Economic Data Watch and Market Outlook

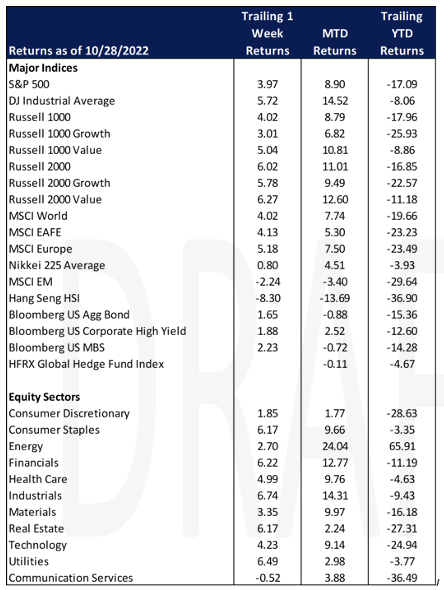

Global equity asset prices were up for the week as the MSCI World Index rose 4.02%. The US Aggregate Bond index also rose, advancing 1.65%.

On Wednesday, November 2nd, we’ll get a flurry of countries reporting on production progress but those data points will likely take a back seat to the US Fed’s rate decision but, more importantly, language from Chairman Powell around future guidance. Much of the advance this past week in the equity markets was due to speculation that the Fed may pause after Wednesday’s increase which is largely expected to be 75 basis points.

Elon Musk closed his deal with Twitter this past Friday and is taking the company private. The deal was closed at $44 billion, with banks providing $13B in financing. Some of that financing is connected to the price of Musk’s Tesla holdings. While this will unlikely cause any major market dislocations should there be a stock price decline in either, it does put added scrutiny on banks such as Morgan Stanley who loaned approximately $13 billion to facilitate the deal.

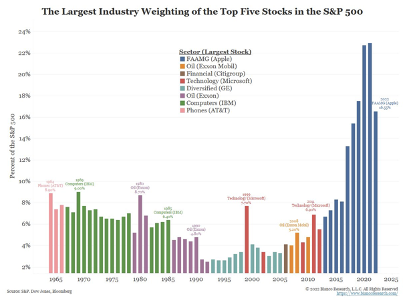

The FAAMG stocks’ hold on major indices continues to decline as rates have increased.

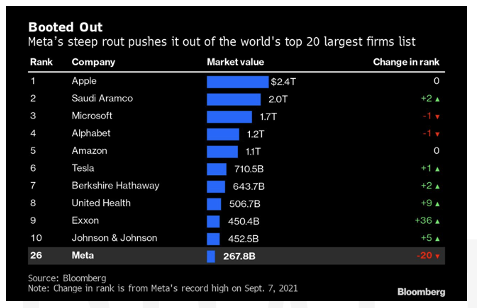

With Meta’s (aka Facebook) recent earnings release and guidance, their equity’s market cap has fallen to 26th on the global list according to Bloomberg.

With Meta’s (aka Facebook) recent earnings release and guidance, their equity’s market cap has fallen to 26th on the global list according to Bloomberg.

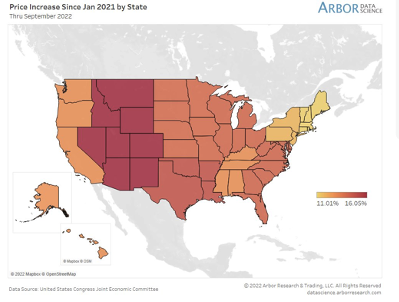

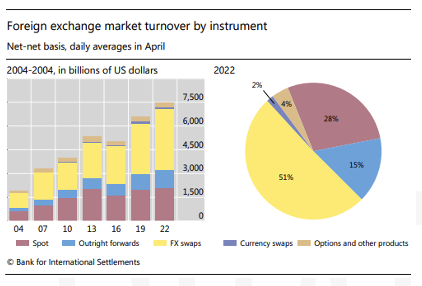

Inflation has not hit everyone equally. Numerous discussions have transpired about the health of the consumer and how it has impacted them at different income levels. Arbor Research pointed out in the chart below how inflation has affected prices on a regional basis. An important consideration as mid-term elections approach and the economy is a key issue.

