Economic Data Watch and Market Outlook

In periods of time when markets move virtually in a straight line, the easiest position to take is “we are due for a correction.” It is no different than seeing black come up at the roulette table a number of times uninterrupted. As seasoned high yield gaming analysts used to supplant their income, the trade is after a string of black numbers to start betting red and each time you lose, add more and play it again. The challenge is being correct and properly positioned that the current direction continues. Market pundits frequently use the term tailwind or headwind, circumstances that can change quickly or last for an undetermined period of time. This past week markets continued to break record highs, slowly and consistently. Is the glass half full or half empty? We feel the glass is looking just fine.

Earnings season will reach peak heights in the two coming weeks and so far they have been very healthy. As we stated last week, the best sign of healthy ownership is when a stock reports, trades occur that push the stock price lower, shaking out short term holds or investors who reached their personal trading targets and then long-term investors add on to their positions during weakness and a few days later the price is higher. We saw this transpire with J.P. Morgan and this past week with Netflix. On release of earnings Tuesday night, the stock traded down 2% lower and finished the week up about 5%.

We will shortly be past the majority of earnings and go back to the macro which can be boiled down to three variables: FOMC taper, employment and stagflation (spending power.) From speaking with many unconstrained bond managers, it is clear that they are still managing to a peak in the ten-year bond at 1.75% and are playing the flattening or steepening of the yield curve. We feel equity investors are prepared for what seems to be the inevitable break to slightly higher yields and rates will settle for a period of time still below 2%. As David Tepper stated on CNBC Friday, a ten-year yield of 4% could be a different story. The employment picture continues to slightly confound logic. At some point it seems people will run out of funds and need to go back to work. This is based on the amount of cash in the system versus historical levels and the fact that consumer spending is defying expectations in strength. Lastly, Google searches show a material increase in defining stagflation. People just don’t understand it. It is an easy application to understand the price increases or “supply chain” issues. Does anyone know where all the truck drivers went? Although retail inventories are lower, all accounts are that most items are available for a price and within a decent amount of time. Consumers have grown accustomed to “just in time inventory” and imported deflation so perhaps this is just a brief period of adjustment. Did the housing starts slow due to higher prices for plywood, slowdown in mortgage approval, appraisal issues, seasonality as we approach winter or have the recent trends of employees being asked to return to the office made suburban living less desirable with long commutes without the new dog you love so dearly?

We believe that the possible impediments that are frequently referenced as reasons for a correction can be evaluated as reasons for the elongation of the current positive trends in equities, specifically in the US with its fiscal strength and balanced government. Rising natural gas prices will be a true headwind to Europe and Asia to both consumer spending and potential industrial moderation.

