily Shot HFR (returns have a two-day lag), Jim Bianco Research, Market Watch, Morningstar, Pitchbook, Standard & Poor’s, Morgan Stanley, Goldman Sachs and the Wall Street Journal.