Economic Data Watch and Market Outlook

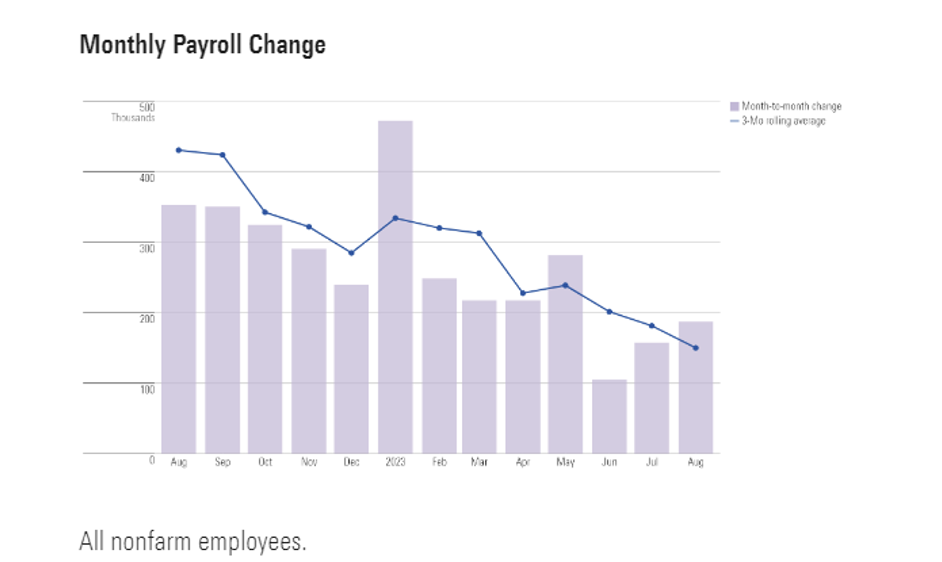

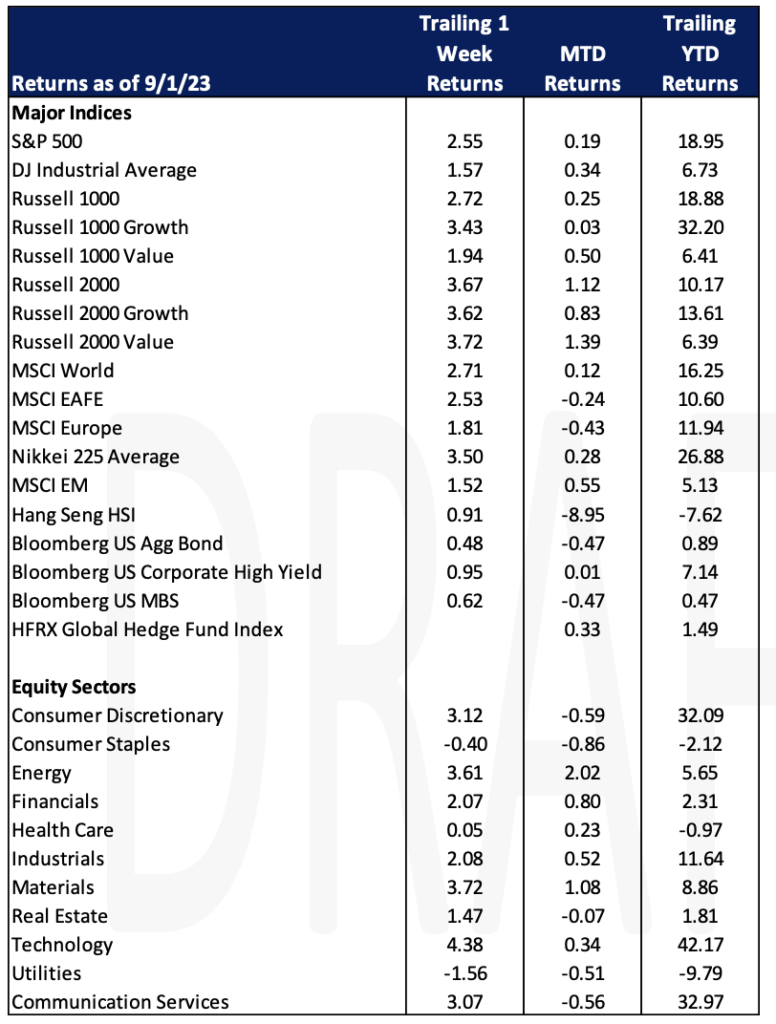

Global equity and bond markets rebounded after the previous week’s weakness (MSCI World +2.71% and the Bloomberg US Aggregate Bond +0.48%) as job growth is continuing to trend downwards. While there was an acceleration in August, the three-month moving average tells a different story. In the past three months job growth was 1.2% annualized, representing a major decrease from a 2.4% annualized level in the beginning of 2023. Data released by the US Department of Labor showed US businesses adding 187,000 jobs in August.