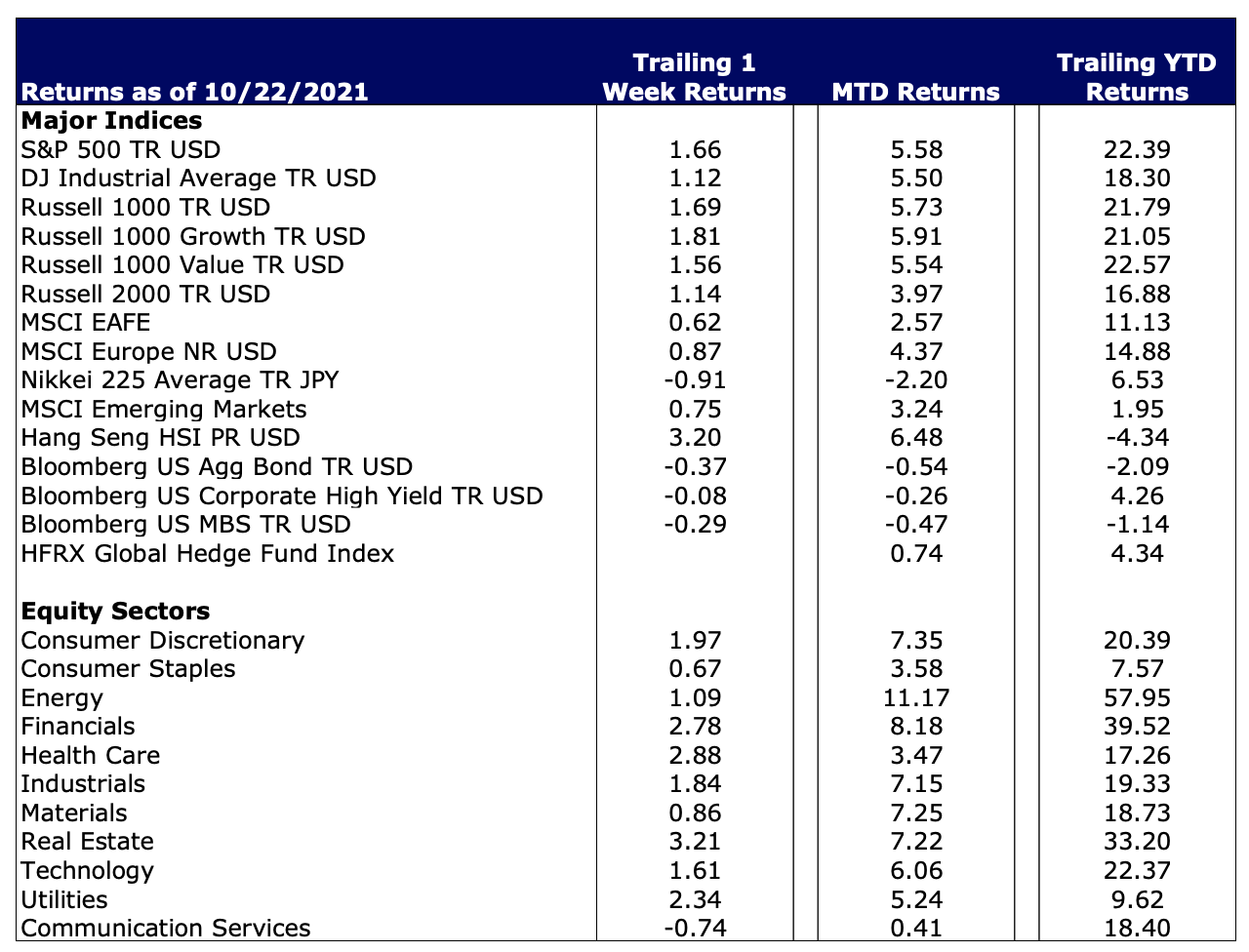

U.S. Equities

Larger cap US equities continued to march higher with the Russell 1000 up 1.81%. Small caps advanced as well (Russell 2000, 1.14%). Healthcare and Financials led the way, rising 2.88%, and 2.60% respectively.