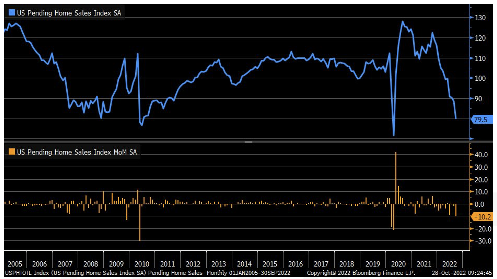

Month-over-month personal income continued to rise coming in at 0.4% vs 0.3% in the prior month and personal spending increased above estimates to 0.6% versus the 0.4% estimate and 0.4% the previous month. Despite that, higher rates are taking a toll on the housing market as new home sales plunged 10.2% versus the estimate of a 4% decline.

Additional data from Redfin alludes to that trend continuing. Granted the consumer at this point is in much better shape than in 2008, as are the banks, but the significant slowdown has ramifications for homebuilders and industries that rely on the consumer to fill a new home with appliances, furniture etc.

Equities

The Dow Jones Industrial Average month-to-date gains ending Friday were +14.52%, putting the cumulative year to date return thus far at -8.06%. If gains hold thru Monday’s close it will be the strongest monthly gain since January 1976 and the largest October gain in its 126-year history.

The NASDAQ and the S&P 500 gained 2.87% and 2.46% on Friday and 2.24% and 3.97% for the week, respectively. The NASDAQ had a very volatile week as the big technology names lost more than $255 billion in market capitalization due to disappointing earnings from Meta Platforms (META: – 23.72% / week), Alphabet (GOOG: -4.87% / week), Amazon (AMZN: -13.17% / week) and Microsoft (MSFT: -2.62% / week).

Stocks that moved the market on Friday included: Amazon (AMZN) which fell 6.80% as the projected sales for the holiday season would be far below expectations as well as weaker than expected results from its AWS cloud unit at 27%. Meanwhile, Apple (AAPL: +7.56%) and Exxon (XOM: +2.93%) both recorded record revenue. Exxon had its most lucrative quarter ever.

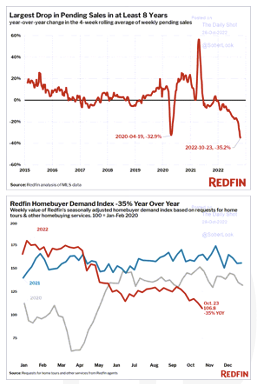

Global equity funds attracted inflows of $7.8 billion for the week ended October 26, after having outflows for the past nine weeks. US Equity funds had inflows of $7.9 billion and Asian equity funds had inflows of $2.1 billion while European equity funds had outflows of $2.3 billion.

EU antitrust regulators renewed interim measures to keep US life sciences companies Illumina (ILMN.O), whose products and services serve customers in the research, clinical and applied markets, and enable the adoption of a variety of genomic solutions, and Grail (GRAL.O), healthcare company focused on early detection of multiple cancers, as separate entities. This followed the European Commission’s decision to block the merger and potentially unwind the takeover as it was completed before the deal was approved.

China’s equity indices had heavy losses (Hang Seng: -8.30% / week and -36.90 / year to date) due to the market wariness of President Xi Jinping tightening his grip on his country by securing his third term as leader. Meanwhile, China’s largest banks (ICBC, Agricultural Bank of China, Bank of Communications Co, Bank of China, and China Construction Bank) seemed to have weathered the property crisis as all posted net profits though showing a shrinking net interest margin, indicating loan demand is weak as the Chinese economy slows. Also, it is noted by Fitch Ratings that big state-owned banks lending to property developers accounts for only 3-7% of their total loans.