The unemployment rate came in at 3.8% versus a 3.5% estimate. The 0.3% jump equated to 514,000 people losing their jobs during August as reported by the Bureau of Labor Statistics. The striking workers in Hollywood and the bankruptcy of Yellow Trucking contributed to the rise. Old Dominion, Yellow’s largest competitor, offered $1.5 billion for its 169 terminals.

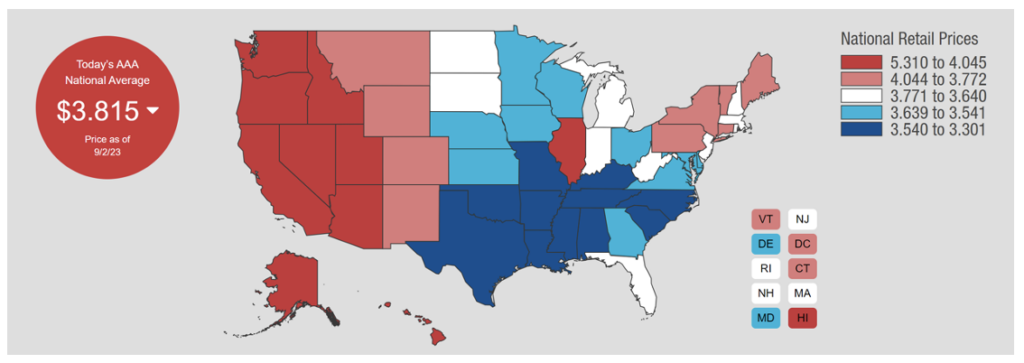

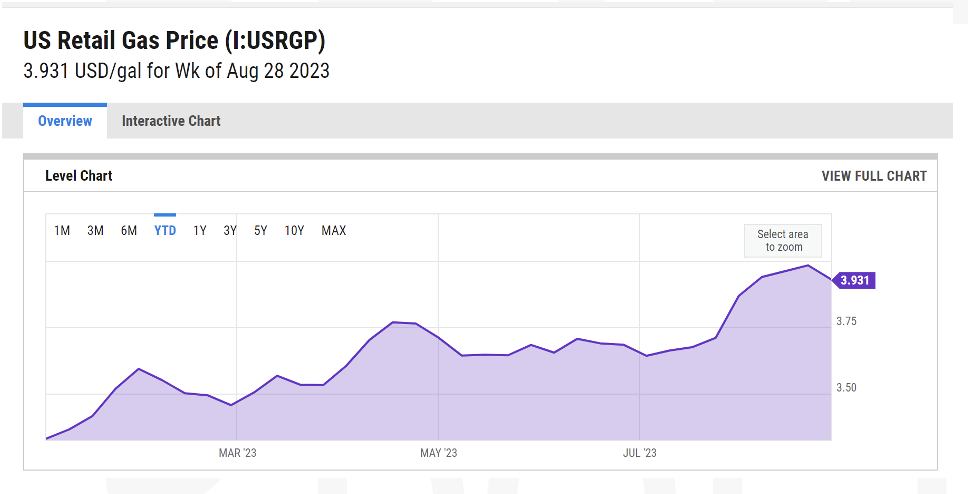

US oil futures breached $85 a barrel this week for the first time since November 2022. Crude oil has climbed throughout the summer driven by OPEC supply cuts as well as production cuts from Saudi Arabia and Russia. West Texas Intermediate climbed over 2% Friday in response to US jobs data indicating that a pause from the Fed can be expected.

Gas prices trended down this week but have been increasing steadily year-to-date.

Private equity funds and hedge funds are suing the US Securities and Exchange commission over new restrictions placed on private markets last month. The National Venture Capital Association, the American Investment Council, and Managed Funds Association are among the groups that believe the SEC went too far in their rollout of new rules which would mandate new forms of disclosures and bar firms from making preferential deals to investors based on size. The new rule affects funds that have over $27 trillion under management.

The upcoming trading week is shortened by the Labor Day holiday but mid-week we will learn about US Trade Data and how the service sector is faring when the Institute of Supply Management (ISM) releases their results. Wednesday is also a big day as we’ll get continued glimpses into the housing market. Later in the week jobless claims and energy data will be released.

Authors:

Jon Chesshire, Managing Director, Head of Research

Sam Morris, Analyst

Data Source: Apollo, Barron’s, Bloomberg, BBC, Charles Schwab, CNBC, the Daily Shot HFR (returns have a two-day lag), Goldman Sachs, Jim Bianco Research, J.P. Morgan, Market Watch, Morningstar, Morgan Stanley. Pitchbook, Standard & Poor’s and the Wall Street Journal.