International Equities

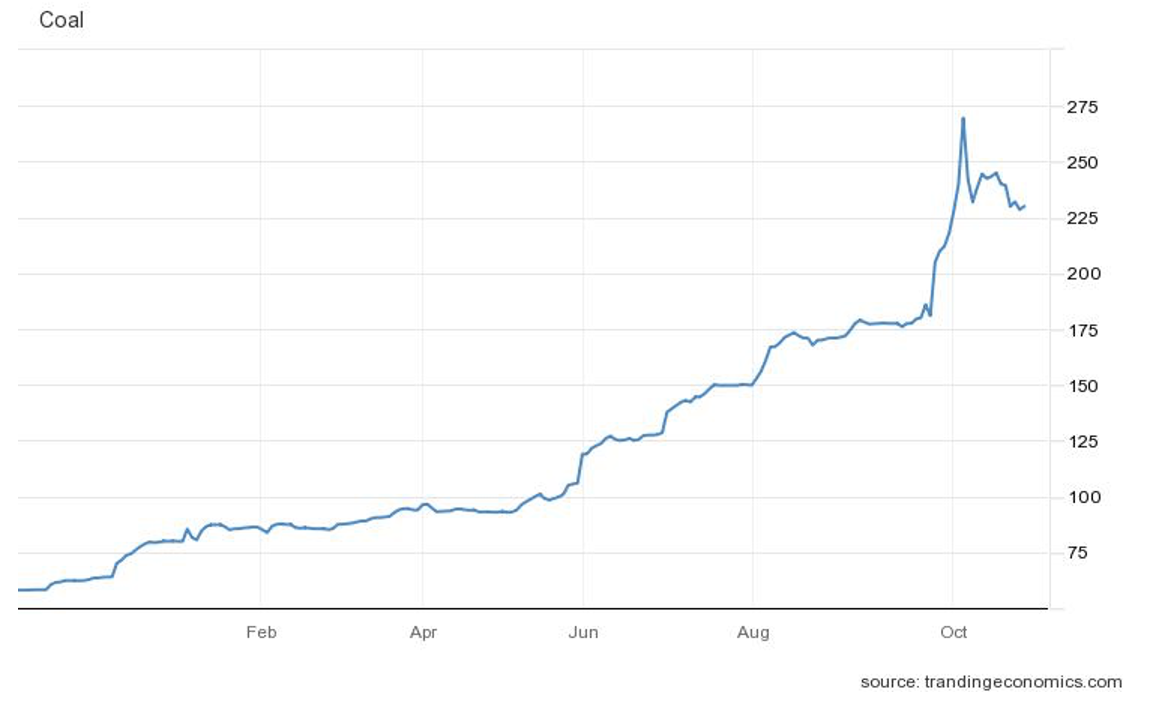

Developed Market equities advanced 0.62% in US Dollar terms with stocks in Europe rising 0.87% for the week. Emerging Market Equities were up 0.75%%. China, Taiwan and India drove performance for the week. Longer term, China continues to struggle to restart its economy as Covid resurges, Evergrande continues to make headlines creating anxiety among investors but other headwinds exist. China remains heavily dependent on coal to power its economy, roughly two-thirds and prices have surged (see Figure One). Regulators have been hesitant to raise prices for residents and businesses. As a result, power producers are operating at limited capacity or have shut down in recent weeks.

Figure One.

Fixed Income

Interest rates as measured by the benchmark US Treasury yield rose during the past week with the two-year Treasury note yielding 0.45% and the ten-year bond at 1.63%. Treasury Secretary Yellen made headlines after an appearance on CNN on Sunday morning stating that we would continue to see rising prices into mid-to-late 2022. She suggested that the rate of increases have slowed but smaller increase would still occur.

We continue to look at options in portfolios to offset current and likely future weakness in fixed income securities. Private credit has continued to perform well. Opportunities in real estate also have potential.

Hedge Funds

As equity indices continue their march higher, hedge funds followed suit, albeit not at the same pace as short positions continue to detract from performance. Both the Goldman Sachs and Morgan Stanley US prime brokerage books saw active de-grossing (a mix of long selling and short covering) but net exposure remained the same. That said, with mark-to-market moves in stocks, overall gross exposure stayed close to the same. Consumer discretionary, the most shorted sector in the Russell 3000, saw net buying from short covering. Crowded names were essentially flat for the week, with both longs and shorts outperforming the S&P. Other regions did not see a similar level of de-grossing as the US. Asia ex-Japan saw net buying in China, both from long purchases and short covering.

Data Source: Bloomberg, CNBC, The Daily Shot, HFR (returns have a two-day lag), Morningstar, Pension and Investments, Standard & Poor’s, Trading Economics, US Census Bureau, and the Wall Street Journal, Morgan Stanley and Goldman Sachs weekly hedge fund updates

This report discusses general market activity, industry, or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice. It is for informational purposes only and does not constitute, and is not to be construed as, an offer or solicitation to buy or sell any securities or related financial instruments. Opinions expressed in this report reflect current opinions of Clearbrook as of the date appearing in this material only. This report is based on information obtained from sources believed to be reliable, but no independent verification has been made and Clearbrook does not guarantee its accuracy or completeness. Clearbrook does not make any representations in this material regarding the suitability of any security for a particular investor or the tax-exempt nature or taxability of payments made in respect to any security. Investors are urged to consult with their financial advisors before buying or selling any securities. The information in this report may not be current and Clearbrook has no obligation to provide any updates or changes.