Economic Data Watch and Market Outlook

A shortened trading week for bonds this past week as markets took a breather on Monday for Columbus Day (or Thanksgiving if you’re in Canada). The S&P 500 advanced 1.84%. One of the best indicators a solid market has no name but is measured by how stocks perform at earnings releases. This past week we saw a number of very positive longer-term indicators. Wednesday’s earnings from JPM were very positive but were based on lower costs, especially loan loss reserves. BlackRock posted strong earnings based on an increase of actively managed equity accounts. On Wednesday, JPM was down about 3% and BlackRock was up 4%. But on Thursday, JPM was up 1.53% and BlackRock was up 2.85%. This shows the divergent of short-term strategies but a longer-term positive bias. We think this has high odds of continuing from now to year end.

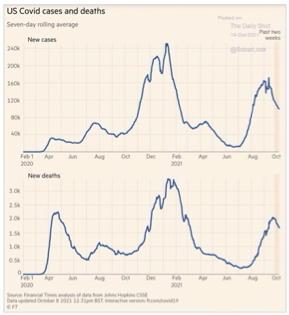

The offset is the question of stagflation with the concerns of divergent employment trends. Covid prevention and treatment data continues to work through various stages of approval but as Figure One below shows rolling averages of cases and deaths continue to trend downward.

Figure One:

As data improves around efficacy and more companies start to mandate vaccinations to return to work, we are monitoring how they return, noting some signs of pushback with work from home being a method of choice at least partially for those that can. Further wage pressure is also an important focus as labor strikes are also starting to occur. Kellogg currently has 1400 on strike and 90% of 10,100 United Auto Workers at John Deere rejected the 5%-6% wage increase threatening to strike on Wednesday. Additionally, 24,000 nurses have threatened to strike in California and Oregon.

As Wednesday’s Consumer Price Index release showed an increase of 0.4% in September which equates to a 5.4% rate year over year with core prices (ex-food and energy) rising 4%. According to AAA, the gas prices climbed to an average of $3.31 per gallon at the time of this writing.

We continue to believe that these pressures will be relieved over time but not in the short term and while prices can decline or more likely level off, wage growth typically does not change as rapidly.