European and Asian indices performance was mixed on Friday.

Fixed Income

Treasury yields fell across the board in the last week of October for the first time in over a month. 1 through 30-year yields are all still ranging between 4.0% – 4.60% but the fall back from their highs is meaningful. The 2-year Treasury yield ended the week at 4.41%, down from last Friday by 8 bps. The 10 and 30-year Treasury yields followed suit, coming in at 4.02% and 4.15% respectively to close out the last week of October. Treasury yields are falling with the hope that the Federal Reserve will begin to slow down the speed of interest rate increases. Compounded with the fact that GDP came in positive for the first time in two quarters, yields are reacting as one would expect. The fall in yields is also affecting the dollar, which is still relatively strong but is now 4 points off its September high of 114 according to the US dollar Index.

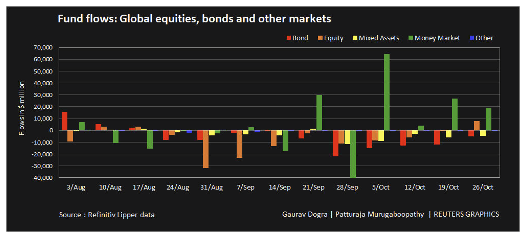

Global institutions have dramatically reduced holdings of yuan denominated bonds by upwards of $90B since February 2022. Total holdings by international investors of Chinese government bonds and other debt fell to $460B in the month of September, the lowest level since December 2020. The US dollar’s recent rally is the main culprit for the significant fall off we have seen, causing investors to pull money from foreign markets and move into US bonds for better returns. These moves have resulted in significant volume in global currency markets. Latest data available from the Bank of International Settlements show almost $7.5 trillion, in USD terms daily, ending April (the latest data available).

Hedge Fund (through Thursday)

With global indices’ strong weekly performance, it is not surprising hedge funds lagged for the week. Prime brokers’ books were net bought even with a decline in global trading activity. Flows were risk on through short covering and to a lesser extent long buying. Net buying was driven my macro products which saw the largest net notional buying in 5 years. This was accomplished via long buying and short covering. On the other hand, single-stocks were net sold for the 4th straight week with long sales outpacing short covering 1.5:1. All regions were net bought except EM Europe with North America and developed Europe leading the way. This was done mainly through short covering. 8 of 11 global sectors were net sold let by consumer staples, industrials and materials with healthcare, energy (short covering) and utilities net bought. Hedge funds covered healthcare shorts across sub-sectors at the fastest pace since December.

Private Equity

Despite the worsening macroeconomic trends spreading throughout Europe, European PE deal making remained resilient in Q3 of 2022. Larger deal sizes continue to show an upward trend with the average deal size through Q3 of €289.1 million versus €215.9 million in 2021. However, through Q3 exit values declined from the elevated figures of 2021. As bear markets have spread throughout Europe, exits have become less attractive to investors and management teams alike due to lower valuations. Exit value via public listings is on pace for its lowest annual total since 2012.

PE fundraising saw a significant slowdown in Q3 as capital becomes more expensive in the current interest rate environment. In step with less than favorable exit conditions, distributions have fallen, and limited partners are adopting a wait-and-see approach before committing new capital. Fundraising figures also indicate that fund sizes could shift as we enter a market down turn. PE growth-expansion funds have remained popular through Q3 as investment horizons linked to high-growth companies could generate heightened returns in the long run.

Analysts suspect the European PE deal making environment to continue to experience pressure throughout Q4 given the declining consumer and business confidence, rising inflation, decline in GDP and wide-spread interest rate hikes.

Data Source: Bloomberg, BBC, Charles Schwab, CNBC, the Daily Shot HFR (returns have a two-day lag), Jim Bianco Research, Market Watch, Morningstar, Pitchbook, Standard & Poor’s, Morgan Stanley, Goldman Sachs and the Wall Street Journal.