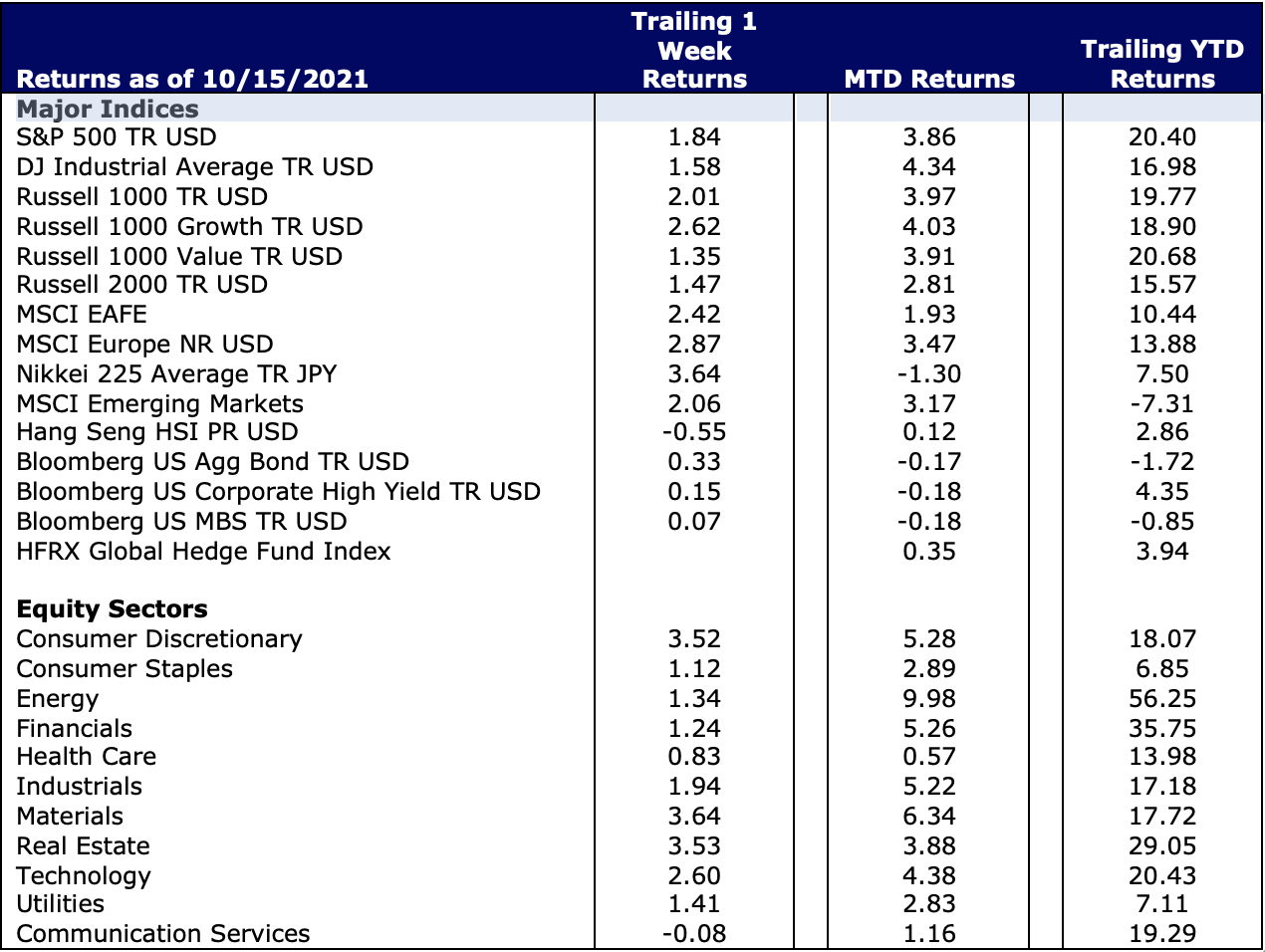

U.S. Equities

Larger cap US equities rose for the week with the Russell 1000 up 2.01%. Small caps rebounded from their decline last week as the Russell 2000 rose 1.47%. The Materials, Real Estate, and Technology sectors were the key drivers of positive performance, rising 3.64%, 3.53%, and 2.60% respectively.

Going into the last quarter of ‘21, supply shortages and bottlenecks are making a case for earlier holiday shopping. This shift in focus is another optimistic positive for investors as they approach November and December given that there will be little incentive to companies to adjust prices downward. We are mindful while this may create a short-term windfall, it may frontload demand and exacerbate short-term supply chain issues. Excluding toy sales, shoppers may resort to increase use of gift cards as a means to avoid a lack of available goods.

International Equities

Holidays are more impactful in Europe which is also something to now incorporate into consumer spending and travel. We expect similar trends to occur in Europe as noted above.

Developed Market equities rose 2.42% in US Dollar terms for the week as did Emerging Market Equities up 2.06% USD terms.

From a global perspective, the growing questions about the stability of the Chinese market raises questions for the short term. China released its GDP numbers late Sunday. Expectations were for a 5.2% year over year growth rate, but the result fell short at 4.9%. Economists have revised the number down after a 7.9% print for the second quarter over the summer. The Evergrande situation continues to play out as the entity is working on a restructuring plan that includes selling off assets such as its Swedish electric car unit. As China’s economic growth continues to moderate, it is considering the implementation of a property tax system on residential properties. China is one of the few countries that does not have a property tax system.

Fixed Income

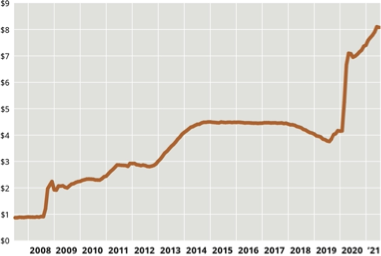

Interest rates as measured by the benchmark US Treasury yield curve flattened during the past week with the two-year Treasury note yielding .395% and the ten-year bond at 1.574% as September’s Producer Price Index came in slightly softer than expected rising 0.5% versus 0.6%. The softer numbers allow the Fed to continue on a path to tapering which was widely implemented during more dire financial times. Figure Two shows the significance of the US Fed’s balance sheet expansion. It should be noted that tapering does not mean a stoppage of Fed purchase, it means a slowing of purchases and it should be expected that the Fed’s balance sheet should reach $9 trillion before the process is completely halted assuming that there is no other need to reinstate the process.

Figure Two:

Source: Pensions & Investments

Hedge Funds

Hedge funds were net buyers of global equities this past week although at the lightest volumes seen since January 2020. This included both long buying and short covering. Crowded longs did a reversal with US crowded longs outperforming the S&P while European crowded longs underperformed. Financials were the most sold sector for the week. Despite net buying, TMT mega-caps (FAAMG) long/short ratios are at one-year lows. Macro hedges were also reduced.

Bitcoin (BTC) rose to over $60,000 per coin as ProShares announced it would offer a Bitcoin Futures ETF. The market for a pure Bitcoin ETF has stalled as the Fed continues to delay approving the structure. It was speculated that the new SEC Chairman Gary Gensler had previous experience in blockchain before taking the helm of the regulatory body. However, Gensler has opted to look to focus on the market mechanism and its structure before giving the greenlight to an ETF. We believe that a pure BTC ETF is not likely until late 2022 or early 2023. We continue to explore crypto assets and decentralized finance (DeFi) with more robust notes in the coming weeks. For most of Clearbrook’s clients that operate as an Endowment or Foundation, we believe that accepting crypto assets are a great way to gain access to a new donor base.

Data Source: AAA, Bloomberg, The Daily Shot, Financial Times, US Federal Reserve, HFR (returns have a two-day lag), Morningstar, Pension and Investments, Pitchbook Research, Standard & Poor’s, US Census Bureau, and the Wall Street Journal

This report discusses general market activity, industry, or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice. It is for informational purposes only and does not constitute, and is not to be construed as, an offer or solicitation to buy or sell any securities or related financial instruments. Opinions expressed in this report reflect current opinions of Clearbrook as of the date appearing in this material only. This report is based on information obtained from sources believed to be reliable, but no independent verification has been made and Clearbrook does not guarantee its accuracy or completeness. Clearbrook does not make any representations in this material regarding the suitability of any security for a particular investor or the tax-exempt nature or taxability of payments made in respect to any security. Investors are urged to consult with their financial advisors before buying or selling any securities. The information in this report may not be current and Clearbrook has no obligation to provide any updates or changes.